Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please only correct option Financial Systems can be organised as one of the following: Question 1 Not yet answered Marked out of 0.50 Flag question

Please only correct option

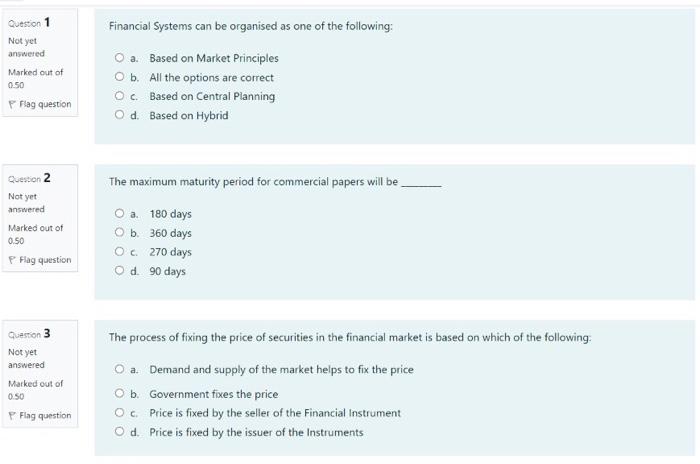

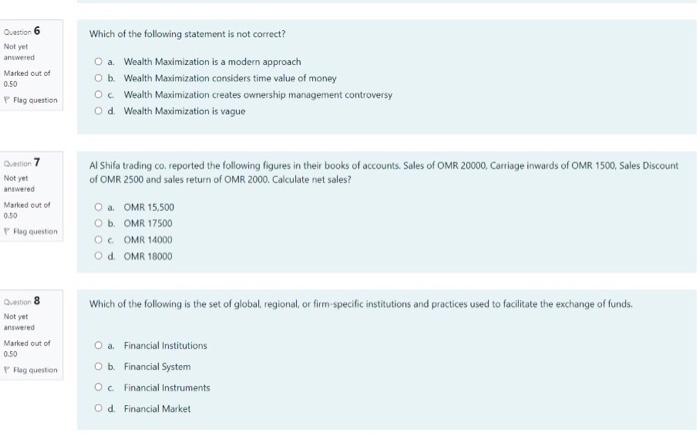

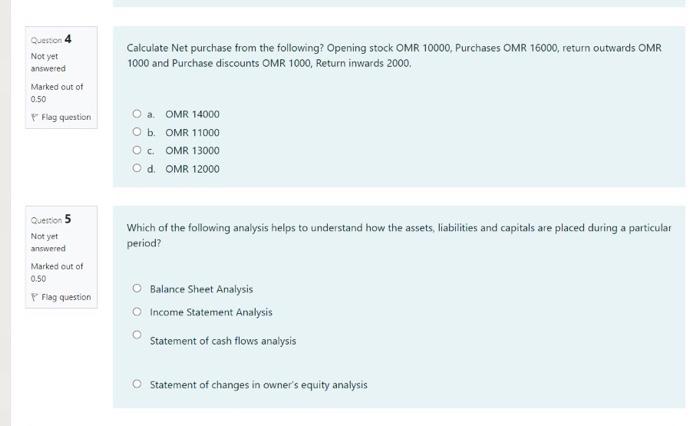

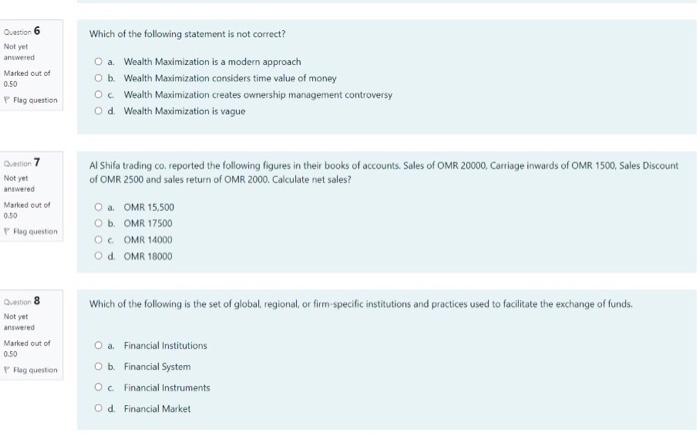

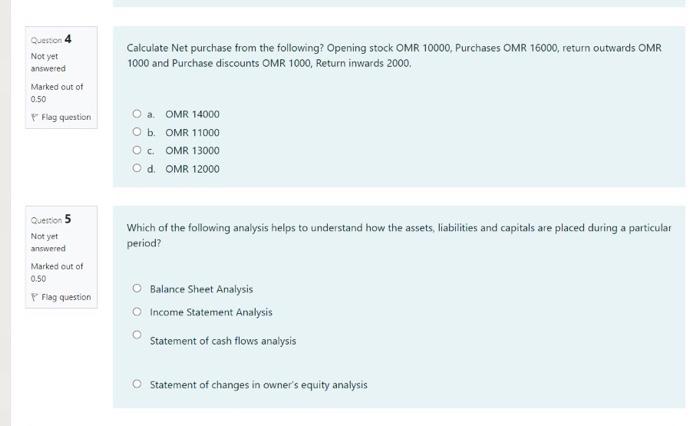

Financial Systems can be organised as one of the following: Question 1 Not yet answered Marked out of 0.50 Flag question a. Based on Market Principles O b. All the options are correct Oc. Based on Central Planning Od Based on Hybrid Question 2 The maximum maturity period for commercial papers will be Not yet answered Marked out of 0.50 O a. 180 days Ob 360 days Oc 270 days Od 90 days P Flag question Question 3 Not yet answered Marked out of 0.50 Flag question The process of fixing the price of securities in the financial market is based on which of the following O a Demand and supply of the market helps to fix the price O b. Government fixes the price Oc Price is fixed by the seller of the Financial Instrument Od Price is fixed by the issuer of the Instruments Oestor 6 Not yet answered Marked out of 0.50 Flag question Which of the following statement is not correct? O a Wealth Maximization is a modern approach Ob Wealth Maximization considers time value of money Oc Wealth Maximization creates ownership management controversy od Wealth Masimization is vague Bio 7 Not yet anwered Marked out of 0.50 og guestion Al Shifa trading co, reported the following ligures in their books of accounts Sales of OMR 20000. Coriage inwards of OMR 1500, Sales Discount of OMR 2500 and sales return of OMR 2000. Calculate net sales? O a OMR 15,500 O b. OMR 17500 O OMR 14000 Od OMR 18000 to 8 Which of the following is the set of global regional, or firm-specific institutions and practices used to facilitate the exchange of funds. Not yet answered Marked out of 0.50 Flag question O Financial institutions Ob Financial System Oc Financial Instruments Od Financial Market Question 4 Not yet answered Calculate Net purchase from the following? Opening stock OMR 10000, Purchases OMR 16000, return outwards OMR 1000 and Purchase discounts OMR 1000, Return inwards 2000, Marked out of 0.50 Flag question O a OMR 14000 O b. OMR 11000 Oc. OMR 13000 Od OMR 12000 Which of the following analysis helps to understand how the assets, liabilities and capitals are placed during a particular period? Question 5 Not yet answered Marked out of 0.50 Flag question Balance Sheet Analysis Income Statement Analysis Statement of cash flows analysis o Statement of changes in owner's equity analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started