Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please help I will rate definately. All questions pls. 22. Which of the she already owns to her RRSP? following is/are true when a

please please help I will rate definately. All questions pls.

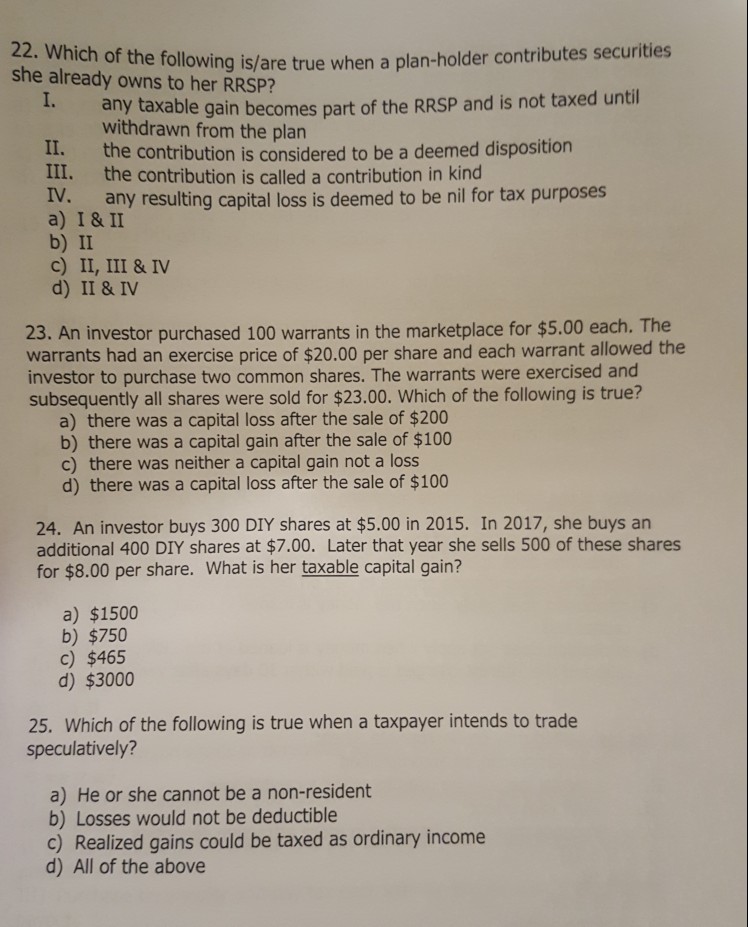

22. Which of the she already owns to her RRSP? following is/are true when a plan-holder contributes securities I. any taxable gain becomes withdrawn from the plan part of the RRSP and is not taxed until II. the contribution is considered to be a deemed disposition III. the contribution is called a contribution in kind Vany resulting capital loss is deemed to be nil for tax purposes a) I & II b) II c) 11, 111 & d) II & IV 23. An investor purchased 100 warrants in the marketplace for $5.00 each. The warrants had an exercise price of $20.00 per share and each warrant allowed the investor to purchase two common shares. The warrants were exercised and subsequently all shares were sold for $23.00. Which of the following is true? a) there was a capital loss after the sale of $200 b) there was a capital gain after the sale of $100 c) there was neither a capital gain not a loss d) there was a capital loss after the sale of $100 24. An investor buys 300 DIY shares at $5.00 in 2015. In 2017, she buys an additional 400 DIY shares at $7.00. Later that year she sells 500 of these shares for $8.00 per share. What is her taxable capital gain? a) $1500 b) $750 c) $465 d) $3000 25. Which of the following is true when a taxpayer intends to trade speculatively? a) He or she cannot be a non-resident b) Losses would not be deductible c) Realized gains could be taxed as ordinary income d) All of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started