Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE PLEASE PLEASE THANKS!!! just do 4 just do the last 4!!! In the last reporting period, Helena's Heavenly Fodure Company recorded 100,000 units sold

PLEASE PLEASE PLEASE THANKS!!!

just do 4

just do the last 4!!!

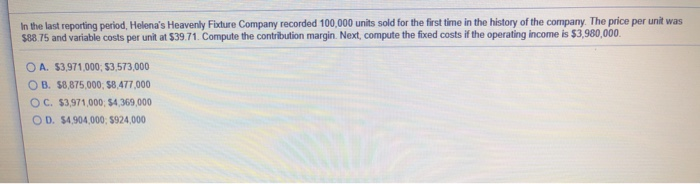

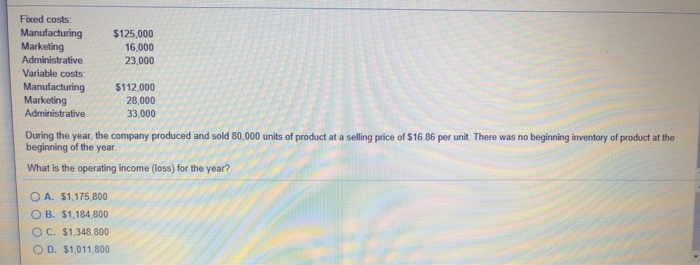

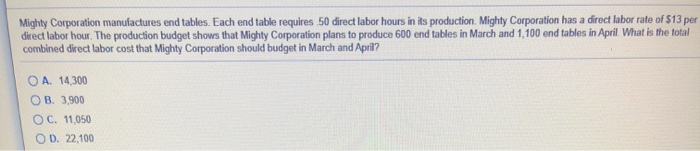

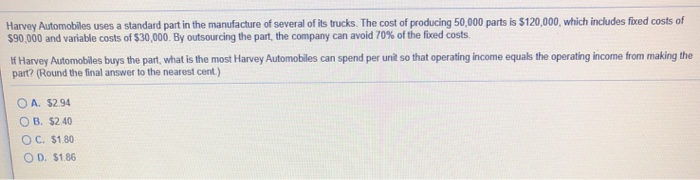

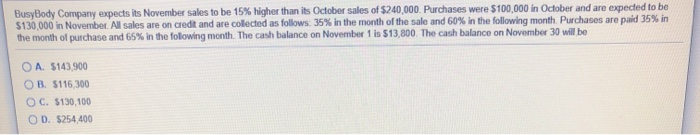

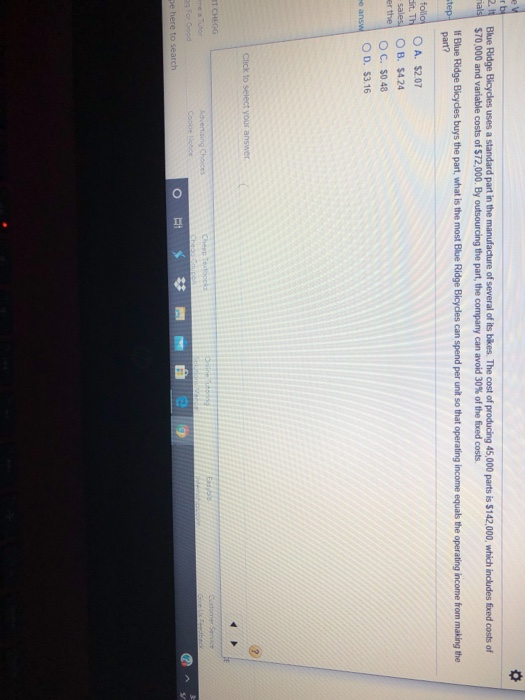

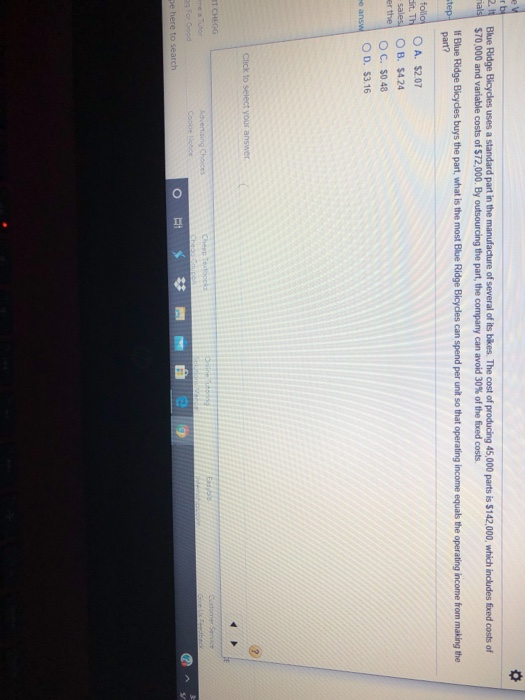

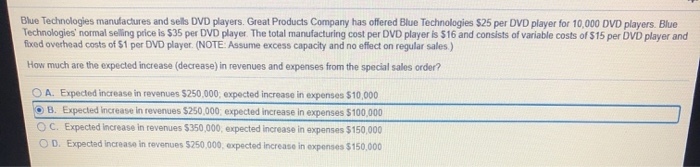

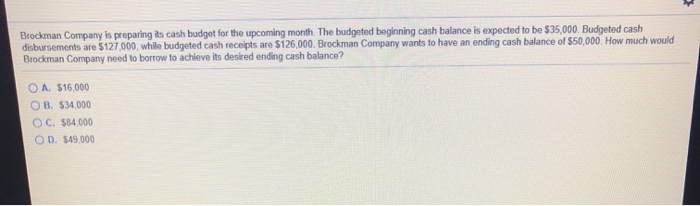

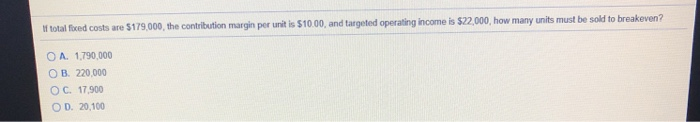

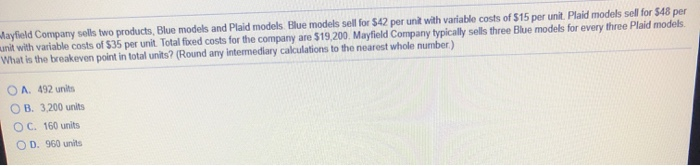

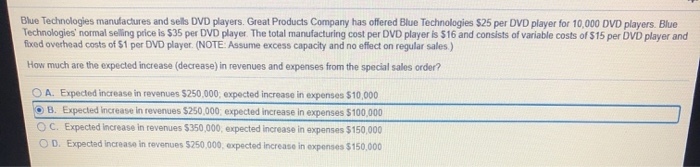

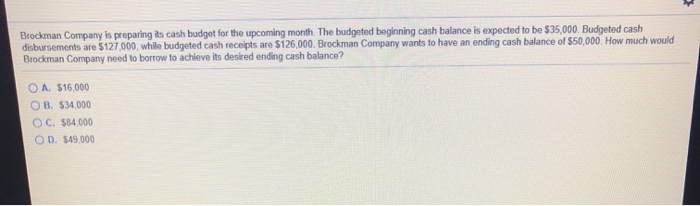

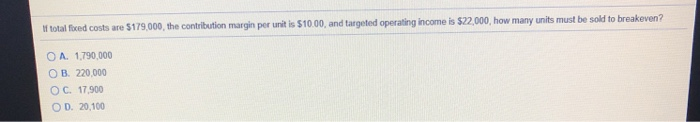

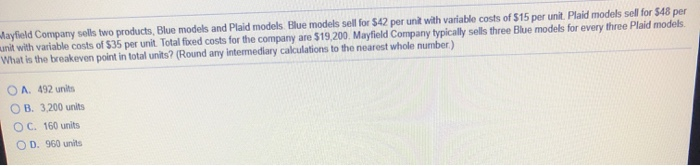

In the last reporting period, Helena's Heavenly Fodure Company recorded 100,000 units sold for the first time in the history of the company. The price per unit was $88.75 and variable costs per unit at $39.71. Compute the contribution margin. Next, compute the forced costs if the operating income is $3,980,000 O A. 53,971,000, 53,573,000 O B. 58,875,000, 58,477,000 OC. $3,971,000 $4,369,000 OD. 54,904,000, 5924,000 $125,000 16,000 23,000 Foxed costs Manufacturing Marketing Administrative Variable costs Manufacturing Marketing Administrative $112.000 28,000 33,000 During the year, the company produced and sold 80,000 units of product at a selling price of $16.86 per unit. There was no beginning inventory of product at the beginning of the year. What is the operating income (Loss) for the year? O A. 51,175 800 OB. 51,184 800 O C. $1,348,800 OD. $1,011,800 Mighty Corporation manufactures and tables. Each end table requires 50 direct labor hours in its production. Mighty Corporation has a direct labor rate of $13 per direct labor hour. The production budget shows that Mighty Corporation plans to produce 600 end tables in March and 1.100 end tables in April. What is the total combined direct labor cost that Mighty Corporation should budget in March and April? O A. 14,300 OB. 3,900 OC. 11,050 OD. 22,100 Harvey Automobiles uses a standard part in the manufacture of several of its trucks. The cost of producing 50,000 parts is $120,000, which includes fored costs of $90,000 and variable costs of $30,000. By outsourcing the part, the company can avoid 70% of the fixed costs. If Harvey Automobiles buys the part what is the most Harvey Automobiles can spend per unit so that operating income equals the operating income from making the part? (Round the final answer to the nearest cent) O A 52.94 OB. $2.40 OC. $180 OD. $186 BusyBody Company expects its November sales to be 15% higher than its October sales of $240,000. Purchases were $100,000 in October and are expected to be $130,000 in November. All sales are on credit and are collected as follows: 35% in the month of the sale and 60% in the following month. Purchases are paid 35% in the month of purchase and 65% in the folowing month. The cash balance on November 1 is $13.800. The cash balance on November 30 will be O A $143900 OB. 5116 300 OC. 5130,100 OD. $254400 2. nals Blue Ridge Bicycles uses a standard part in the manufacture of several of its bikes. The cost of producing 45,000 parts is $142,000, which includes fixed costs of $70,000 and variable costs of $72,000. By outsourcing the part, the company can avoid 30% of the fixed costs, If Blue Ridge Bicycles buys the part, what is the most Blue Ridge Bicycles can spend per unit so that operating income equals the operating income from making the step part? follo it. Th -sales er the O A. $2.07 OB. 5424 OC. 50.48 OD. 53.16 e answ Click to select your answer OT CHEGG vertising Coodete For Good be here to search os *Meig Brockman Company is preparing its cash budget for the upcoming month. The budgeted beginning cash balance is expected to be $35,000. Budgeted cash disbursements are $127,000, while budgeted cash receipts are $126,000. Brockman Company wants to have an ending cash balance of $50,000. How much would Brockman Company need to borrow to achieve its desired ending cash balance? O A 516,000 OB. 534,000 OC. $84,000 OD. 549.000 If total fixed costs are $179.000, the contribution margin per unit is $10.00, and targeted operating income is $22,000, how many units must be sold to breakeven? OA. 1,790,000 OB. 220,000 O C. 17.900 OD 20,100 Aayfield Company sells two products, Blue models and Plaid models Blue models sell for $42 per unit with variable costs of $15 per unit. Plaid models sell for $48 per unit with variable costs of $35 per unit. Total forced costs for the company are $19.200 Mayfield Company typically sells three Blue models for every three Plaid models. What is the breakeven point in total units? (Round any intermediary calculations to the nearest whole number) OM 492 units OB. 3.200 units O C. 160 units OD. 960 units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started