Answered step by step

Verified Expert Solution

Question

1 Approved Answer

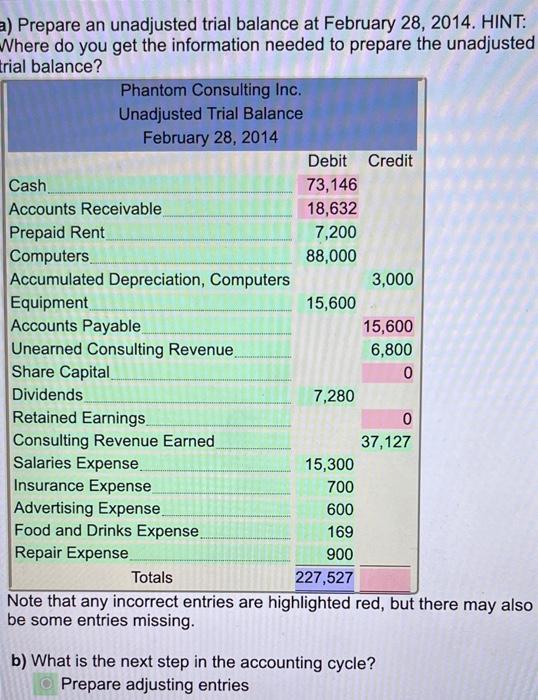

Please only help with the ones highlighted red, thank you :) a) Prepare an unadjusted trial balance at February 28, 2014. HINT: Where do you

Please only help with the ones highlighted red, thank you :)

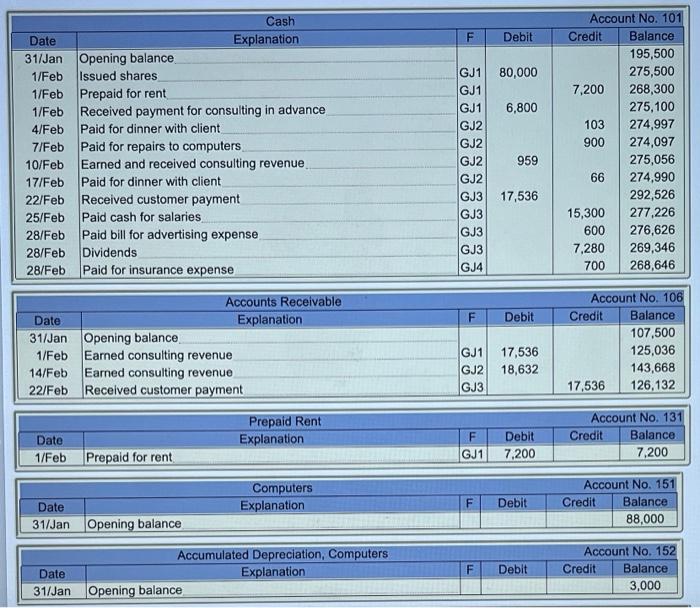

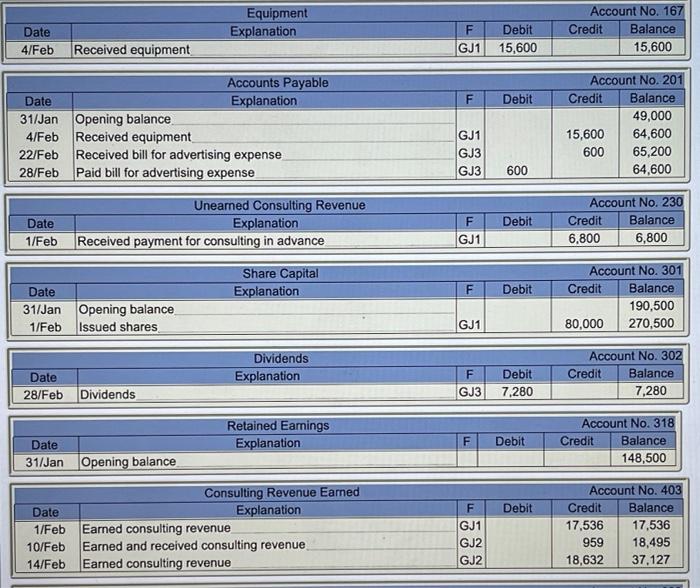

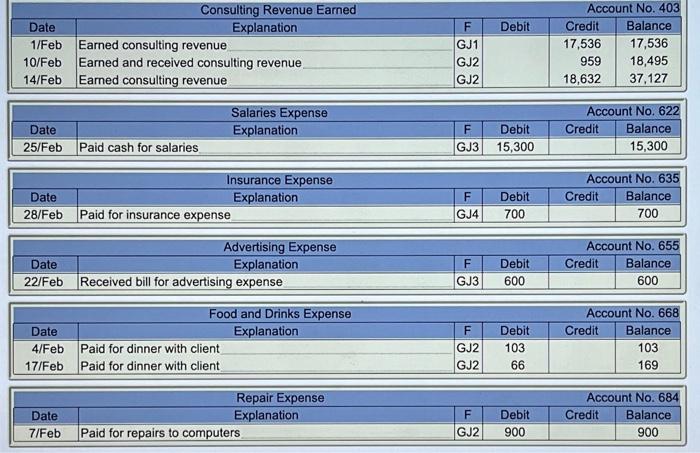

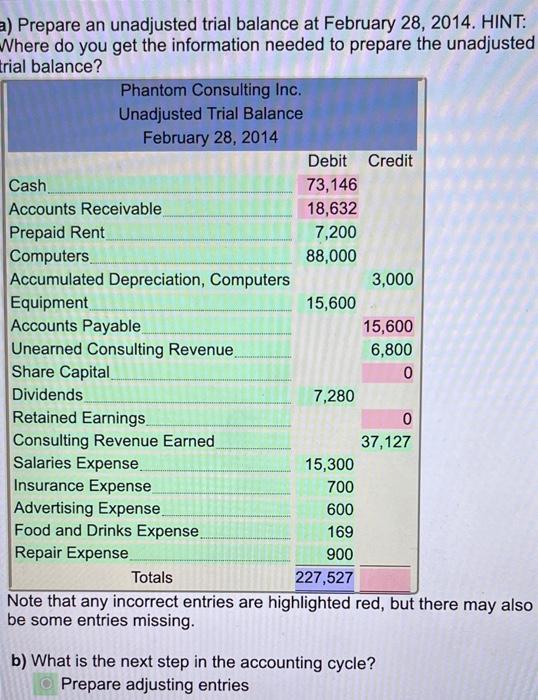

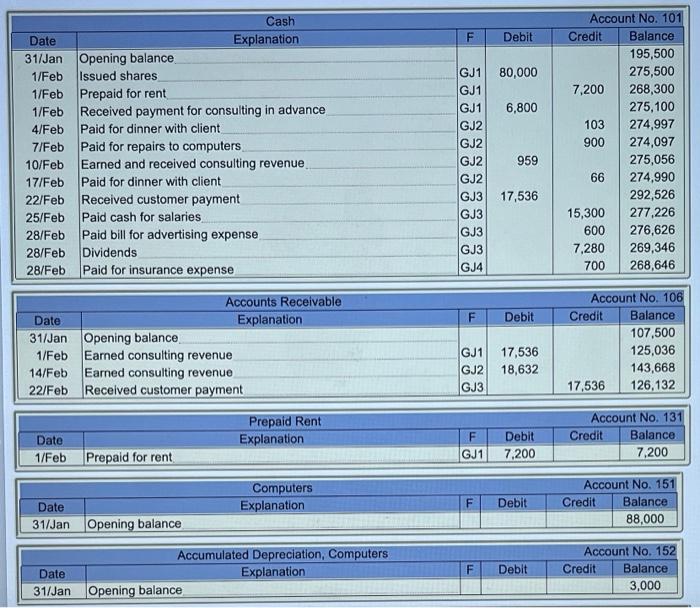

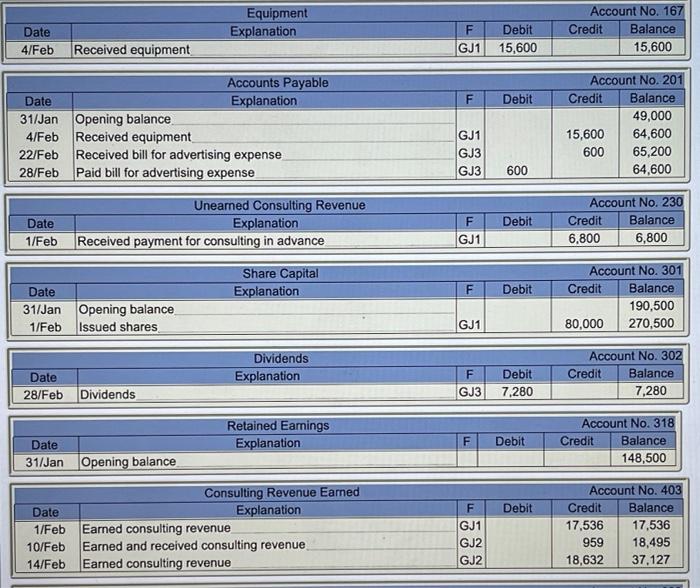

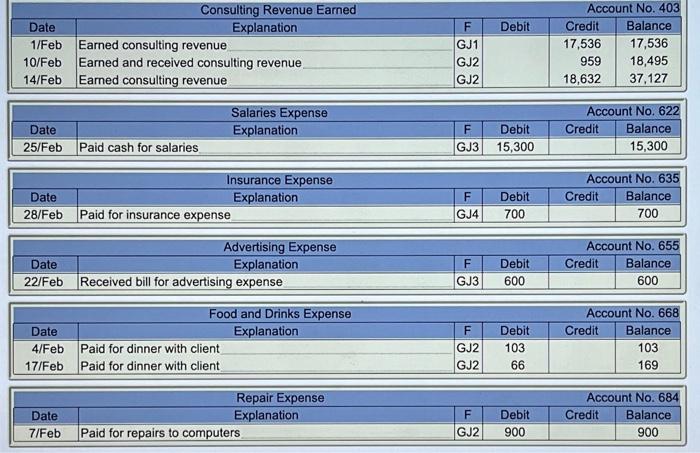

a) Prepare an unadjusted trial balance at February 28, 2014. HINT: Where do you get the information needed to prepare the unadjusted trial balance? Phantom Consulting Inc. Unadjusted Trial Balance February 28, 2014 Debit Credit Cash 73,146 Accounts Receivable 18,632 Prepaid Rent 7,200 Computers 88,000 Accumulated Depreciation, Computers 3,000 Equipment 15,600 Accounts Payable 15,600 Unearned Consulting Revenue 6,800 Share Capital 0 Dividends 7,280 Retained Earnings 0 Consulting Revenue Earned 37,127 Salaries Expense 15,300 Insurance Expense 700 Advertising Expense 600 Food and Drinks Expense 169 Repair Expense 900 Totals 227,527 Note that any incorrect entries are highlighted red, but there may also be some entries missing. b) What is the next step in the accounting cycle? Prepare adjusting entries F Debit 80,000 6,800 Cash Date Explanation 31/Jan Opening balance 1/Feb Issued shares 1/Feb Prepaid for rent 1/Feb Received payment for consulting in advance 4/Feb Paid for dinner with client 7/Feb Paid for repairs to computers 10/Feb Earned and received consulting revenue 17/Feb Paid for dinner with client 22/Feb Received customer payment 25/Feb Paid cash for salaries 28/Feb Paid bill for advertising expense 28/Feb Dividends 28/Feb Paid for insurance expense Account No. 101 Credit Balance 195,500 275,500 7,200 268,300 275,100 103 274,997 900 274,097 275,056 66 274,990 292,526 15,300 277,226 600 276,626 7,280 269,346 700 268,646 GJ1 GJ1 GJ1 GJ2 GJ2 GJ2 GJ2 GJ3 GJ3 GJ3 GJ3 GJ4 959 17,536 F Debit Accounts Receivable Date Explanation 31/Jan Opening balance 1/Feb Earned consulting revenue 14/Feb Earned consulting revenue 22/Feb Received customer payment Account No. 106 Credit Balance 107,500 125,036 143,668 17,536 126,132 GJ1 GJ2 GJ3 17,536 18,632 Prepaid Rent Explanation Date 1/Feb Prepaid for rent F GJ1 Debit 7,200 Account No. 131 Credit Balance 7,200 Computers Explanation F Debit Date 31/Jan Opening balance Account No. 151 Credit Balance 88,000 Accumulated Depreciation, Computers Explanation Opening balance F Date 31/Jan Debit Account No. 152 Credit Balance 3,000 Equipment Explanation Date 4/Feb F GJ1 Debit 15,600 Account No. 167 Credit Balance 15,600 Received equipment F Debit Date 31/Jan 4/Feb 22/Feb 28/Feb Accounts Payable Explanation Opening balance Received equipment Received bill for advertising expense Paid bill for advertising expense Account No. 201 Credit Balance 49,000 15,600 64,600 600 65,200 64,600 GJ1 GJ3 GJ3 600 Uneamed Consulting Revenue Explanation Received payment for consulting in advance Date 1/Feb Debit F GJ1 Account No. 230 Credit Balance 6.800 6,800 Share Capital Explanation F Debit Date 31/Jan Opening balance 1/Feb Issued shares Account No. 301 Credit Balance 190,500 80,000 270,500 GJ1 Dividends Explanation Date 28/Feb Dividends F GJ3 Debit 7.280 Account No. 302 Credit Balance 7,280 Retained Earnings Explanation F Debit Date 31/Jan Account No. 318 Credit Balance 148,500 Opening balance Debit Date 1/Feb 10/Feb 14/Feb Consulting Revenue Earned Explanation Earned consulting revenue Earned and received consulting revenue Earned consulting revenue F GJ1 GJ2 GJ2 Account No. 403 Credit Balance 17,536 17,536 959 18,495 18,632 37,127 Debit Date 1/Feb 10/Feb 14/Feb Consulting Revenue Earned Explanation Earned consulting revenue Earned and received consulting revenue Earned consulting revenue F GJ1 GJ2 GJ2 Account No. 403 Credit Balance 17,536 17,536 959 18,495 18,632 37,127 Salaries Expense Explanation Date 25/Feb F GJ3 Debit 15,300 Account No. 622 Credit Balance 15,300 Paid cash for salaries Date 28/Feb Insurance Expense Explanation Paid for insurance expense F GJ4 Debit 700 Account No. 635 Credit Balance 700 Date 22/Feb Advertising Expense Explanation Received bill for advertising expense F GJ3 Debit 600 Account No. 655 Credit Balance 600 Food and Drinks Expense Date Explanation 4/Feb Paid for dinner with client 17/Feb Paid for dinner with client F GJ2 GJ2 Debit 103 66 Account No. 668 Credit Balance 103 169 Date 7/Feb Repair Expense Explanation Paid for repairs to computers F GJ2 Debit 900 Account No. 684 Credit Balance 900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started