Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please do all parts of this question and kindly mention each part. I will give positive rating if you solve all parts of this

please please do all parts of this question and kindly mention each part. I will give positive rating if you solve all parts of this question perfectly and mentioned each part separately. please do perfectly

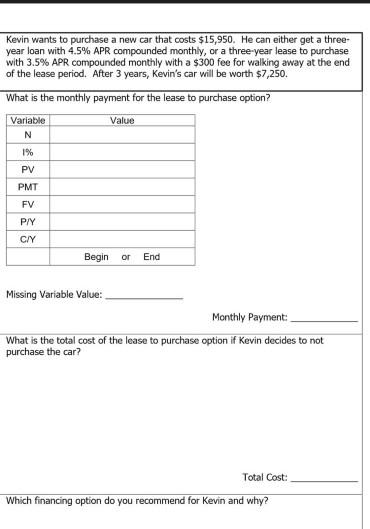

Kevin wants to purchase a new car that costs $15,950. He can either get a three- year loan with 4.5% APR compounded monthly, or a three-year lease to purchase with 3.5% APR compounded monthly with a $300 fee for walking away at the end of the lease period. After 3 years, Kevin's car will be worth $7,250. What is the monthly payment for the lease to purchase option? Value Variable N 1% PV PMT FV P/Y C/Y Begin or End Missing Variable Value: Monthly Payment What is the total cost of the lease to purchase option if Kevin decides to not purchase the car? Total Cost: Which financing option do you recommend for Kevin and whyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started