Answered step by step

Verified Expert Solution

Question

1 Approved Answer

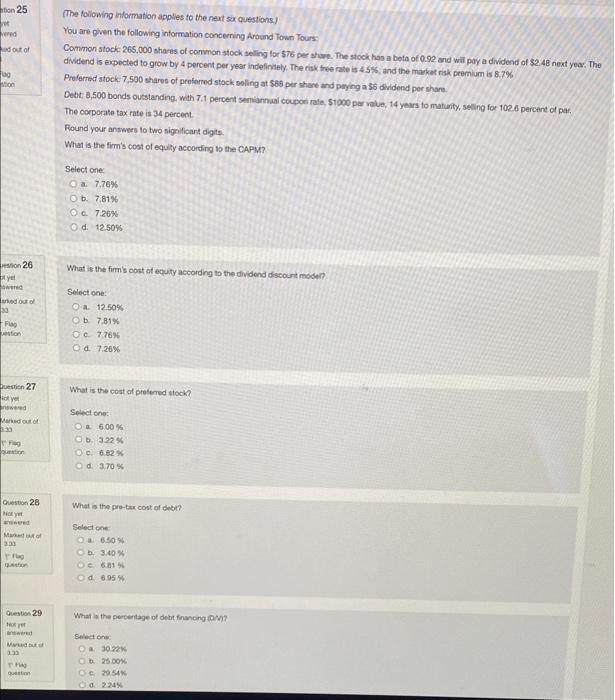

please please pleaase help me!! everything relates to each question thank you ver big hon 25 ered ed out of The following information applies to

please please pleaase help me!! everything relates to each question thank you ver big

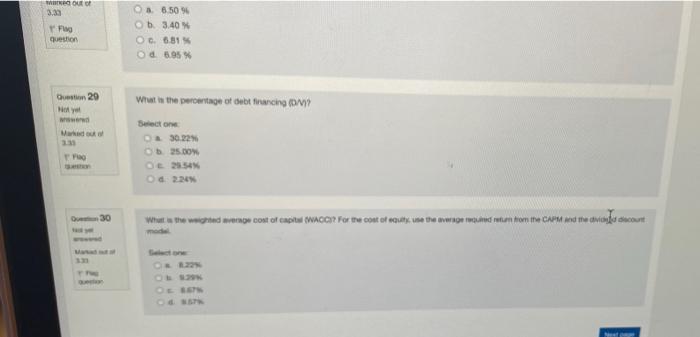

hon 25 ered ed out of The following information applies to the next sex Questions) You are given the following information concerning Around Town Tours Common stock 266.000 shares of common stock seling for $76 per share. The stock has a bota of 0.92 and will pay a dividend of $248 next year. The dividend is expected to grow by 4 percent per year indefinitely. The risk free rate is 45%, and the market is premium is 8.7% Preferred stock 7.500 shares of preferred stock oeling at $88 pur share and paying a $5 dividend per share Debt: 3,500 bonds outstanding, with 7.1 percent semiannual compostata, $1000 par vain, 14 years to maturity, selling for 102.6 percent of per, The corporate tax rate is 34 percent Round your answers to two significant digits. What is the firm's cost of equity according to the CAPM? Select one: a 7.76% b. 7,81% Oo. 7.26% Od 12.50% in 26 yel What is the firm's cost of equity according to the dividend discount model red out of 10 Fas Select one: @ 12.50% Ob 731% Oc7.76% Od 7.26% What is the cost of preferred stock? buestion 27 est yet wered ad out Select one 5.00 b. 322% OC. 6.82% od 3.70 % Quest 28 Ricky What is the prese cost of debt? Select Mado 333 6.50 b. 3.40 6.815 od 6.95 Question 29 What is the percentage of debt financing OAV? M Selector 30.22 2500X 2054 224 Best Tuto Tag Question a 6.50% Ob 3.40 O. 6.31 Od 6.95 Gusti 20 Hiyo www What is the percentage of oubt trancha DVY 23 Stone 3022 Ob 25W OL2554 Od 2 What we the wind verwow cost of capital WACCI? For the cost of cutsune the age od return from the CAPM and the device court OE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started