Question

Please only do Stage 2, but need to use the information of stage 1, please see. Stage1 Glacier Holdings Ltd (GHL) is a public company

Please only do Stage 2, but need to use the information of stage 1, please see.

Stage1

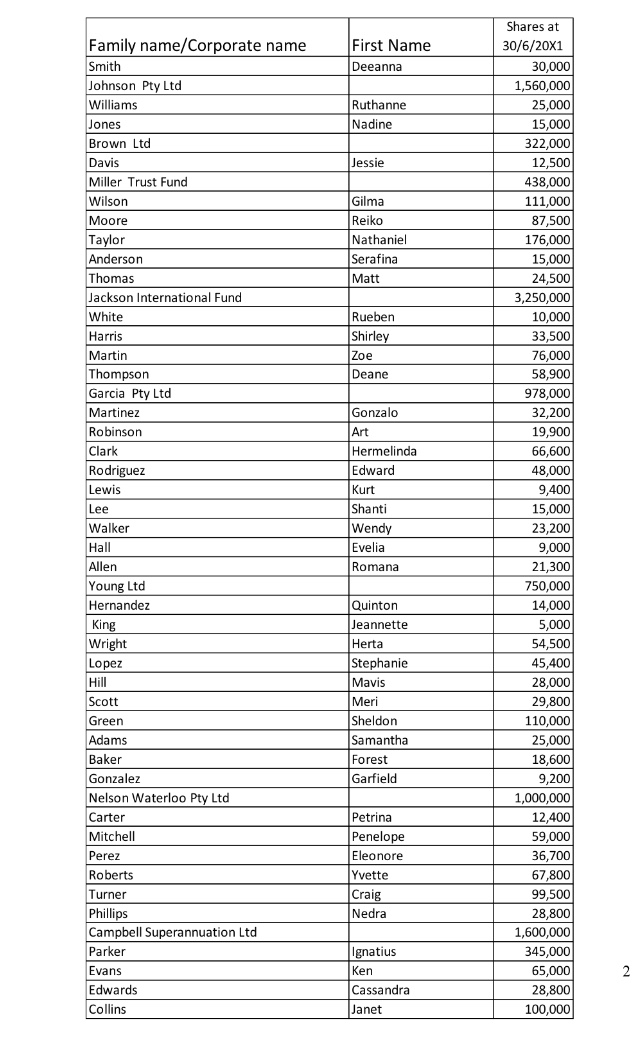

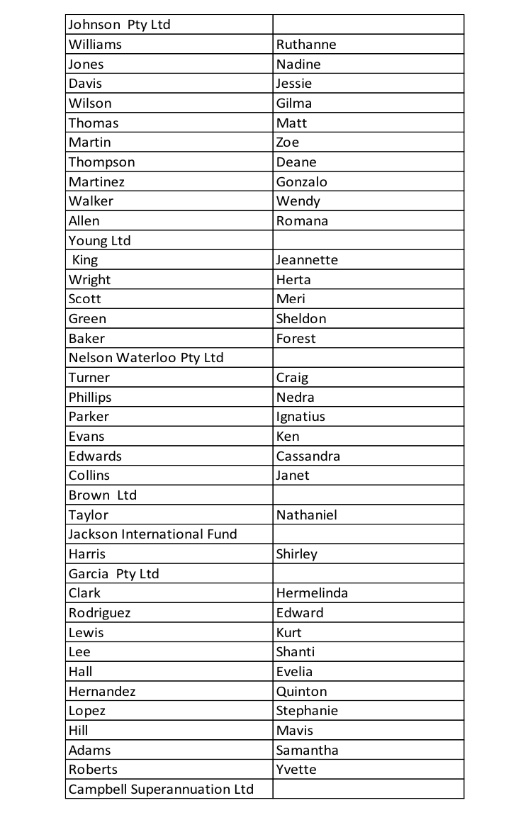

Glacier Holdings Ltd (GHL) is a public company and was incorporated a number of years ago and has been very successful. The equity section of the balance sheet of the company at the 30th June 20X1 is provided below: OWNERS EQUITY Issued Capital 85,000,000 Reserves 39,952,000 Retained profits 13,675,400 TOTAL OWNERS EQUITY 138,627,400 The companys financial year ends on 30th June. Additional Information: 1. Issued capital is comprised of: 12,000,000 ordinary shares all issued at $5.00 each $25,000,000 of 6%pa preference shares. Dividends on these shares are paid annually on the last day of August. A list of ordinary shareholders and their holdings as at 30th June 20X1 is provided on the next page.

During the 20X0/X1 year shareholders were given the opportunity to participate in the dividend reinvestment plan introduced by GHL. Under this plan shareholders would receive ordinary shares in lieu of cash for dividends. Shareholders must agree that their entire holding is subject to the DRP plan. Shares are issued at 95% of the closing ASX share price on the day in which the dividend is declared. It is likely that the calculation of the number of shares under the DRP plan will result in a part share (ie not a whole number). In that event the number of shares will be rounded down to the next whole number. For example, a calculation which results in 12,345.78 shares will be rounded down to 12,345. Whenever the rounding occurs that rounded down number will be used as the basis for future transactions and calculations.

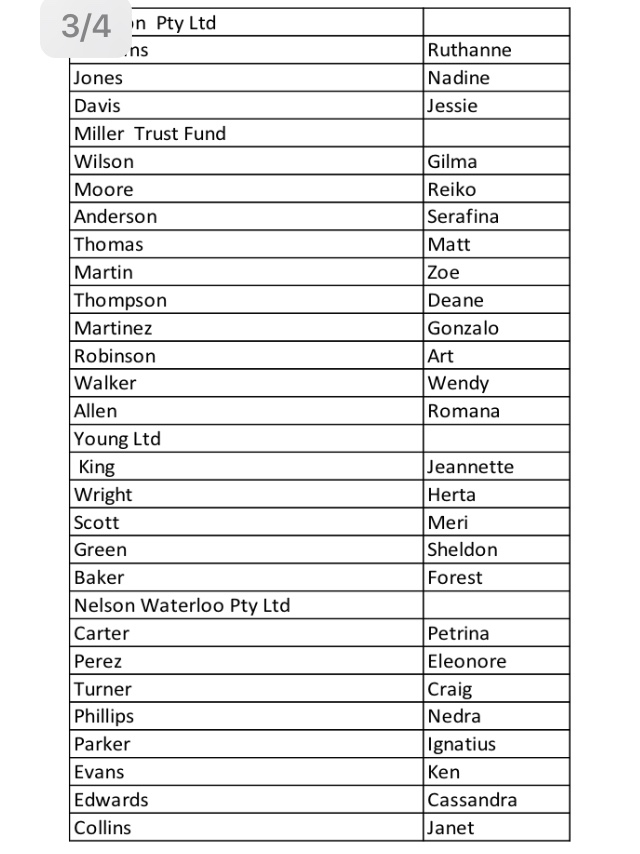

The following shareholders agreed to have their shareholding be subject to the DRP plan:

On the 15th June 20X1 the company determined a final dividend of 4.0 cents per ordinary share. This was declared on the 15th July 20X1 and paid the day after the annual general meeting which was held on the 14th September 20X1.

The following are a selection of ASX closing daily share prices for GHL

| Date | Closing Share Price $ | Date | Closing Share Price $ |

| 30/4/X1 | $5.00 | 31/7/X1 | $5.28 |

| 15/5/X1 | $5.08 | 15/8/X1 | $5.22 |

| 31/5/X1 | $5.26 | 31/8/X1 | $5.18 |

| 15/6/X1 | $5.28 | 14/9/X1 | $5.38 |

| 30/6/X1 | $5.23 | 30/9/X1 | $5.30 |

| 15/7/X1 | $5.20 | 14/10/X1 | $5.29 |

REQUIREMENTS FOR STAGE 1

1. Prepare all the general journal entries for all transactions that result from the information above for Glacier Holdings Ltd. for the period 1st July 20X1 to 15th September 20X1. Where there is a calculation you should provide a working paper and your journal narration can refer to the working paper for details. (18 marks)

2. Provide a list of ordinary shareholders and the number of shares they each hold after the payment of the final dividend on 15th September 20X1. Also clearly state the following:

The number of ordinary shares on issue subject to the dividend reinvestment plan.

The number of ordinary shares on issue which are not subject to the dividend reinvestment plan.

The total number of ordinary shares on issue. (7 marks )

Stage 2

Stage 2 follows from the transactions and solutions from Stage 1. You should ensure that you have examined your solutions from Stage 1 and compared them to the suggested solution in MyUni, understood any differences and re-set (if necessary) any of your numbers.

The matters which need to be addressed in Stage 2 are more complex than Stage 1 and some transactions lead into subsequent transactions. It is imperative that you take your time with these and make sure that you fully appreciate the implications and the resulting general journal entries. Accuracy of calculations and the numbers that follow is vitally important. It needs to be kept in mind that these matters deal with shareholders that is, parties external to the company. This means, for example, that if a dividend is paid and shares issued as a result and it is later found that there is an error then the shareholders will need to be advised, the corrections made to the dividend and the shares issued altered. In reality this would be extremely time consuming, expensive and embarrassing. Consequently, care needs to be taken so that calculations and numbers which flow through to subsequent matters are complete and correct. Any errors, and their flow through effects, will affect marks severely.

The following are matters which occurred from Glacier Holdings ltd (GCL).

1. On the 30th October 20X1 the Board of Directors decided to offer ordinary shareholders a 1:10 rights issue. Shareholders who accept the offer pay 90% of the share price on the day of the Board decision. Acceptance and payment by shareholders needs to be made on the 16th December 20X1. The following shareholders took up the offer and paid the appropriate amounts on the required date:

2. An interim dividend of 5 cents per ordinary share was declared and paid on the 10th March 20X2. (Please refer to the Stage 1 information for DRP details.)

3. On the 18th June 20X2 the company determined a final dividend for the financial year of 5.5 cents per ordinary share. This was declared on the 20th July 20X2.

| The following are a selection of ASX daily closing share prices for GHL |

| Date | Closing Share Price $ | Date | Closing Share Price $ |

| 14/10/X1 | $5.29 | 31/3/X2 | $5.43 |

| 30/10/X1 | $5.36 | 10/4/X2 | $5.53 |

| 16/11/X1 | $5.41 | 30/4/X2 | $5.51 |

| 30/11/X1 | $5.40 | 15/5/X2 | $5.60 |

| 16/12/X1 | $5.33 | 31/5/X2 | $5.54 |

| 31/12/X1 | $5.31 | 18/6/X2 | $5.48 |

| 12/1/X2 | $5.27 | 30/6/X2 | $5.68 |

| 31/1/X2 | $5.18 | 11/7/X2 | $5.70 |

| 12/2/X2 | $5.29 | 20/7/X2 | $5.75 |

| 28/2/X2 | $5.35 | 31/7/X2 | $5.68 |

| 10/3/X2 | $5.40 | 20/8/X2 | $5.69 |

REQUIREMENTS FOR STAGE 2

1. You are required to consider the three (3) different matters and subsequent transactions which are presented above and provide the following in this order:

Prepare a working paper for the rights share issue and the subsequent general journal entry. Round amounts for the entry to the nearest dollar.

Prepare a working paper identifying the total number of ordinary shares on issue after the rights issue and those that are subject to the DRP and those that are not.

Prepare a working paper for the interim dividend and the subsequent general journal entry.

Prepare a working paper identifying the total number of ordinary shares on issue after the payment of the interim dividend and those that are subject to the DRP and those that are not.

Prepare a working paper for the final dividend and the subsequent general journal entry. (NB there is no need to do a journal for the payment of the dividend.) (40 marks)

2. Assume the final dividend declared on 20th July 20X2 was paid at a later date. Provide a list of ordinary shareholders and the number of shares they each hold after the payment of the final dividend. Also clearly state the following:

The number of ordinary shares on issue subject to the dividend reinvestment plan.

The number of ordinary shares on issue which are not subject to the dividend reinvestment plan.

The total number of ordinary shares on issue. (10 marks )

3. Prepare the general ledger T account for Ordinary Share Capital for the period 1/7/20X1 to 1/7/20X2 (this incorporates both Stage 1 and Stage 2). Ensure it is properly balanced at 30/6/20X2. (10 marks )

NB The order of issues to be addressed in 1. above is designed to help students consider them in the appropriate sequence.

Shares at Family name/Corporate name First Name 30/6/20X1 Smith Deeanna 30,000 Johnson Pty Ltd Williams 1,560,000 Ruthanne 25,000 15,000 322,000 Jones Nadine Brown Ltd Jessie Davis Miller Trust Fund Wilson 12,500 438,000 Gilma 111,000 87,500 Moore Taylor Anderson Reiko Nathaniel Serafina 176,000 15,000 24,500 3,250,000 10,000 Thomas Jackson International Fund Matt Rueben White Harris Martin |Shirley 33,500 Zoe Deane 76,000 Thompson Garcia Pty Ltd Martinez Robinson 58,900 978,000 32,200 19,900 66,600 Gonzalo Art Hermelinda Edward Clark Rodriguez Lewis 48,000 9,400 Kurt Shanti Wendy Evelia 15,000 23,200 9,000 Lee Walker Hall Allen Young Ltd Hernandez Romana 21,300 750,000 Quinton Jeannette 14,000 5,000 King Wright Lopez Hill 54,500 45,400 28,000 29,800 110,000 25,000 Herta Stephanie Mavis Meri Sheldon Scott Green Samantha Forest Garfield Adams Baker 18,600 Gonzalez 9,200 1,000,000 12,400 Nelson Waterloo Pty Ltd Carter Petrina Penelope Eleonore Mitchell Perez Roberts Turner Phillips 59,000 36,700 67,800 99,500 28,800 1,600,000 345,000 Yvette Craig Nedra Campbell Superannuation Ltd Parker Ignatius Ken Cassandra Janet Evans Edwards Collins 2 65,000 28,800 100,000 3/4 n Pty Ltd Ruthanne Nadine |Jessie .ns Jones Davis Miller Trust Fund Gilma Reiko Wilson Moore Anderson Thomas Serafina Matt Zoe Martin Thompson Deane Gonzalo Martinez Robinson Art Wendy Romana Walker Allen Young Ltd King Wright Scott Green Baker Nelson Waterloo Pty Ltd Jeannette Herta Meri Sheldon Forest Petrina Eleonore Craig Carter Perez Turner Phillips Parker Evans Edwards Nedra Ignatius Ken Cassandra Janet Collins Johnson Pty Ltd Ruthanne Williams Jones Davis Nadine Jessie Wilson Gilma Thomas Matt Zoe Martin Thompson Martinez Deane Gonzalo Wendy Walker Allen Young Ltd King Wright Romana Jeannette Herta Meri Scott Sheldon Forest Green Baker Nelson Waterloo Pty Ltd Craig Turner Phillips Parker Evans Edwards Nedra Ignatius Ken Cassandra Collins Janet Brown Ltd Taylor Jackson International Fund Harris Garcia Pty Ltd Nathaniel |Shirley Hermelinda Edward Clark Rodriguez Lewis Kurt Shanti Evelia Quinton Stephanie Lee Hall Hernandez Lopez Hill Adams Roberts Campbell Superannuation Ltd Mavis Samantha Yvette Shares at Family name/Corporate name First Name 30/6/20X1 Smith Deeanna 30,000 Johnson Pty Ltd Williams 1,560,000 Ruthanne 25,000 15,000 322,000 Jones Nadine Brown Ltd Jessie Davis Miller Trust Fund Wilson 12,500 438,000 Gilma 111,000 87,500 Moore Taylor Anderson Reiko Nathaniel Serafina 176,000 15,000 24,500 3,250,000 10,000 Thomas Jackson International Fund Matt Rueben White Harris Martin |Shirley 33,500 Zoe Deane 76,000 Thompson Garcia Pty Ltd Martinez Robinson 58,900 978,000 32,200 19,900 66,600 Gonzalo Art Hermelinda Edward Clark Rodriguez Lewis 48,000 9,400 Kurt Shanti Wendy Evelia 15,000 23,200 9,000 Lee Walker Hall Allen Young Ltd Hernandez Romana 21,300 750,000 Quinton Jeannette 14,000 5,000 King Wright Lopez Hill 54,500 45,400 28,000 29,800 110,000 25,000 Herta Stephanie Mavis Meri Sheldon Scott Green Samantha Forest Garfield Adams Baker 18,600 Gonzalez 9,200 1,000,000 12,400 Nelson Waterloo Pty Ltd Carter Petrina Penelope Eleonore Mitchell Perez Roberts Turner Phillips 59,000 36,700 67,800 99,500 28,800 1,600,000 345,000 Yvette Craig Nedra Campbell Superannuation Ltd Parker Ignatius Ken Cassandra Janet Evans Edwards Collins 2 65,000 28,800 100,000 3/4 n Pty Ltd Ruthanne Nadine |Jessie .ns Jones Davis Miller Trust Fund Gilma Reiko Wilson Moore Anderson Thomas Serafina Matt Zoe Martin Thompson Deane Gonzalo Martinez Robinson Art Wendy Romana Walker Allen Young Ltd King Wright Scott Green Baker Nelson Waterloo Pty Ltd Jeannette Herta Meri Sheldon Forest Petrina Eleonore Craig Carter Perez Turner Phillips Parker Evans Edwards Nedra Ignatius Ken Cassandra Janet Collins Johnson Pty Ltd Ruthanne Williams Jones Davis Nadine Jessie Wilson Gilma Thomas Matt Zoe Martin Thompson Martinez Deane Gonzalo Wendy Walker Allen Young Ltd King Wright Romana Jeannette Herta Meri Scott Sheldon Forest Green Baker Nelson Waterloo Pty Ltd Craig Turner Phillips Parker Evans Edwards Nedra Ignatius Ken Cassandra Collins Janet Brown Ltd Taylor Jackson International Fund Harris Garcia Pty Ltd Nathaniel |Shirley Hermelinda Edward Clark Rodriguez Lewis Kurt Shanti Evelia Quinton Stephanie Lee Hall Hernandez Lopez Hill Adams Roberts Campbell Superannuation Ltd Mavis Samantha YvetteStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started