Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please help! ! ! A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate

please please help! ! !

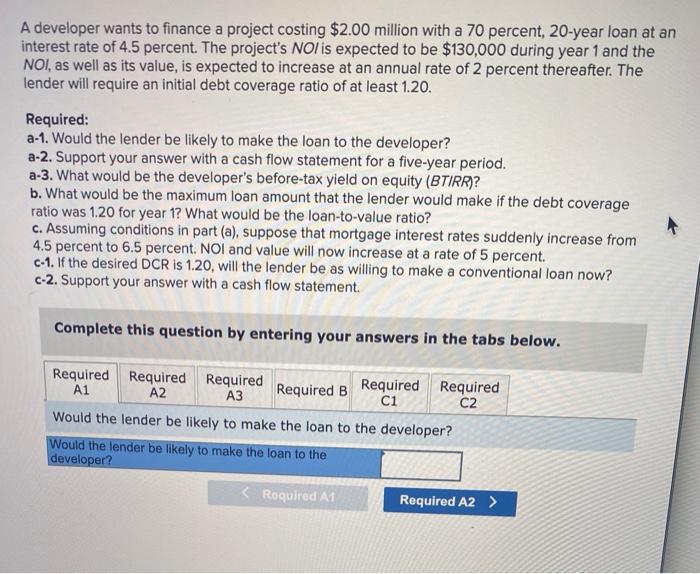

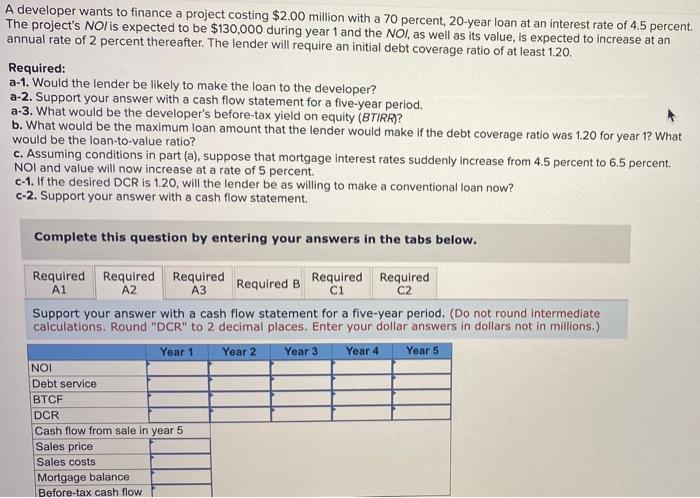

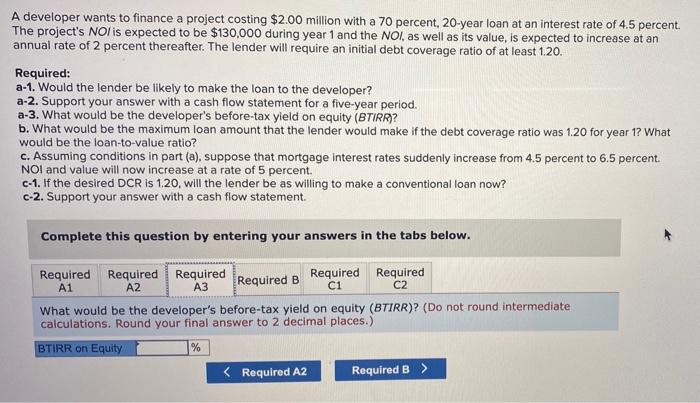

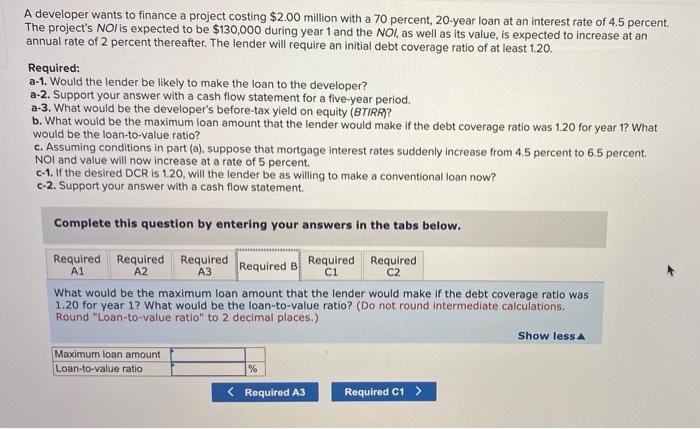

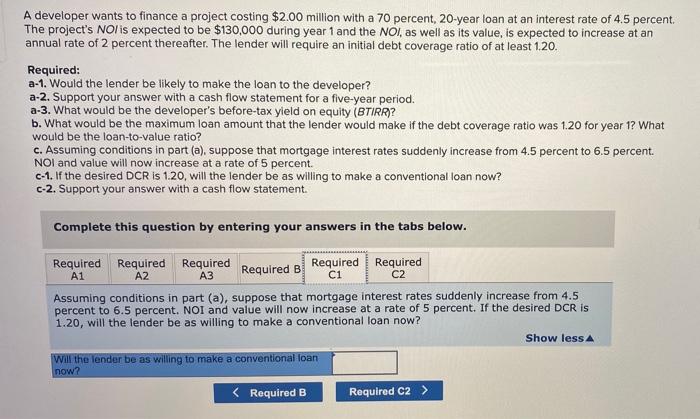

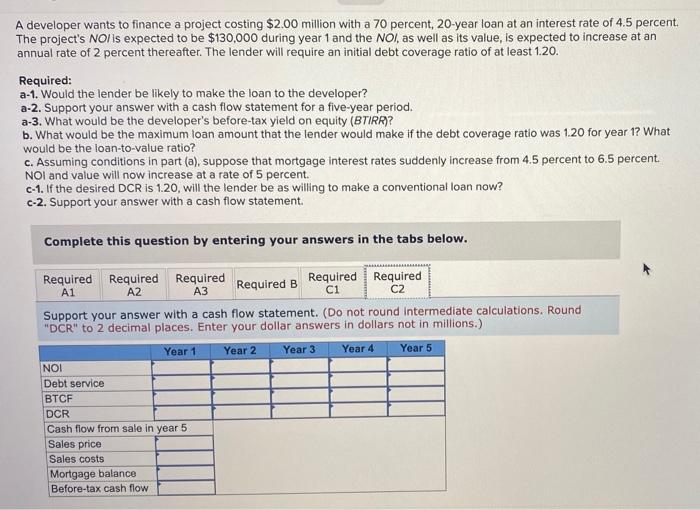

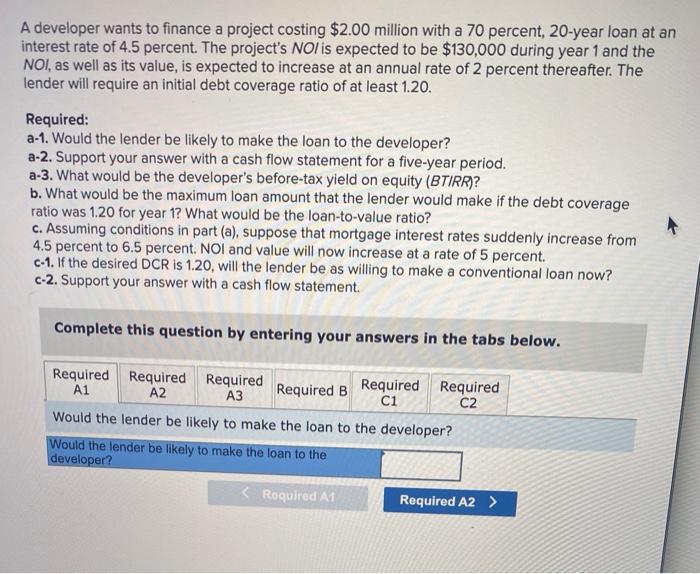

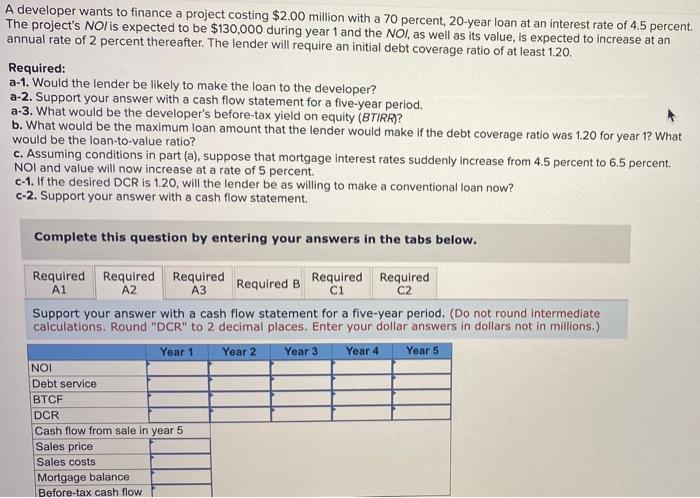

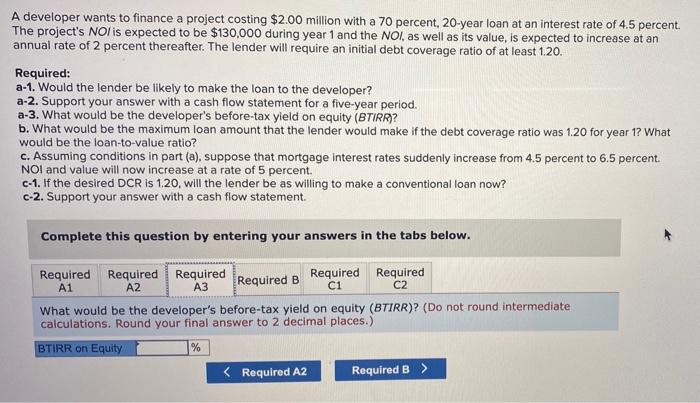

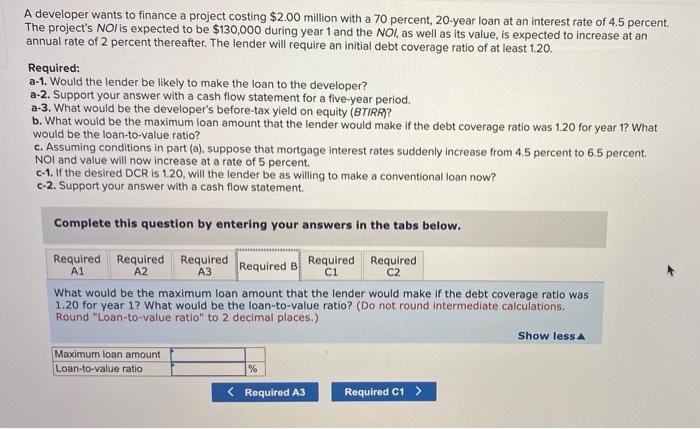

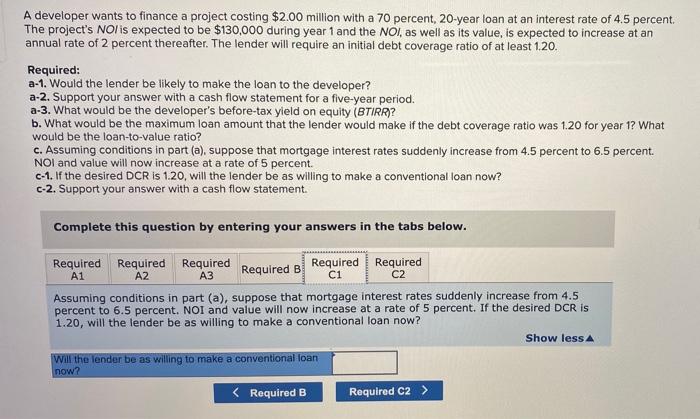

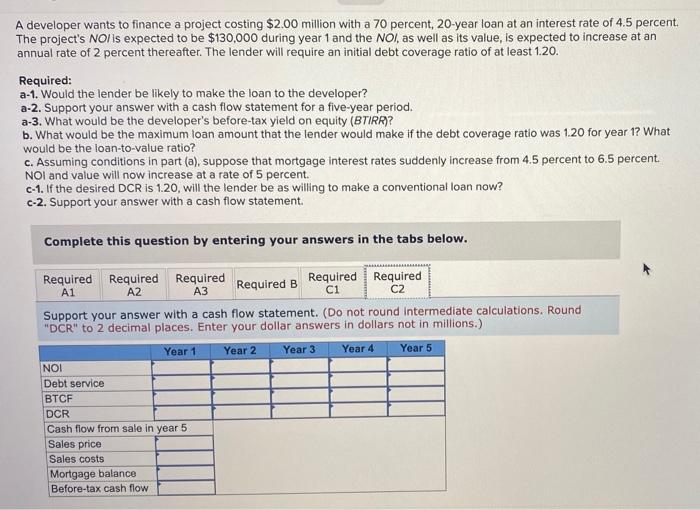

A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent. The project's NOI is expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent. C-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. Required Required Required A1 A2 Required B Required Required C1 C2 Would the lender be likely to make the loan to the developer? Would the lender be likely to make the loan to the developer? Roquired A1 Required A2 > A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent. The project's NO/ is expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage Interest rates suddenly increase from 4.5 percent to 6.5 percent NOI and value will now increase at a rate of 5 percent. c-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. Required Required Required A1 Required Required A2 Required B C1 C2 Support your answer with a cash flow statement for a five-year period. (Do not round Intermediate calculations. Round "DCR" to 2 decimal places. Enter your dollar answers in dollars not in millions.) Year 1 Year 2 Year 3 Year 4 Year 5 NOI Debt service BTCF DCR Cash flow from sale in year 5 Sales price Sales costs Mortgage balance Before-tax cash flow A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent. The project's NOI is expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent C-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. Required Required Required Required Required A1 A2 Required B A3 C1 C2 What would be the developer's before-tax yield on equity (BTIRR)? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) BTIRR on Equity % A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent The project's Nol is expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent NOI and value will now increase at a rate of 5 percent. c-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. Required Required Required Required B Required Required A1 A2 A3 ci C2 What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 17 What would be the loan-to-value ratio? (Do not round intermediate calculations. Round "Loan-to-value ratio" to 2 decimal places.) Show less Maximum loan amount Loan-to-value ratio % A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent The project's NOlis expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent. c-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. A1 A2 Required Required Required Required Required A3 Required B C1 C2 Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. Nos and value will now increase at a rate of 5 percent. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? Show less Will the lender be as willing to make a conventional loan now? A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent. The project's NOI is expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent. c-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. Required Required Required Required Required A1 A2 A3 Required B C1 C2 Support your answer with a cash flow statement. (Do not round Intermediate calculations. Round "DCR" to 2 decimal places. Enter your dollar answers in dollars not in millions.) Year 1 Year 2 Year 3 Year 4 Year 5 NOI Debt service BTCF DCR Cash flow from sale in year 5 Sales price Sales costs Mortgage balance Before-tax cash flow A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent. The project's NOI is expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent. C-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. Required Required Required A1 A2 Required B Required Required C1 C2 Would the lender be likely to make the loan to the developer? Would the lender be likely to make the loan to the developer? Roquired A1 Required A2 > A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent. The project's NO/ is expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage Interest rates suddenly increase from 4.5 percent to 6.5 percent NOI and value will now increase at a rate of 5 percent. c-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. Required Required Required A1 Required Required A2 Required B C1 C2 Support your answer with a cash flow statement for a five-year period. (Do not round Intermediate calculations. Round "DCR" to 2 decimal places. Enter your dollar answers in dollars not in millions.) Year 1 Year 2 Year 3 Year 4 Year 5 NOI Debt service BTCF DCR Cash flow from sale in year 5 Sales price Sales costs Mortgage balance Before-tax cash flow A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent. The project's NOI is expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent C-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. Required Required Required Required Required A1 A2 Required B A3 C1 C2 What would be the developer's before-tax yield on equity (BTIRR)? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) BTIRR on Equity % A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent The project's Nol is expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent NOI and value will now increase at a rate of 5 percent. c-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. Required Required Required Required B Required Required A1 A2 A3 ci C2 What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 17 What would be the loan-to-value ratio? (Do not round intermediate calculations. Round "Loan-to-value ratio" to 2 decimal places.) Show less Maximum loan amount Loan-to-value ratio % A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent The project's NOlis expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent. c-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. A1 A2 Required Required Required Required Required A3 Required B C1 C2 Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. Nos and value will now increase at a rate of 5 percent. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? Show less Will the lender be as willing to make a conventional loan now? A developer wants to finance a project costing $2.00 million with a 70 percent, 20-year loan at an interest rate of 4.5 percent. The project's NOI is expected to be $130,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. Required: a-1. Would the lender be likely to make the loan to the developer? a-2. Support your answer with a cash flow statement for a five-year period. a-3. What would be the developer's before-tax yield on equity (BTIRR)? b. What would be the maximum loan amount that the lender would make if the debt coverage ratio was 1.20 for year 1? What would be the loan-to-value ratio? c. Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent. c-1. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? c-2. Support your answer with a cash flow statement Complete this question by entering your answers in the tabs below. Required Required Required Required Required A1 A2 A3 Required B C1 C2 Support your answer with a cash flow statement. (Do not round Intermediate calculations. Round "DCR" to 2 decimal places. Enter your dollar answers in dollars not in millions.) Year 1 Year 2 Year 3 Year 4 Year 5 NOI Debt service BTCF DCR Cash flow from sale in year 5 Sales price Sales costs Mortgage balance Before-tax cash flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started