Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please ONLY Provide the correct answer, I do not need work, as it is multiple choice, And please answer the FULL- Question if you choose

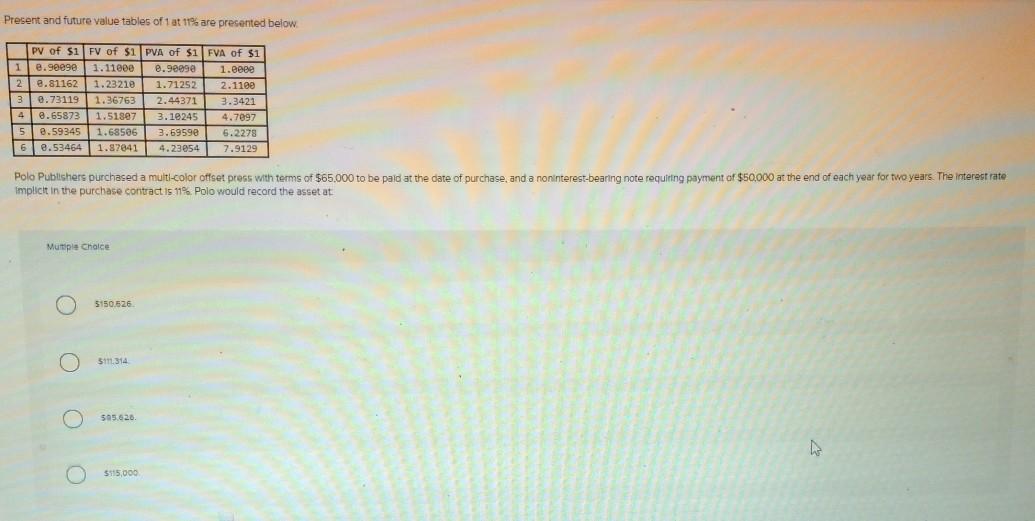

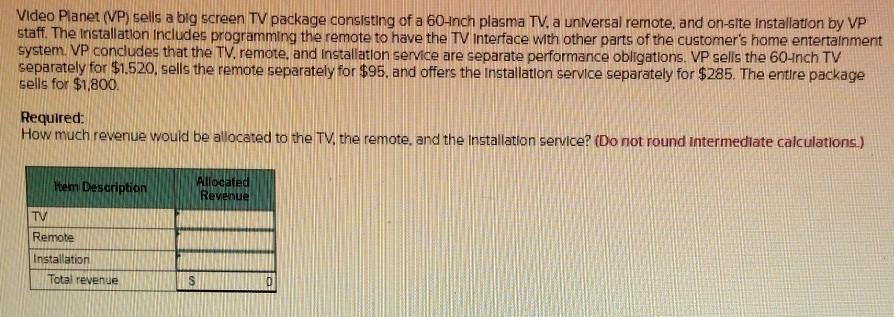

Please ONLY Provide the correct answer, I do not need work, as it is multiple choice, And please answer the FULL- Question if you choose to accept. It may have Multiple parts, but it will not take over 5 minutes total I will give thumbs up Present and future value tables of 1 at 11% are presented below. 1 2 PV of $1 FV of $1 PVA of $1 FVA of $1 .90e9e 1.11000 0.9093e 1. e.81162 1.23210 1.71252 2.1100 0.73119 1.36763 2.44371 3.3421 8.65873 1.51807 3.10245 4.7097 0.59345 1.68505 8.6959e 6.2278 0.53464 1.87841 4.23054 7.9129 4 Polo Publishers purchased a multi-color offset press with terms of $65.000 to be paid at the date of purchase, and a noninterest-bearing note requiring payment of $50,000 at the end of each year for two years. The interest rate Implicit in the purchase contact is 11% Polo would record the asset at Multiple Choice 5150.526 $11.314 505.620. 5500 Video Planet (VP) sells a big screen TV package consisting of a 60-Inch plasma TV. a universal remote, and on-site Installation by VP staff. The installation Includes programming the remote to have the TV Interface with other parts of the customer's home entertainment system. VP concludes that the TV remote, and installation service are separate performance obligations. VP sells the 60-Inch TV separately for $1.520, sells the remote separately for $95, and offers the Installation service separately for $285. The entire package sells for $1,800. Required: How much revenue would be allocated to the TV, the remote, and the Installation service? (Do not round intermediate calculations.) Item Description Allocated Revenue TV Remote Installation Total revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started