Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please, Please explain every EACH STEP how you get the answers. The Question is to find the distributed earnings and fill out the table. But

Please, Please explain every EACH STEP how you get the answers.

Please, Please explain every EACH STEP how you get the answers.

The Question is to find the distributed earnings and fill out the table. But please show each step so that I can understand.

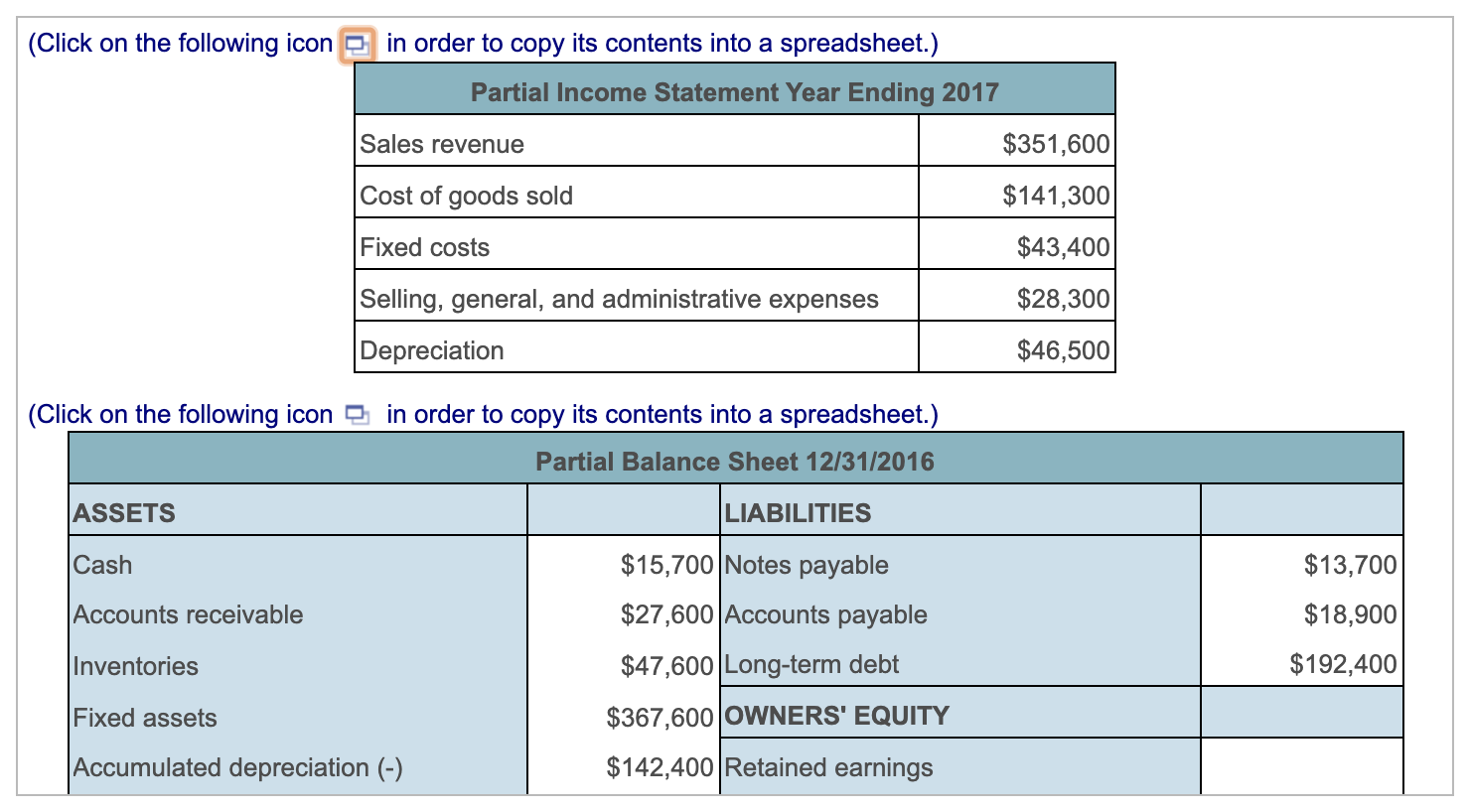

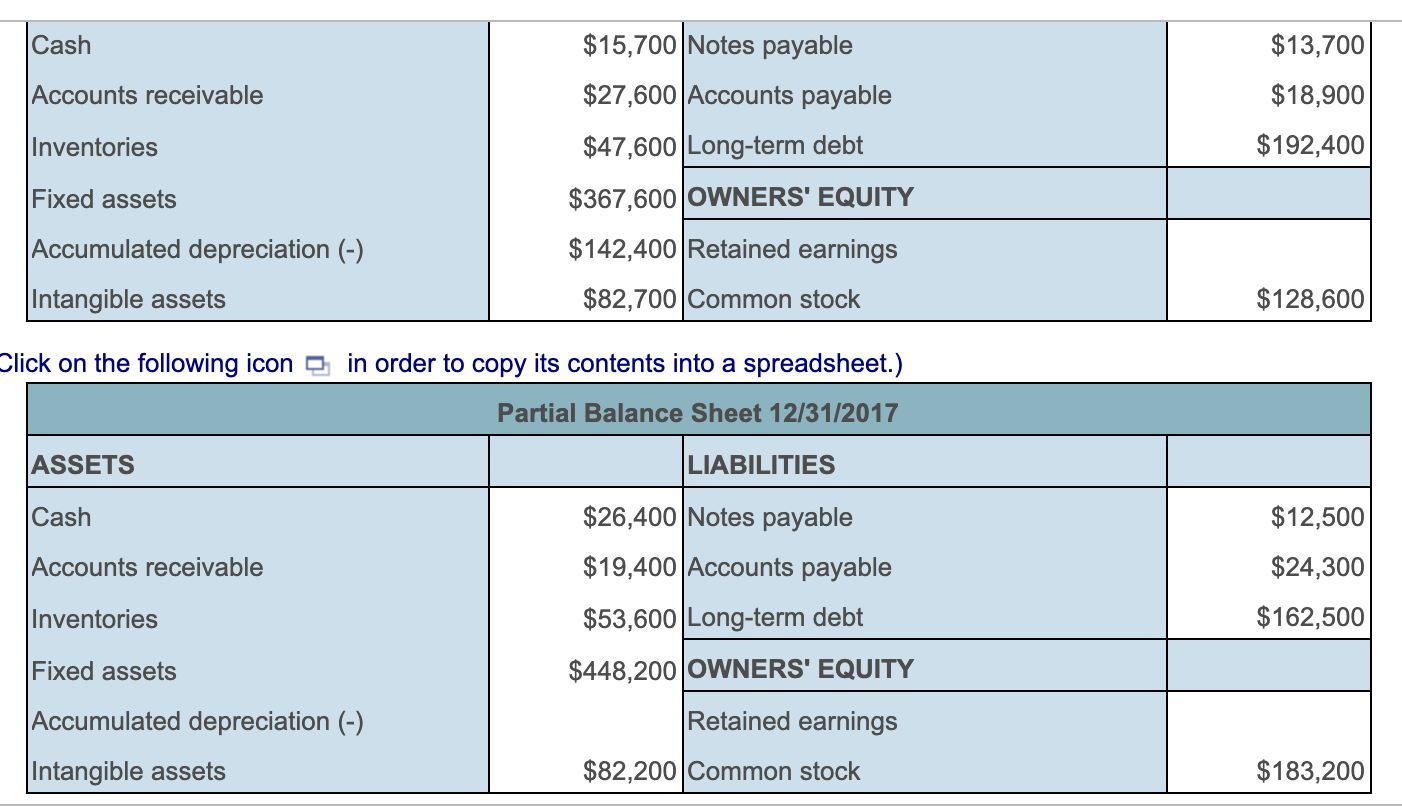

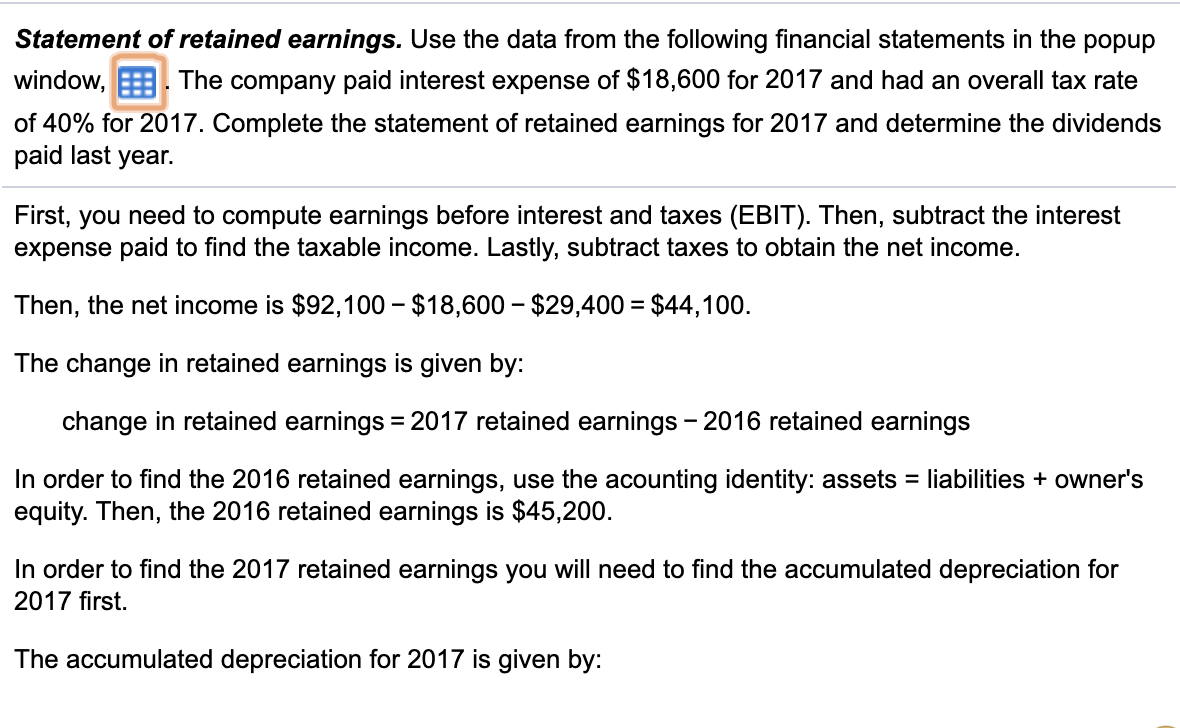

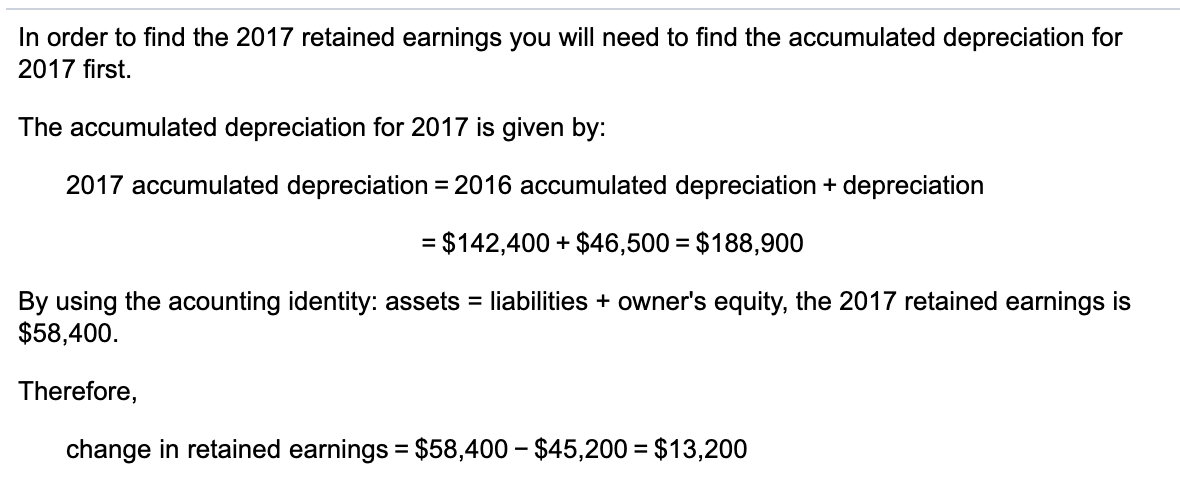

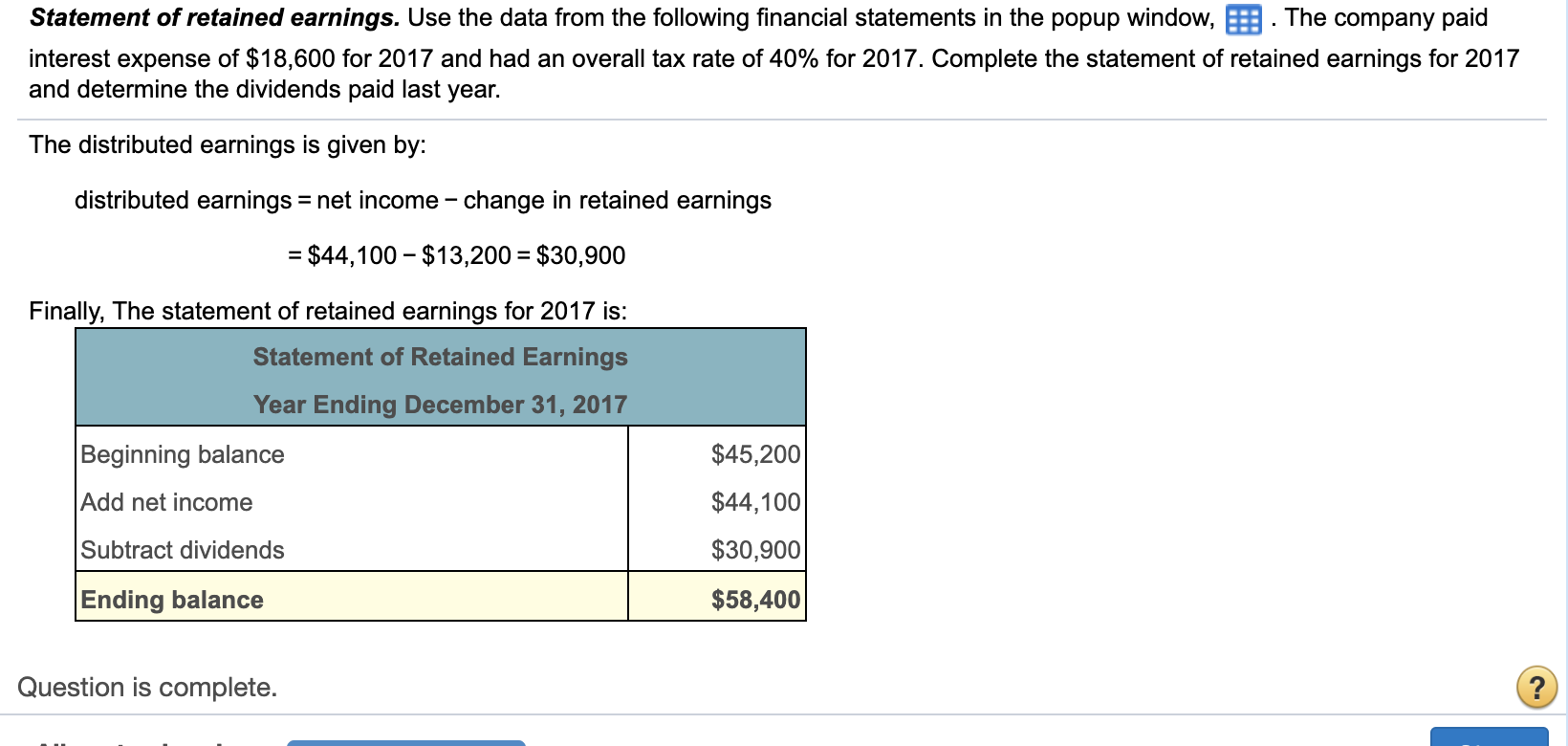

(Click on the following icon in order to copy its contents into a spreadsheet.) Partial Income Statement Year Ending 2017 Sales revenue $351,600 Cost of goods sold $141,300 $43,400 Fixed costs Selling, general, and administrative expenses $28,300 Depreciation $46,500 in order to copy its contents into a spreadsheet.) (Click on the following icon Partial Balance Sheet 12/31/2016 LIABILITIES ASSETS $15,700 Notes payable Cash $13,700 $27,600 Accounts payable Accounts receivable $18,900 $192,400 Inventories $47,600 Long-term debt Fixed assets $367,600 OWNERS' EQUITY |Accumulated depreciation (-) $142,400 Retained earnings $15,700 Notes payable Cash $13,700 $27,600 Accounts payable Accounts receivable $18,900 $192,400 Inventories $47,600 Long-term debt $367,600 OWNERS' EQUITY Fixed assets Accumulated depreciation (-) $142,400 Retained earnings $82,700 Common stock Intangible assets $128,600 Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2017 ASSETS LIABILITIES $26,400 Notes payable Cash $12,500 $19,400 Accounts payable Accounts receivable $24,300 Inventories $162,500 $53,600 Long-term debt $448,200 OWNERS' EQUITY Fixed assets Accumulated depreciation (-) Retained earnings Intangible assets $82,200 Common stock $183,200 Statement of retained earnings. Use the data from the following financial statements in the popup The company paid interest expense of $18,600 for 2017 and had an overall tax rate window, of 40% for 2017. Complete the statement of retained earnings for 2017 and determine the dividends paid last year First, you need to compute earnings before interest and taxes (EBIT). Then, subtract the interest expense paid to find the taxable income. Lastly, subtract taxes to obtain the net income. Then, the net income is $92,100 $18,600 $29,400 $44,100. The change in retained earnings is given by: change in retained earnings = 2017 retained earnings 2016 retained earnings In order to find the 2016 retained earnings, use the acounting identity: assets = equity. Then, the 2016 retained earnings is $45,200 liabilitiesowner's In order to find the 2017 retained earnings you will need to find the accumulated depreciation for 2017 first The accumulated depreciation for 2017 is given by: In order to find the 2017 retained earnings you will need to find the accumulated depreciation for 2017 first The accumulated depreciation for 2017 is given by: 2017 accumulated depreciation 2016 accumulated depreciation depreciation = = $142,400+ $46,500 $188,900 By using the acounting identity: assets = liabilities owner's equity, the 2017 retained earnings is $58,400 Therefore, change in retained earnings $58,400 $45,200 $13,200 Statement of retained earnings. Use the data from the following financial statements in the popup window, The company paid interest expense of $18,600 for 2017 and had an overall tax rate of 40% for 2017. Complete the statement of retained earnings for 2017 and determine the dividends paid last year. The distributed earnings is given by: distributed earnings net income - change in retained earnings = $44,100 $13,200 $30,900 Finally, The statement of retained earnings for 2017 is: Statement of Retained Earnings Year Ending December 31, 2017 Beginning balance $45,200 Add net income $44,100 Subtract dividends $30,900 $58,400 Ending balance Question is completeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started