Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please please solve all parts of this question urgently and perfectly. Make sure to do it on a page with clear handwriting and mention each

Please please solve all parts of this question urgently and perfectly. Make sure to do it on a page with clear handwriting and mention each part answer as you give.

Please please solve all parts of this question urgently and perfectly. Make sure to do it on a page with clear handwriting and mention each part answer as you give.

I will give positive rating if you solve perfectly and urgently and solve all parts.

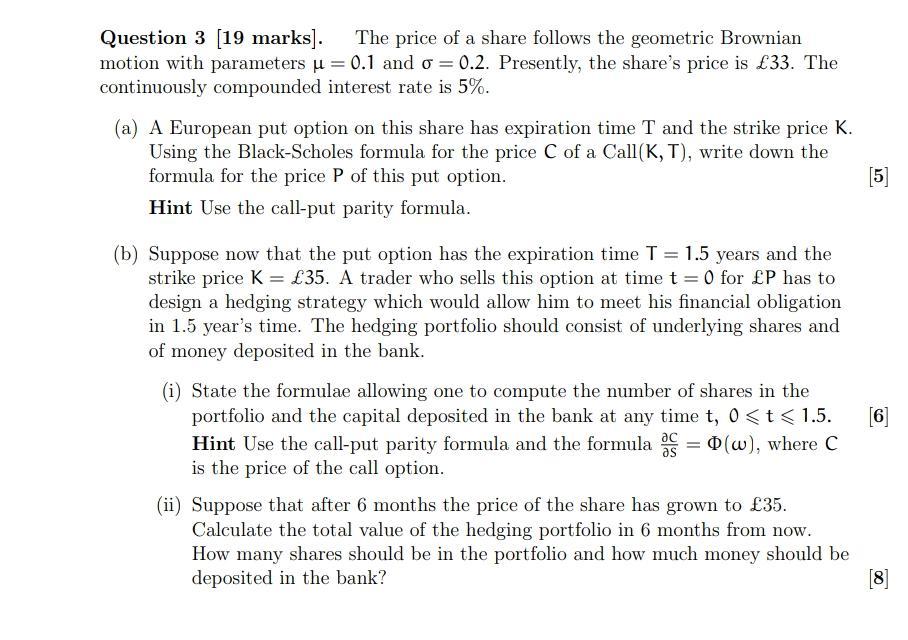

Question 3 (19 marks]. The price of a share follows the geometric Brownian motion with parameters u = 0.1 and o = 0.2. Presently, the share's price is 33. The continuously compounded interest rate is 5%. (a) A European put option on this share has expiration time T and the strike price K. Using the Black-Scholes formula for the price C of a Call(K, T), write down the formula for the price P of this put option. Hint Use the call-put parity formula. [5] (b) Suppose now that the put option has the expiration time T = 1.5 years and the strike price K = 35. A trader who sells this option at time t = 0 for P has to design a hedging strategy which would allow him to meet his financial obligation in 1.5 year's time. The hedging portfolio should consist of underlying shares and of money deposited in the bank. (i) State the formulae allowing one to compute the number of shares in the portfolio and the capital deposited in the bank at any time t, 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started