Question

Please, only excel file !!! During the year 2020 the company Stars United Inc. had an income before taxes from continuing operations of $576,000, including

Please, only excel file !!!

During the year 2020 the company Stars United Inc. had an income before taxes from continuing operations of $576,000, including a depreciation expense of $74,000

On 2nd of February, Stars United Inc sold an unprofitable segment. The loss before taxes from operating the segment during the month of January was $50,000.

The company sold the assets of the segments for $260,000 obtaining a gain before taxes of $40,000.

On 27 of March, a tornado destroyed some of the company's facilities causing a loss before taxes of $500,000

On 1st of April, the company issues $1,000 cumulative preferred stock at par with a preferred stock dividend rate of 8% payable each December 31

During the year 2020, the company had an average of 120,000 common stocks outstanding

Tax rate is 25%

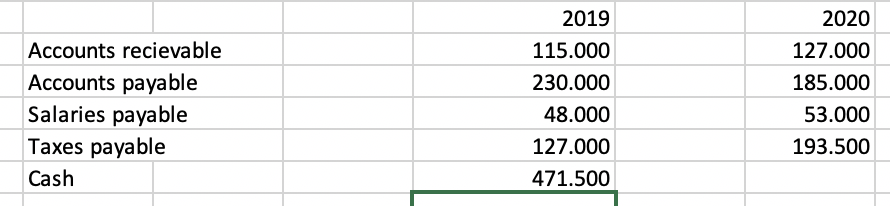

Below the balances of several current assets and liabilities accounts at December 31, 2019 and 2020:

1. Record on the journal the issuance of the preferred stocks, and the preferred stock dividend payment to be made in 2020.

2. Prepare an income statement of Stars United Inc. for the year 2020 including the earning per share figures.

3. Assume that instead of issuing preferred stocks, the company issued 8% bond with interests to be paid each December 31. Record the issuance of the bonds and the interest payment on the journal.

4. Prepare an income statement and the earning per share figures in case of bonds financing.

5. Prepare a statement of cash flow for year 2020 and calculate the balance of the cash account at December 31.

Accounts recievable Accounts payable Salaries payable Taxes payable Cash 2019 115.000 230.000 48.000 127.000 471.500 2020 127.000 185.000 53.000 193.500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started