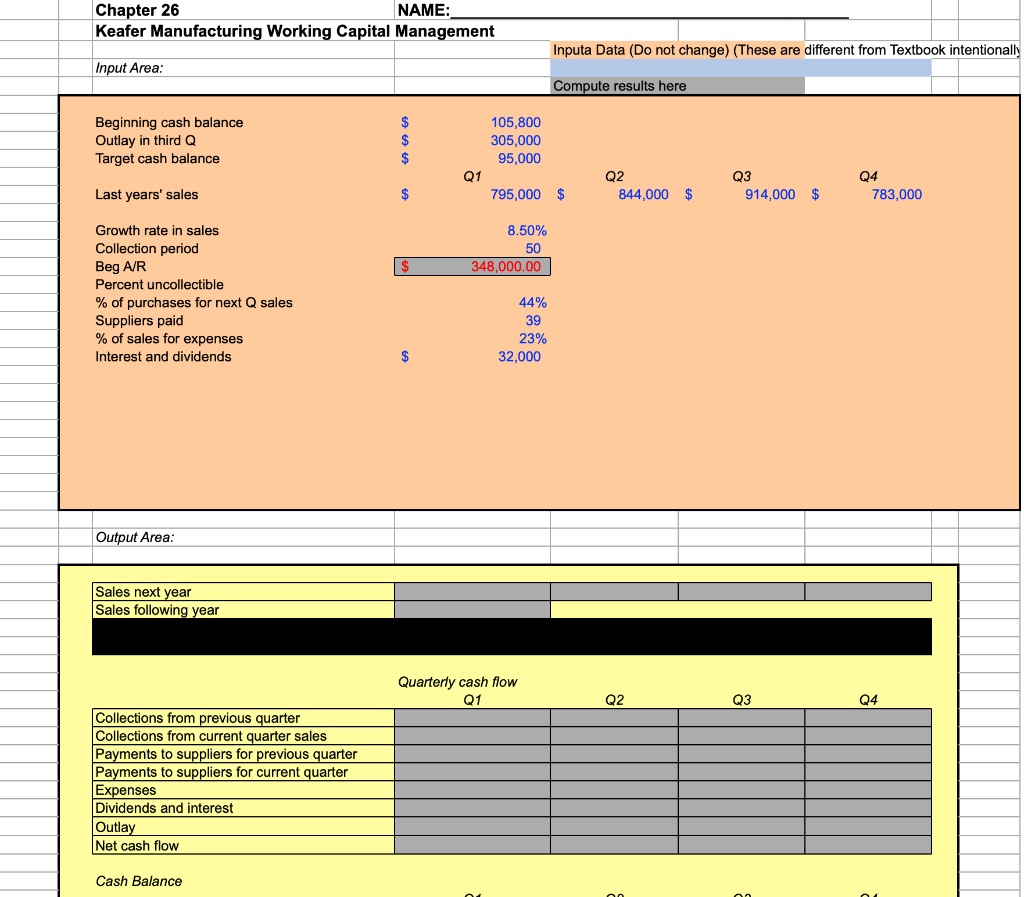

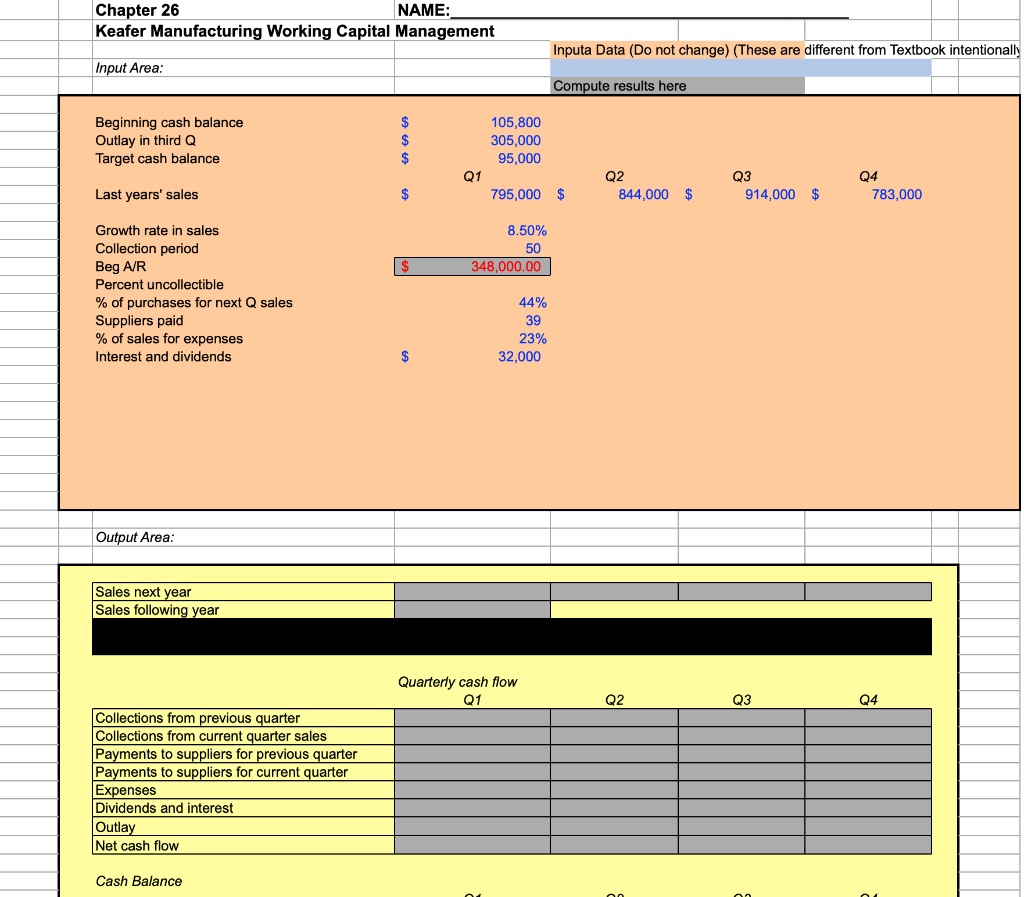

Please only use the numbers provided here in the Excel Template and solve for Cash Budget.

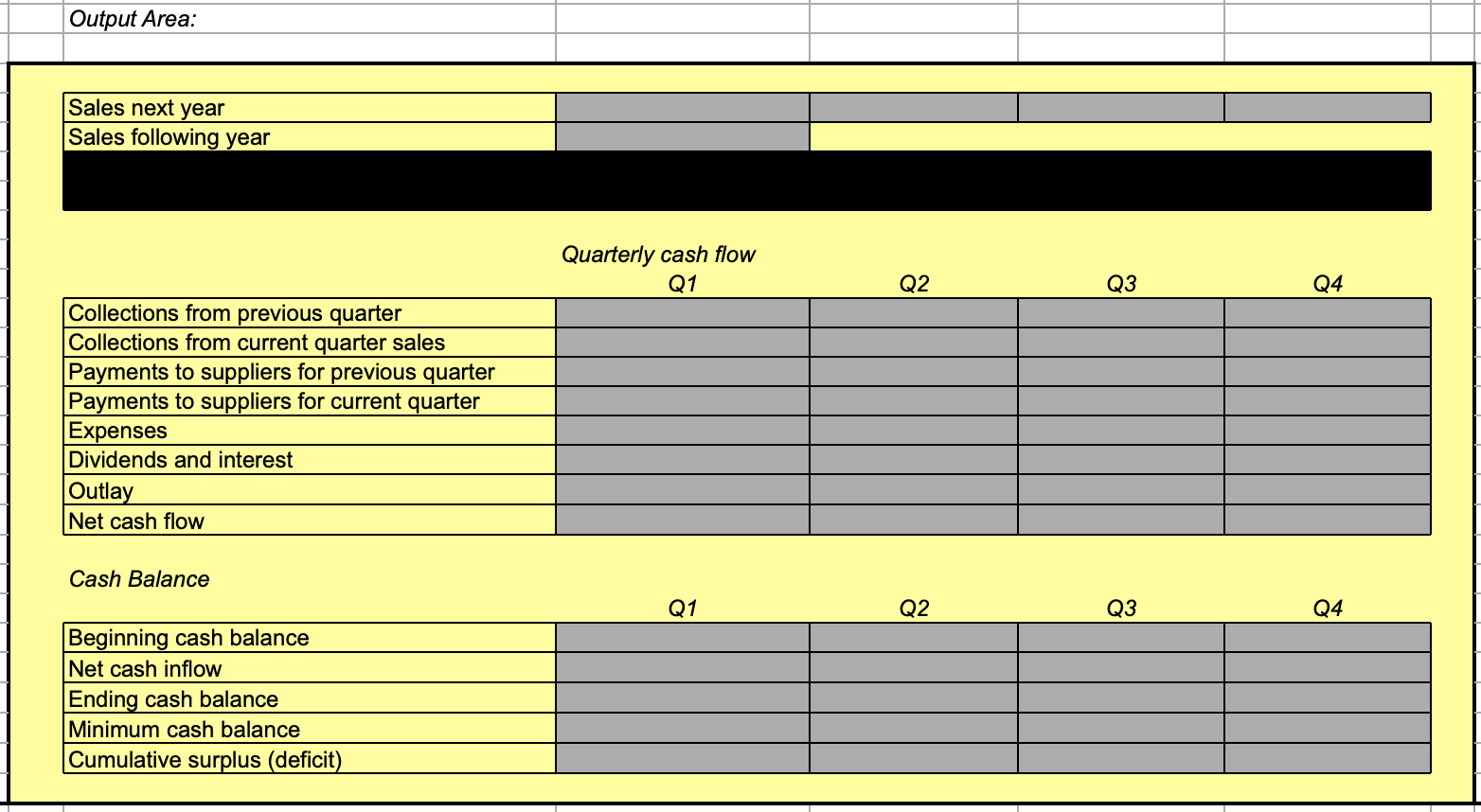

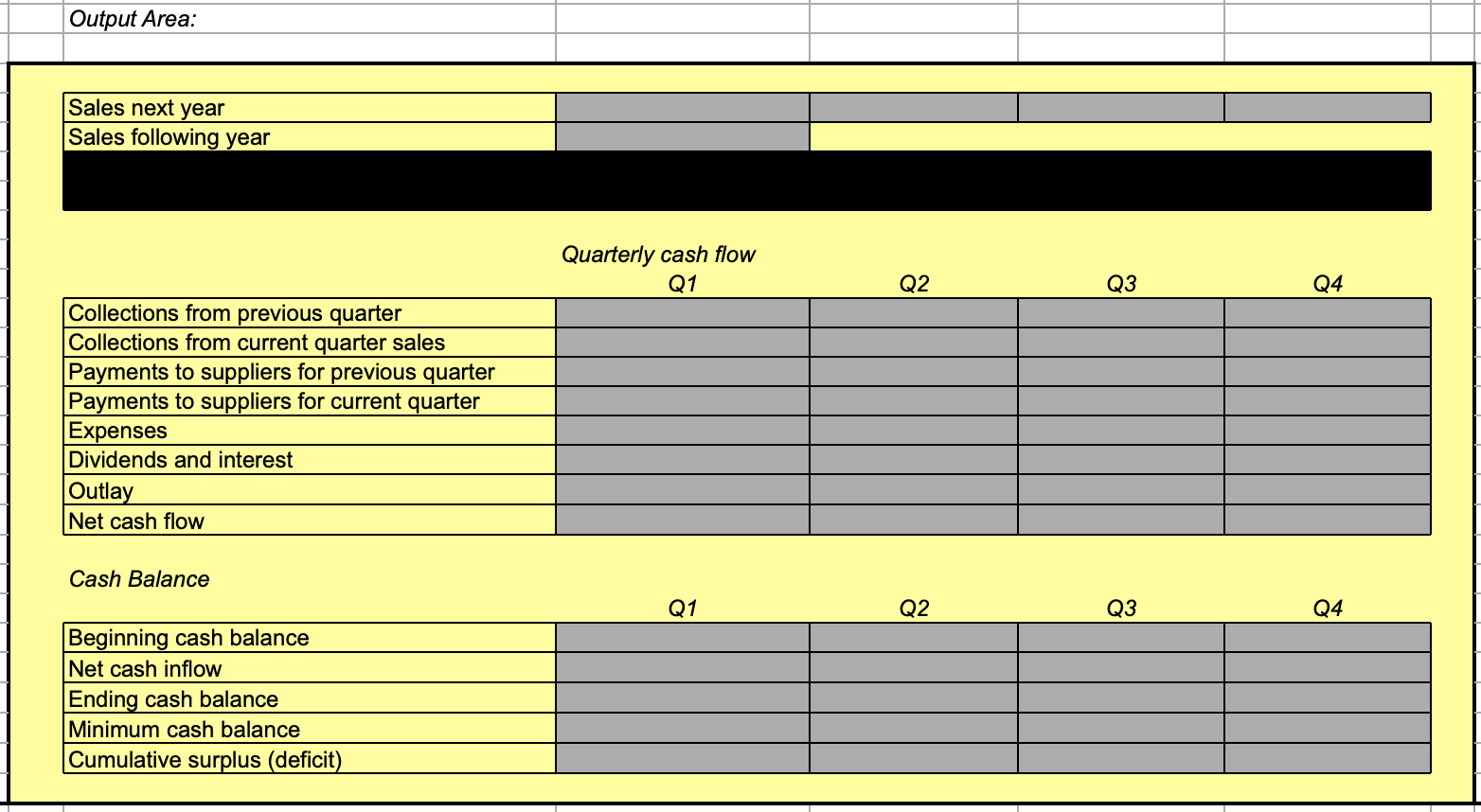

Chapter 26 NAME: Keafer Manufacturing Working Capital Management Inputa Data (Do not change) (These are different from Textbook intentionally Input Area: Compute results here Beginning cash balance Outlay in third Q Target cash balance $ $ 105,800 305,000 95,000 Q1 Q2 844,000 $ Q3 914,000 $ 04 783,000 Last years' sales $ 795,000 $ 8.50% 50 348,000.00 Growth rate in sales Collection period Beg A/R Percent uncollectible % of purchases for next Q sales Suppliers paid % of sales for expenses Interest and dividends 44% 39 23% 32,000 $ Output Area: Sales next year Sales following year Quarterly cash flow Q1 Q2 Q3 Q4 Collections from previous quarter Collections from current quarter sales Payments to suppliers for previous quarter Payments to suppliers for current quarter Expenses Dividends and interest Outlay Net cash flow Cash Balance Output Area: Sales next year Sales following year Quarterly cash flow Q1 Q2 Q3 Q4 Collections from previous quarter Collections from current quarter sales Payments to suppliers for previous quarter Payments to suppliers for current quarter Expenses Dividends and interest Outlay Net cash flow Cash Balance Q1 Q2 Q3 Q4 Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) Chapter 26 NAME: Keafer Manufacturing Working Capital Management Inputa Data (Do not change) (These are different from Textbook intentionally Input Area: Compute results here Beginning cash balance Outlay in third Q Target cash balance $ $ 105,800 305,000 95,000 Q1 Q2 844,000 $ Q3 914,000 $ 04 783,000 Last years' sales $ 795,000 $ 8.50% 50 348,000.00 Growth rate in sales Collection period Beg A/R Percent uncollectible % of purchases for next Q sales Suppliers paid % of sales for expenses Interest and dividends 44% 39 23% 32,000 $ Output Area: Sales next year Sales following year Quarterly cash flow Q1 Q2 Q3 Q4 Collections from previous quarter Collections from current quarter sales Payments to suppliers for previous quarter Payments to suppliers for current quarter Expenses Dividends and interest Outlay Net cash flow Cash Balance Output Area: Sales next year Sales following year Quarterly cash flow Q1 Q2 Q3 Q4 Collections from previous quarter Collections from current quarter sales Payments to suppliers for previous quarter Payments to suppliers for current quarter Expenses Dividends and interest Outlay Net cash flow Cash Balance Q1 Q2 Q3 Q4 Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit)