Question

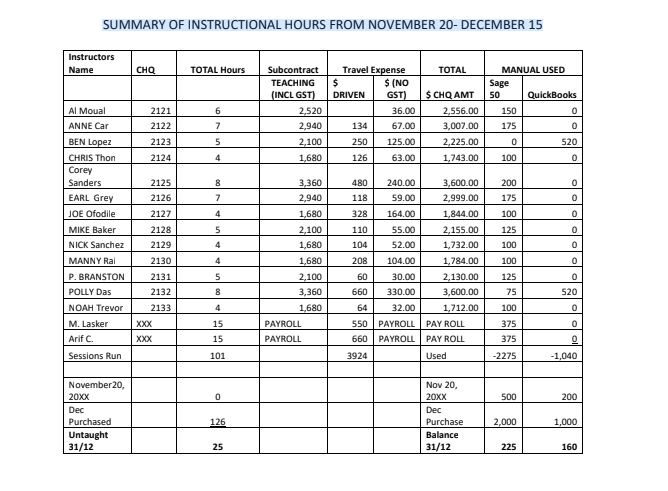

Please pay and record the 13 Contract Staff invoices (including mileages) that have been summarized for (details on an attached page) and record the 4

Please pay and record the 13 Contract Staff invoices (including mileages) that have been summarized for (details on an attached page) and record the 4 payroll cheques including holiday pay (details on an attached page). We are doing the payroll early as we are closing down early for the holidays.

Manual Bookkeeping

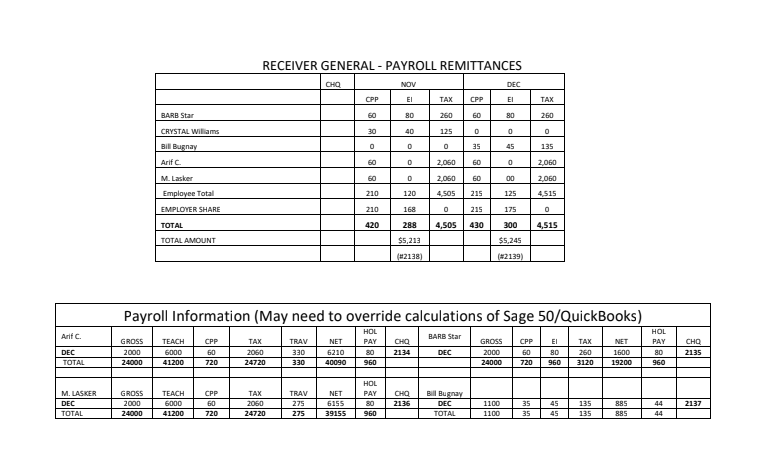

- Record the employers EI and CPP liabilities

- Record the remittance of Payroll Liabilities to the receiver General for November & December (separately)

Simply Accounting/ Quick Books Classes only

Please remit all payroll deductions to date (November and December) but remit them separately. Cheque numbers 2138 &2139 respectively

QUESTION :

Manual Bookkeeping

- Record the employers EI and CPP liabilities

- Record the remittance of Payroll Liabilities to the receiver General for November & December (separately)

Simply Accounting/ Quick Books Classes only

Please remit all payroll deductions to date (November and December) but remit them separately. Cheque numbers 2138 &2139 respectively

.

RECEIVER GENERAL-PAYROLL REMITTANCES CHO NOV DEC CPP EI TAX CPP TAX BARB Star 60 80 260 60 80 250 CRYSTAL Williams 30 40 125 0 0 0 0 0 0 35 45 135 Bill Bugnay Arif 60 0 2,060 60 0 2,060 60 0 2,060 60 00 2,060 210 120 4,505 215 125 4,515 M. Lasker Employee Total EMPLOYER SHARE TOTAL TOTAL AMOUNT 210 168 0 215 175 0 420 28.8 4,505 430 300 4,515 $5,245 $5,213 (2138) (2139) Payroll Information (May need to override calculations of Sage 50/QuickBooks) Arif c. BARB Star CHO GROSS 2000 24000 TEACH 6000 41200 CPP 60 720 TAX 2050 24720 TRAV 330 330 DEC TOTAL HOL PAY 80 960 NET 6210 40090 2134 GROSS 2000 24000 DEC CPP 60 720 HOL PAY 80 960 EI 80 960 TAX 260 3120 CHO 2135 NET 1600 19200 M. LASKER DEC TOTAL GROSS 2000 24000 TEACH 6000 41200 CPP 60 720 TAX 2060 24720 TRAV 275 275 NET 6155 39155 HOL PAY 80 960 CHQ 2136 Bill Bugnay DEC TOTAL 2137 1100 1100 35 35 45 45 135 135 885 885 44 44 SUMMARY OF INSTRUCTIONAL HOURS FROM NOVEMBER 20- DECEMBER 15 Instructors Name CHQ TOTAL Hours TOTAL MANUAL USED Sage 50 QuickBooks 150 0 6 2121 2122 Subcontract TEACHING (INCL GST) 2,520 2,940 2,100 1,680 Travel Expense $ $ (NO DRIVEN GST) 36.00 134 67.00 250 125.00 126 63.00 7 $ CHQ AMT 2,556.00 3,007.00 2,225.00 1,743.00 175 0 2123 5 0 520 2124 4 100 0 8 3,360 0 2125 2126 480 118 240.00 59.00 164.00 200 175 7 0 4 328 100 0 Al Moual ANNE Car BEN Lopez CHRIS Thon Corey Sanders EARL Grey JOE Ofodile MIKE Baker NICK Sanchez MANNY Rai P. BRANSTON POLLY Das NOAH Trevor M. Lasker Arif c. Sessions Run 2127 2128 2129 5 2,940 1,680 2,100 1,680 1,680 110 125 0 4 104 55.00 52.00 104.00 0 2130 4 208 3,600.00 2,999.00 1,844.00 2,155.00 1,732.00 1,784.00 2,130.00 3,600.00 1,712.00 PAY ROLL PAY ROLL 0 100 100 125 75 5 0 2131 2132 8 520 2133 4 2,100 3,360 1,680 PAYROLL PAYROLL 100 0 60 30.00 660 330.00 64 32.00 550 PAYROLL 660 PAYROLL 3924 XXX 15 375 0 15 375 0 101 Used -2275 -1,040 0 500 200 November 20, 20xx Dec Purchased Untaught 31/12 126 Nov 20, 20xx Dec Purchase Balance 31/12 2,000 1,000 25 225 160Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started