Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please only provide detail answer for question number 2 only. I already have the answer to question number 1. please only answer question number 1

please only provide detail answer for question number 2 only.

I already have the answer to question number 1.

please only answer question number 1 and disregard question number 2

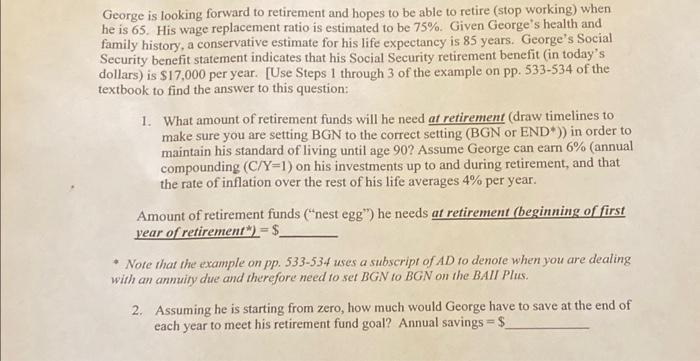

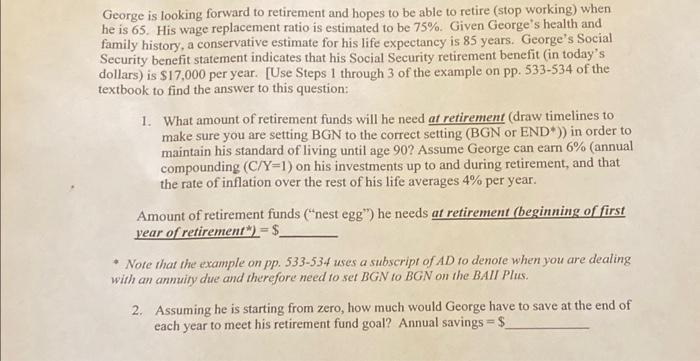

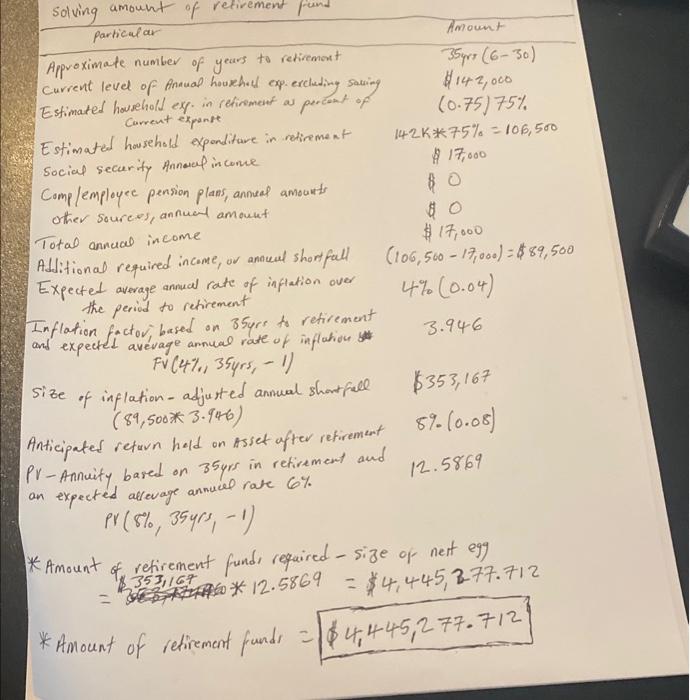

George is looking forward to retirement and hopes to be able to retire (stop working) when he is 65 . His wage replacement ratio is estimated to be 75%. Given George's health and family history, a conservative estimate for his life expectancy is 85 years. George's Social Security benefit statement indicates that his Social Security retirement benefit (in today's dollars) is $17,000 per year. [Use Steps 1 through 3 of the example on pp. 533534 of the textbook to find the answer to this question: 1. What amount of retirement funds will he need at retirement (draw timelines to make sure you are setting BGN to the correct setting (BGN or END*)) in order to maintain his standard of living until age 90 ? Assume George can earn 6% (annual compounding (C/Y=1) on his investments up to and during retirement, and that the rate of inflation over the rest of his life averages 4% per year. Amount of retirement funds ("nest egg") he needs at retirement (beginning of first year of retirement - Note that the example on pp. 533-53.f uses a subscript of AD to denote when you are dealing with an anmuity due and therefore need to set BGN to BGN on the BAII Plus. 2. Assuming he is starting from zero, how much would George have to save at the end of each year to meet his retirement fund goal? Annual savings =$ particalar Amount Approximate number of years to retiremont current level of Anaual hourhad exp. eveluding satuing Estimated household ex. in relirement as percont of (0.75)75% Estimated household exponditure in retirement 142K75%=106,500 Social security Annowl income Complemployee pension plans, anneal amourts other sourees, annuel amount Total annual income Additional required income, or anoual shortfall (106,50017,000)=$89,500 Expected average anmual rate of infiation oved 4%(0.04) the period to retirement Inflation factor, based on 35 yrs to refirement 3.946 and expectel avevage annual rate of FV (4%,354r5,1) size of inflation-adjusted annual shontfill $353,167 (89,5003.946) Anticipated return hald on Asset ofter refirement 8%(0.08) PV-Annuity based on 35 prs in retirement and 12.5869 an expected aflevage annucel rate 6% Pr(8%,35yrs,1) * Amount of refirement fund reqaired - size of nent eg9 =36746012.5869353,167=$4,445,3.77.712 * Amount of retirement funds =$4,445,277.712 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started