PLEASE PLEASE I need quick answer. Please answer the following questions without excel and by step for step

3

Comment (briefly) on the design of the two costing systems + draw an overview diagram of each system. Explain why you believe / do not believe that the ABC system provides better costing information for decision making than the old system.

Question 4

Which management conclusion would you draw from the results?

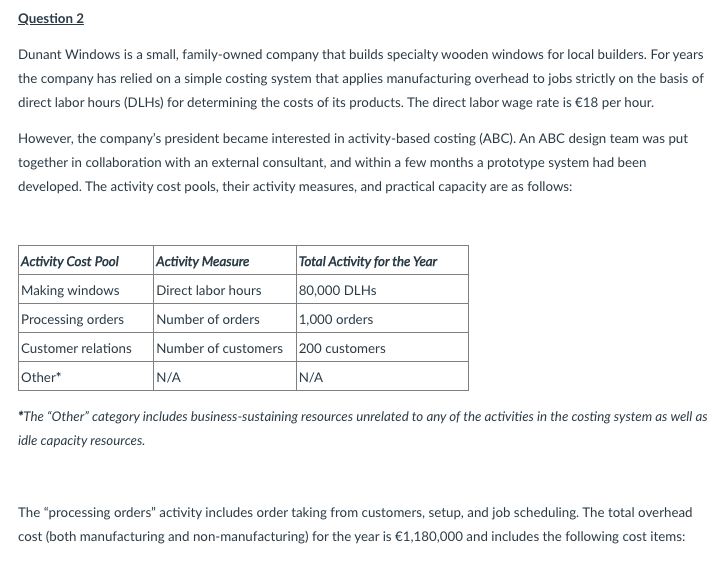

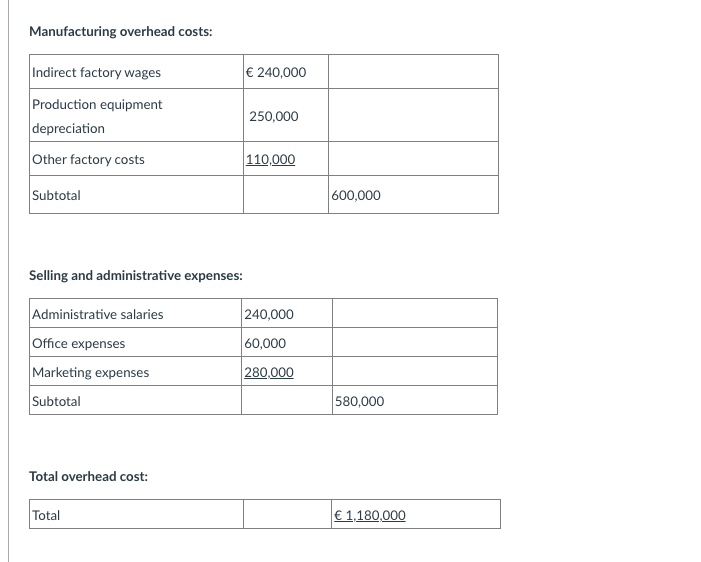

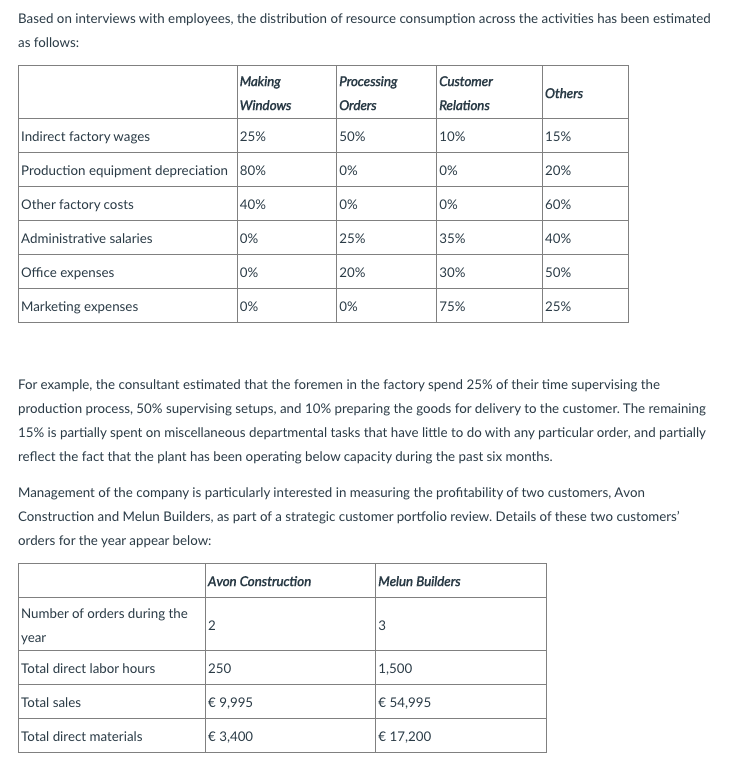

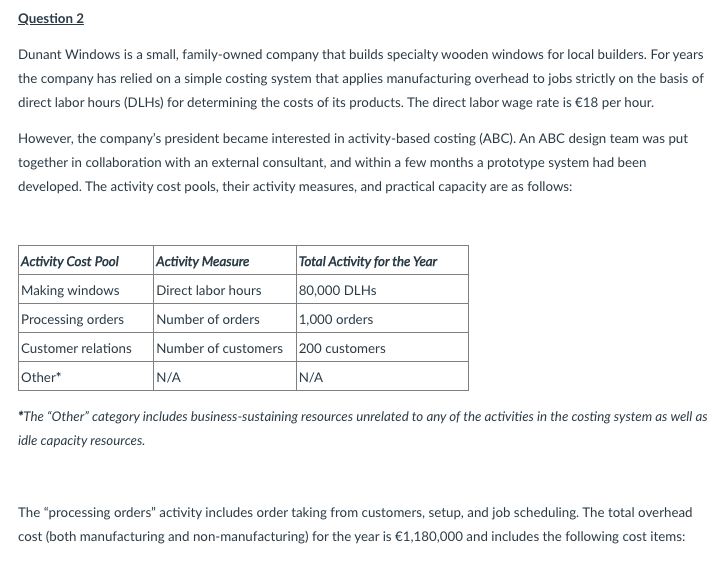

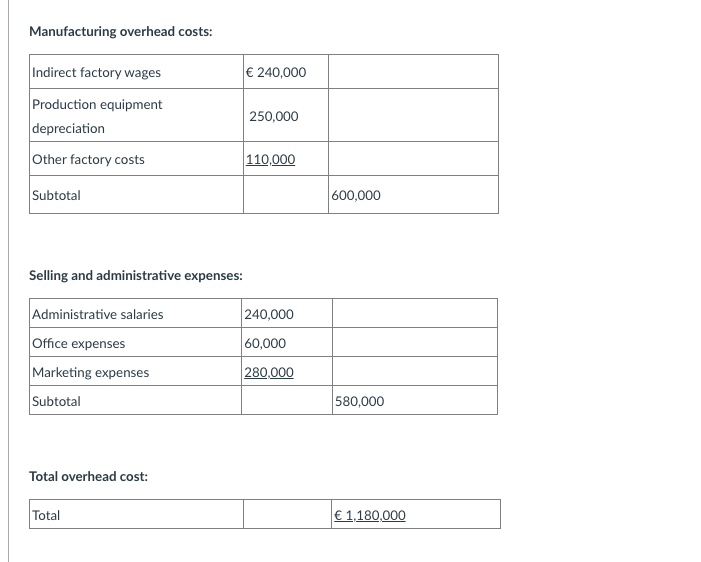

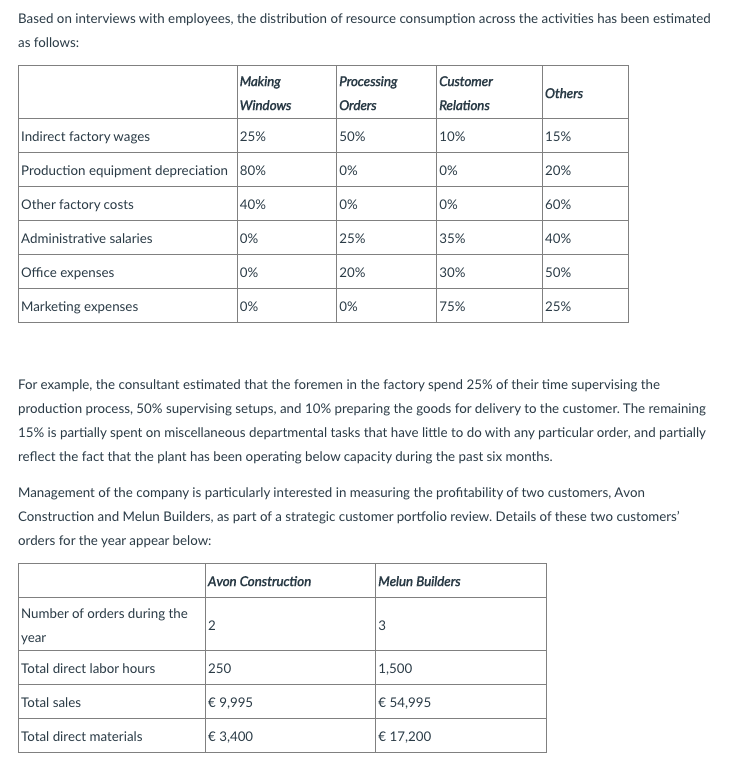

Question 2 Dunant Windows is a small, family-owned company that builds specialty wooden windows for local builders. For years the company has relied on a simple costing system that applies manufacturing overhead to jobs strictly on the basis of direct labor hours (DLHs) for determining the costs of its products. The direct labor wage rate is 18 per hour. However, the company's president became interested in activity-based costing (ABC). An ABC design team was put together in collaboration with an external consultant, and within a few months a prototype system had been developed. The activity cost pools, their activity measures, and practical capacity are as follows: Activity Cost Pool Making windows Processing orders Customer relations Other* Activity Measure Total Activity for the Year Direct labor hours 80,000 DLHS Number of orders 1,000 orders Number of customers 200 customers N/A N/A *The "Other" category includes business-sustaining resources unrelated to any of the activities in the costing system as well as idle capacity resources. The "processing orders" activity includes order taking from customers, setup, and job scheduling. The total overhead cost (both manufacturing and non-manufacturing) for the year is 1,180,000 and includes the following cost items: Manufacturing overhead costs: Indirect factory wages 240,000 250,000 Production equipment depreciation Other factory costs 110,000 Subtotal 600,000 Selling and administrative expenses: 240,000 60,000 Administrative salaries Office expenses Marketing expenses Subtotal 280,000 580,000 Total overhead cost: Total 1.180,000 Based on interviews with employees, the distribution of resource consumption across the activities has been estimated as follows: Making Windows Processing Orders Customer Relations Others Indirect factory wages 25% 50% 10% 15% Production equipment depreciation 80% 0% 0% 20% Other factory costs 40% 0% 0% 60% Administrative salaries 0% 25% 35% 40% Office expenses 0% 20% 30% 50% Marketing expenses 0% 0% 75% 25% For example, the consultant estimated that the foremen in the factory spend 25% of their time supervising the production process, 50% supervising setups, and 10% preparing the goods for delivery to the customer. The remaining 15% is partially spent on miscellaneous departmental tasks that have little to do with any particular order, and partially reflect the fact that the plant has been operating below capacity during the past six months. Management of the company is particularly interested in measuring the profitability of two customers, Avon Construction and Melun Builders, as part of a strategic customer portfolio review. Details of these two customers' orders for the year appear below: Avon Construction Melun Builders Number of orders during the 2 3 year Total direct labor hours 250 1,500 Total sales 9,995 54,995 Total direct materials 3,400 17,200