Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please only solve for part b. Please make it in grid form or I will down vote. i have included a previous answer to refer

Please only solve for part b. Please make it in grid form or I will down vote. i have included a previous answer to refer to. Please make it into a grid and I will upvote. AGAIN ONLY PART B

here is the answer I have for part B. please put in grid form.

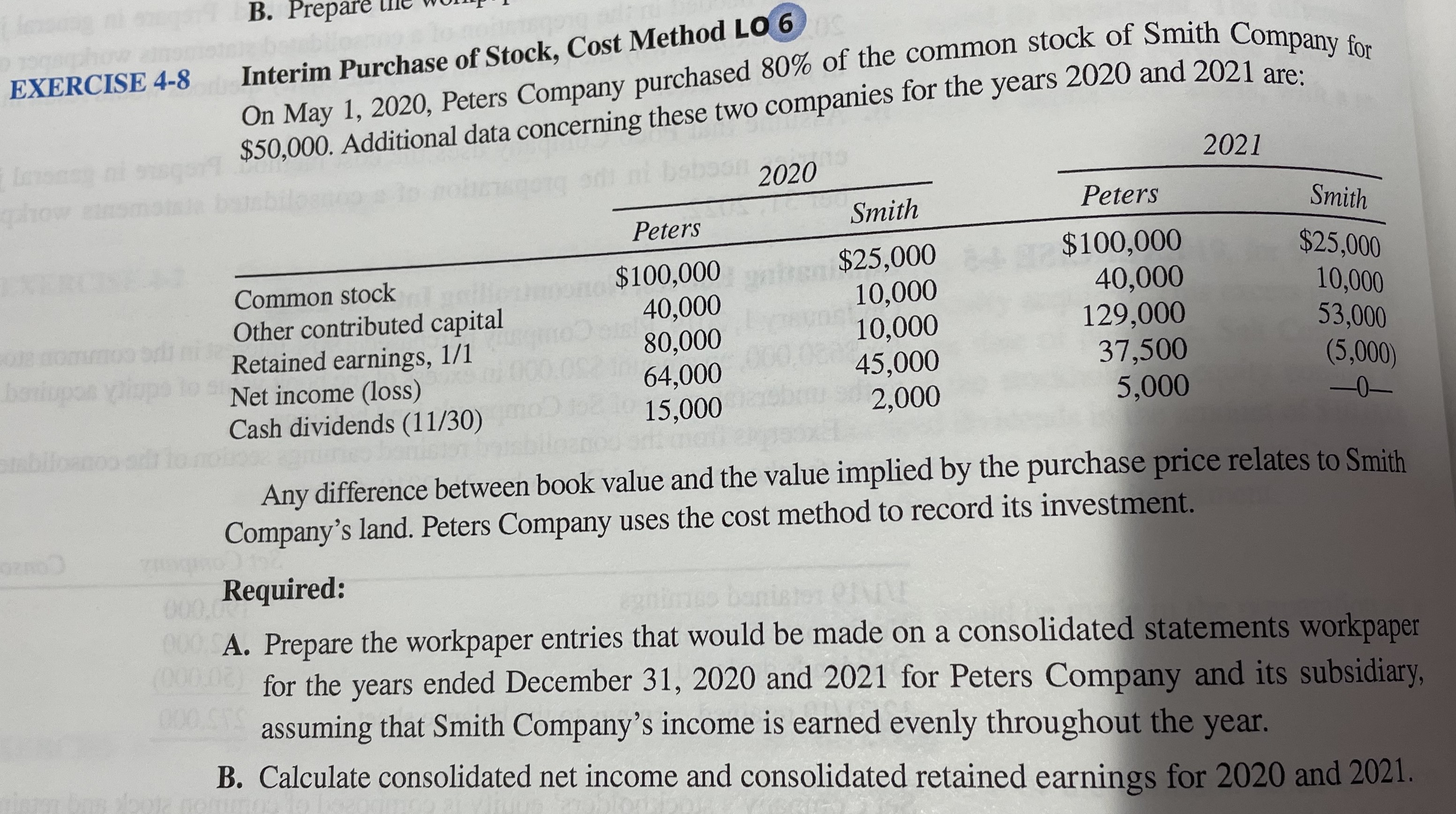

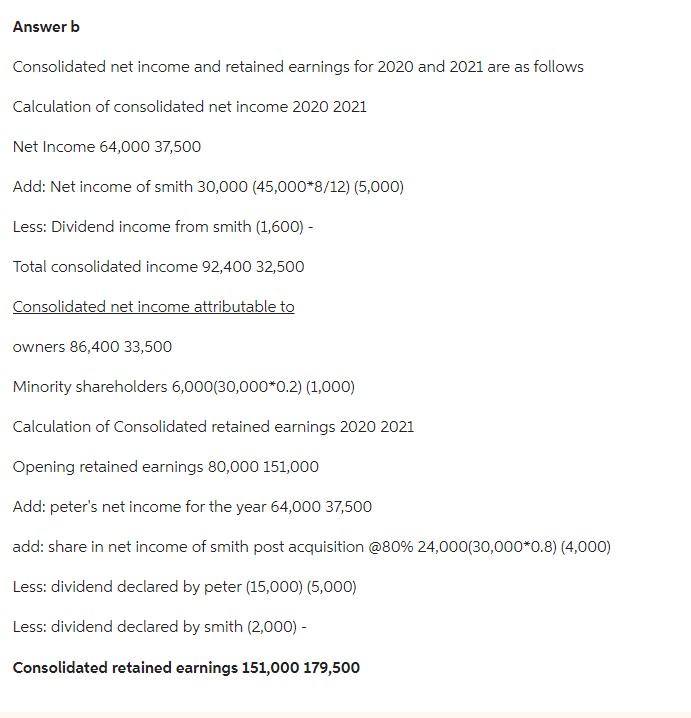

Interim Purchase of Stock, Cost Method LO 6 On May 1, 2020, Peters Company purchased 80% of the common stock of Smith Company for Any difference between book value and the value implied by the purchase price relates to Smith Company's land. Peters Company uses the cost method to record its investment. Required: A. Prepare the workpaper entries that would be made on a consolidated statements workpaper for the years ended December 31, 2020 and 2021 for Peters Company and its subsidiary, assuming that Smith Company's income is earned evenly throughout the year. B. Calculate consolidated net income and consolidated retained earnings for 2020 and 2021. Answer b Consolidated net income and retained earnings for 2020 and 2021 are as follows Calculation of consolidated net income 20202021 Net Income 64,00037,500 Add: Net income of smith 30,000(45,0008/12)(5,000) Less: Dividend income from smith (1,600) - Total consolidated income 92,40032,500 Consolidated net income attributable to owners 86,40033,500 Minority shareholders 6,000(30,0000.2)(1,000) Calculation of Consolidated retained earnings 20202021 Opening retained earnings 80,000151,000 Add: peter's net income for the year 64,00037,500 add: share in net income of smith post acquisition @80\% 24,000(30,000*0.8) (4,000) Less: dividend declared by peter (15,000)(5,000) Less: dividend declared by smith (2,000) - Consolidated retained earnings 151,000179,500 Interim Purchase of Stock, Cost Method LO 6 On May 1, 2020, Peters Company purchased 80% of the common stock of Smith Company for Any difference between book value and the value implied by the purchase price relates to Smith Company's land. Peters Company uses the cost method to record its investment. Required: A. Prepare the workpaper entries that would be made on a consolidated statements workpaper for the years ended December 31, 2020 and 2021 for Peters Company and its subsidiary, assuming that Smith Company's income is earned evenly throughout the year. B. Calculate consolidated net income and consolidated retained earnings for 2020 and 2021. Answer b Consolidated net income and retained earnings for 2020 and 2021 are as follows Calculation of consolidated net income 20202021 Net Income 64,00037,500 Add: Net income of smith 30,000(45,0008/12)(5,000) Less: Dividend income from smith (1,600) - Total consolidated income 92,40032,500 Consolidated net income attributable to owners 86,40033,500 Minority shareholders 6,000(30,0000.2)(1,000) Calculation of Consolidated retained earnings 20202021 Opening retained earnings 80,000151,000 Add: peter's net income for the year 64,00037,500 add: share in net income of smith post acquisition @80\% 24,000(30,000*0.8) (4,000) Less: dividend declared by peter (15,000)(5,000) Less: dividend declared by smith (2,000) - Consolidated retained earnings 151,000179,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started