Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please solve this problem urgently and perfectly. mention each part answer as you give. I will give positive rating if you solve perfectly and

please please solve this problem urgently and perfectly. mention each part answer as you give. I will give positive rating if you solve perfectly and urgently and give correct answers.

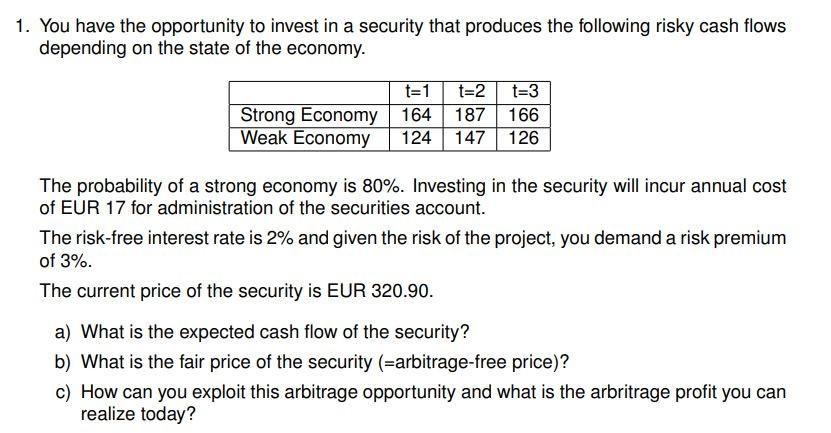

1. You have the opportunity to invest in a security that produces the following risky cash flows depending on the state of the economy. t=1 t=2 t=3 166 Strong Economy 164 Weak Economy 124 147 126 The probability of a strong economy is 80%. Investing in the security will incur annual cost of EUR 17 for administration of the securities account. The risk-free interest rate is 2% and given the risk of the project, you demand a risk premium of 3%. The current price of the security is EUR 320.90. a) What is the expected cash flow of the security? b) What is the fair price of the security (=arbitrage-free price)? c) How can you exploit this arbitrage opportunity and what is the arbritrage profit you can realize todayStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started