Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please do this question urgently and perfectly. I will give positive rating if you solve this urgently and perfectly. highlight the main answer 4

please please do this question urgently and perfectly. I will give positive rating if you solve this urgently and perfectly. highlight the main answer

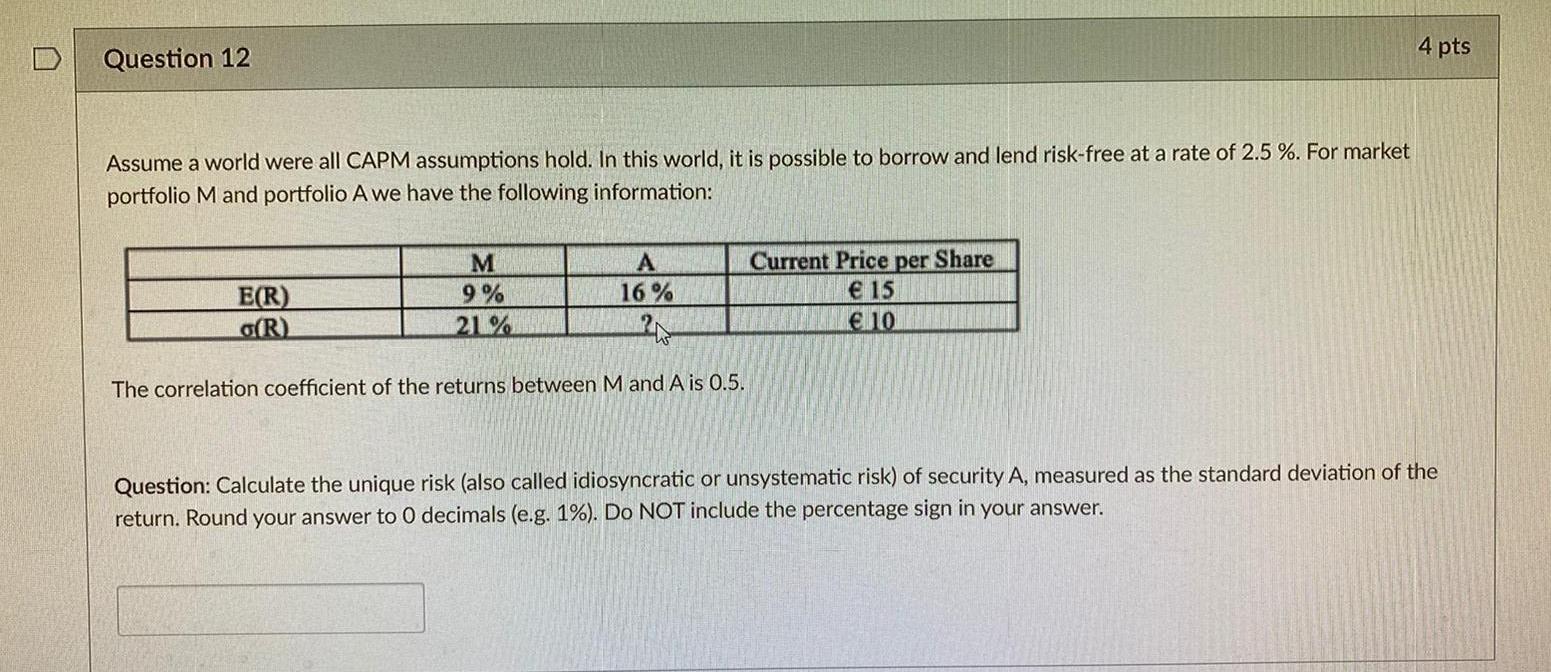

4 pts Question 12 Assume a world were all CAPM assumptions hold. In this world, it is possible to borrow and lend risk-free at a rate of 2.5 %. For market portfolio Mand portfolio A we have the following information: E(R) o(R) M 9 % 21% A 16 % ? Current Price per Share 15 10 The correlation coefficient of the returns between Mand A is 0.5. Question: Calculate the unique risk (also called idiosyncratic or unsystematic risk) of security A, measured as the standard deviation of the return. Round your answer to O decimals (e.g. 1%). Do NOT include the percentage sign in yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started