please please please , i am ask that question for several sevaeral time . please i need a solution and full explain of this solution please i am lose my money please

please please please , i am ask that question for several sevaeral time . please i need a solution and full explain of this solution please i am lose my money please

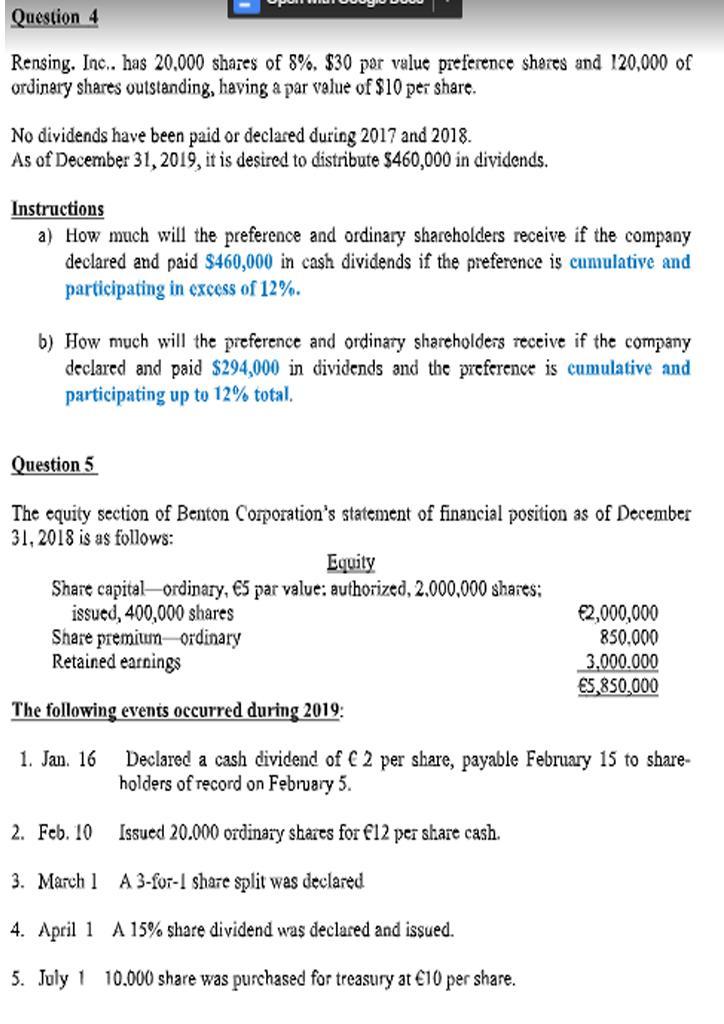

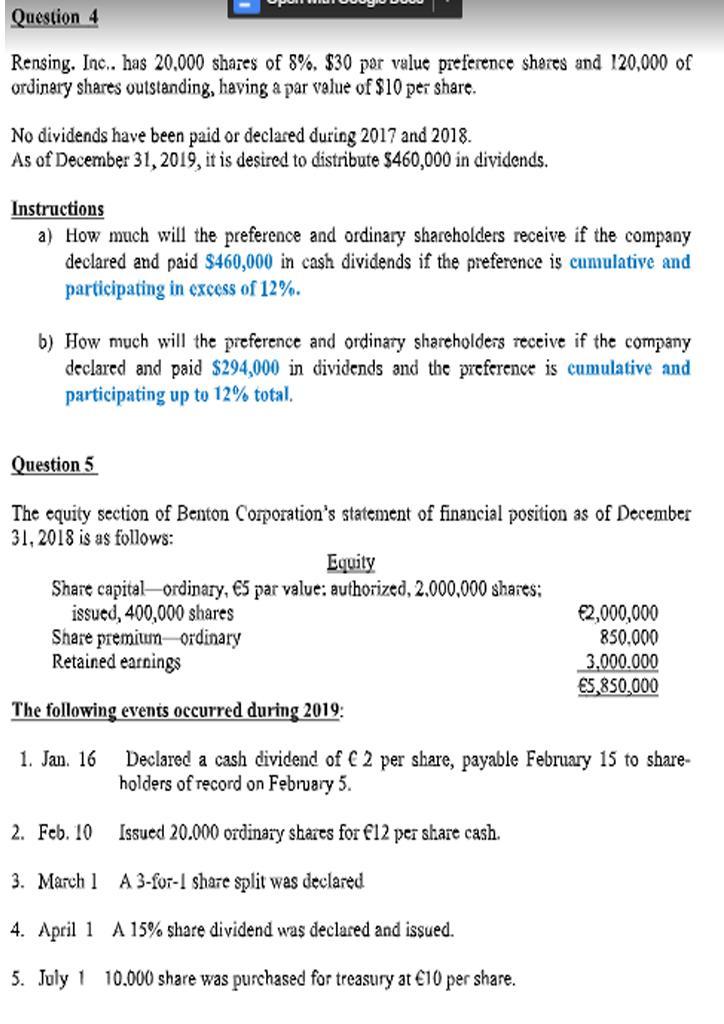

Question 4 Rensing. Inc. has 20.000 shares of 8%. $30 par value preference shares and 120,000 of ordinary shares outstanding, having a par value of $10 per share. No dividends have been paid or declared during 2017 and 2018. As of December 31, 2019, it is desired to distribute $460,000 in dividends. Instructions a) How much will the preference and ordinary shareholders receive if the company declared and paid $460,000 in cash dividends if the preference is cumulative and participating in excess of 12%. b) How much will the preference and ordinary shareholders receive if the company declared and paid $294,000 in dividends and the preference is cumulative and participating up to 12% total. Question 5 The equity section of Benton Corporation's statement of financial position as of December 31, 2018 is as follows: Equity Share capital ordinary, 5 par value: authorized, 2.000.000 shares; issued, 400,000 shares 2,000,000 Share premiun ordinary 850.000 Retained earnings 3.000.000 5,850,000 The following events occurred during 2019: 1. Jan. 16 Declared a cash dividend of 2 per share, payable February 15 to share holders of record on February 5. 2. Feb. 10 Issued 20.000 ordinary shares for 12 per share cash. 3. March 1 A 3-for-1 share split was declared 4. April 1 A 15% share dividend was declared and issued. 5. July 1 10.000 share was purchased for treasury at 10 per share. Question 4 Rensing. Inc. has 20.000 shares of 8%. $30 par value preference shares and 120,000 of ordinary shares outstanding, having a par value of $10 per share. No dividends have been paid or declared during 2017 and 2018. As of December 31, 2019, it is desired to distribute $460,000 in dividends. Instructions a) How much will the preference and ordinary shareholders receive if the company declared and paid $460,000 in cash dividends if the preference is cumulative and participating in excess of 12%. b) How much will the preference and ordinary shareholders receive if the company declared and paid $294,000 in dividends and the preference is cumulative and participating up to 12% total. Question 5 The equity section of Benton Corporation's statement of financial position as of December 31, 2018 is as follows: Equity Share capital ordinary, 5 par value: authorized, 2.000.000 shares; issued, 400,000 shares 2,000,000 Share premiun ordinary 850.000 Retained earnings 3.000.000 5,850,000 The following events occurred during 2019: 1. Jan. 16 Declared a cash dividend of 2 per share, payable February 15 to share holders of record on February 5. 2. Feb. 10 Issued 20.000 ordinary shares for 12 per share cash. 3. March 1 A 3-for-1 share split was declared 4. April 1 A 15% share dividend was declared and issued. 5. July 1 10.000 share was purchased for treasury at 10 per share

please please please , i am ask that question for several sevaeral time . please i need a solution and full explain of this solution please i am lose my money please

please please please , i am ask that question for several sevaeral time . please i need a solution and full explain of this solution please i am lose my money please