Question: Please only look into 15-4. I only need Cases 6 and 7 resolved. I already did 1-5. Again, only do 15-4 and only do cases

Please only look into 15-4. I only need Cases 6 and 7 resolved. I already did 1-5. Again, only do 15-4 and only do cases 6 and 7. Reiterating, Problem 15-4, just number 6 and 7. Please and thank you.

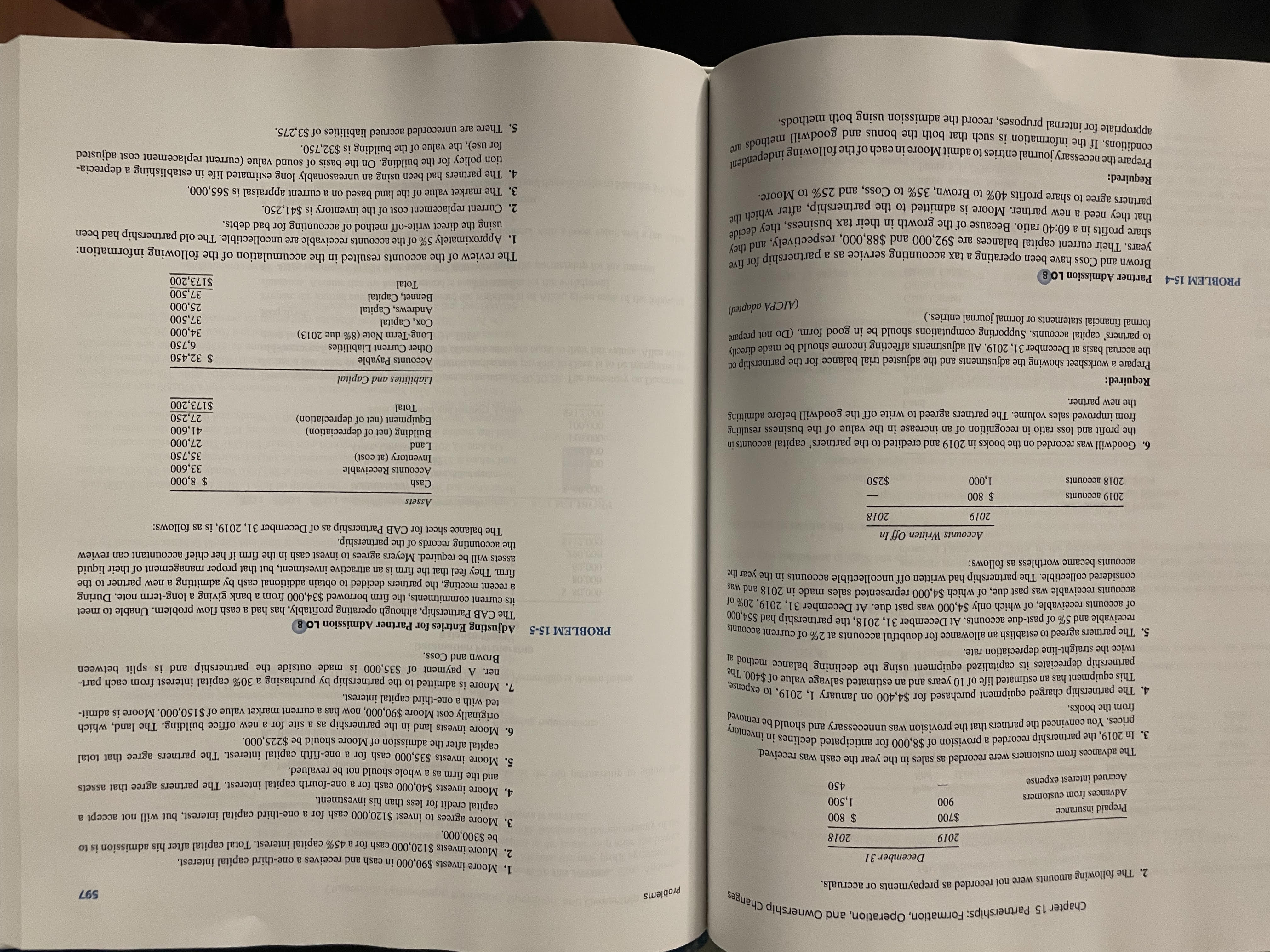

Chapter 15 Partnerships: Formation, Operation, and Ownership Changes 2. The following amounts were not recorded as prepayments or accruals. The advances from customers were recorded as sales in the year the cash was received. 3. In 2019 , the partnership recorded a provision of $8,000 for anticipated declines in inventory prices. You convinced the partners that the provision was unnecessary and should be removed from the books. 4. The partnership charged equipment purchased for $4,400 on January 1,2019 , to expense. This equipment has an estimated life of 10 years and an estimated salvage value of $400. The partnership depreciates its capitalized equipment using the declining balance method at twice the straight-line depreciation rate. 5. The partners agreed to establish an allowance for doubtful accounts at 2% of current accounts receivable and 5% of past-due accounts. At December 31, 2018, the partnership had $54,000 of accounts receivable, of which only $4,000 was past due. At December 31,2019,20% of accounts receivable was past due, of which $4,000 represented sales made in 2018 and was considered collectible. The partnership had written off uncollectible accounts in the year the accounts became worthless as follows: 6. Goodwill was recorded on the books in 2019 and credited to the partners' capital accounts in the profit and loss ratio in recognition of an increase in the value of the business resulting from improved sales volume. The partners agreed to write off the goodwill before admitting the new partner. Required: Prepare a worksheet showing the adjustments and the adjusted trial balance for the partnership on the accrual basis at December 31, 2019. All adjustments affecting income should be made directly to partners' capital accounts. Supporting computations should be in good form. (Do not prepare formal financial statements or formal journal entries.) (AICPA adapted) Partner Admission LO 8 Brown and Coss have been operating a tax accounting service as a partnership for five years. Their current capital balances are $92,000 and $88,000, respectively, and they share profits in a 60:40 ratio. Because of the growth in their tax business, they decide that they need a new partner. Moore is admitted to the partnership, after which the partners agree to share profits 40% to Brown, 35% to Coss, and 25% to Moore. Required: Prepare the necessary journal entries to admit Moore in each of the following independent conditions. If the information is such that both the bonus and goodwill methods are appropriate for internal pruposes, record the admission using both methods. problems 597 1. Moore invests $90,000 in cash and receives a one-third capital interest. 2. Moore invests $120,000 cash for a 45% capital interest. Total capital after his admission is to be $300,000. 3. Moore agrees to invest $120,000 cash for a one-third capital interest, but will not accept a capital credit for less than his investment. 4. Moore invests $40,000 cash for a one-fourth capital interest. The partners agree that assets and the firm as a whole should not be revalued. 5. Moore invests $35,000 cash for a one-fifth capital interest. The partners agree that total capital after the admission of Moore should be $225,000. 6. Moore invests land in the partnership as a site for a new office building. The land, which originally cost Moore $90,000, now has a current market value of $150,000. Moore is admitted with a one-third capital interest. 7. Moore is admitted to the partnership by purchasing a 30% capital interest from each partner. A payment of $35,000 is made outside the partnership and is split between Brown and Coss. PROBLEM 15-5 Adjusting Entries for Partner Admission LO 8 The CAB Partnership, although operating profitably, has had a cash flow problem. Unable to meet its current commitments, the firm borrowed $34,000 from a bank giving a long-term note. During a recent meeting, the partners decided to obtain additional cash by admitting a new partner to the firm. They feel that the firm is an attractive investment, but that proper management of their liquid assets will be required. Meyers agrees to invest cash in the firm if her chief accountant can review the accounting records of the partnership. The balance sheet for CAB Partnership as of December 31, 2019, is as follows: The review of the accounts resulted in the accumulation of the following information: 1. Approximately 5% of the accounts receivable are uncollectible. The old partnership had been using the direct write-off method of accounting for bad debts. 2. Current replacement cost of the inventory is $41,250. 3. The market value of the land based on a current appraisal is $65,000. 4. The partners had been using an unreasonably long estimated life in establishing a depreciation policy for the building. On the basis of sound value (current replacement cost adjusted for use), the value of the building is $32,750. 5. There are unrecorded accrued liabilities of $3,275. Chapter 15 Partnerships: Formation, Operation, and Ownership Changes 2. The following amounts were not recorded as prepayments or accruals. The advances from customers were recorded as sales in the year the cash was received. 3. In 2019 , the partnership recorded a provision of $8,000 for anticipated declines in inventory prices. You convinced the partners that the provision was unnecessary and should be removed from the books. 4. The partnership charged equipment purchased for $4,400 on January 1,2019 , to expense. This equipment has an estimated life of 10 years and an estimated salvage value of $400. The partnership depreciates its capitalized equipment using the declining balance method at twice the straight-line depreciation rate. 5. The partners agreed to establish an allowance for doubtful accounts at 2% of current accounts receivable and 5% of past-due accounts. At December 31, 2018, the partnership had $54,000 of accounts receivable, of which only $4,000 was past due. At December 31,2019,20% of accounts receivable was past due, of which $4,000 represented sales made in 2018 and was considered collectible. The partnership had written off uncollectible accounts in the year the accounts became worthless as follows: 6. Goodwill was recorded on the books in 2019 and credited to the partners' capital accounts in the profit and loss ratio in recognition of an increase in the value of the business resulting from improved sales volume. The partners agreed to write off the goodwill before admitting the new partner. Required: Prepare a worksheet showing the adjustments and the adjusted trial balance for the partnership on the accrual basis at December 31, 2019. All adjustments affecting income should be made directly to partners' capital accounts. Supporting computations should be in good form. (Do not prepare formal financial statements or formal journal entries.) (AICPA adapted) Partner Admission LO 8 Brown and Coss have been operating a tax accounting service as a partnership for five years. Their current capital balances are $92,000 and $88,000, respectively, and they share profits in a 60:40 ratio. Because of the growth in their tax business, they decide that they need a new partner. Moore is admitted to the partnership, after which the partners agree to share profits 40% to Brown, 35% to Coss, and 25% to Moore. Required: Prepare the necessary journal entries to admit Moore in each of the following independent conditions. If the information is such that both the bonus and goodwill methods are appropriate for internal pruposes, record the admission using both methods. problems 597 1. Moore invests $90,000 in cash and receives a one-third capital interest. 2. Moore invests $120,000 cash for a 45% capital interest. Total capital after his admission is to be $300,000. 3. Moore agrees to invest $120,000 cash for a one-third capital interest, but will not accept a capital credit for less than his investment. 4. Moore invests $40,000 cash for a one-fourth capital interest. The partners agree that assets and the firm as a whole should not be revalued. 5. Moore invests $35,000 cash for a one-fifth capital interest. The partners agree that total capital after the admission of Moore should be $225,000. 6. Moore invests land in the partnership as a site for a new office building. The land, which originally cost Moore $90,000, now has a current market value of $150,000. Moore is admitted with a one-third capital interest. 7. Moore is admitted to the partnership by purchasing a 30% capital interest from each partner. A payment of $35,000 is made outside the partnership and is split between Brown and Coss. PROBLEM 15-5 Adjusting Entries for Partner Admission LO 8 The CAB Partnership, although operating profitably, has had a cash flow problem. Unable to meet its current commitments, the firm borrowed $34,000 from a bank giving a long-term note. During a recent meeting, the partners decided to obtain additional cash by admitting a new partner to the firm. They feel that the firm is an attractive investment, but that proper management of their liquid assets will be required. Meyers agrees to invest cash in the firm if her chief accountant can review the accounting records of the partnership. The balance sheet for CAB Partnership as of December 31, 2019, is as follows: The review of the accounts resulted in the accumulation of the following information: 1. Approximately 5% of the accounts receivable are uncollectible. The old partnership had been using the direct write-off method of accounting for bad debts. 2. Current replacement cost of the inventory is $41,250. 3. The market value of the land based on a current appraisal is $65,000. 4. The partners had been using an unreasonably long estimated life in establishing a depreciation policy for the building. On the basis of sound value (current replacement cost adjusted for use), the value of the building is $32,750. 5. There are unrecorded accrued liabilities of $3,275

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts