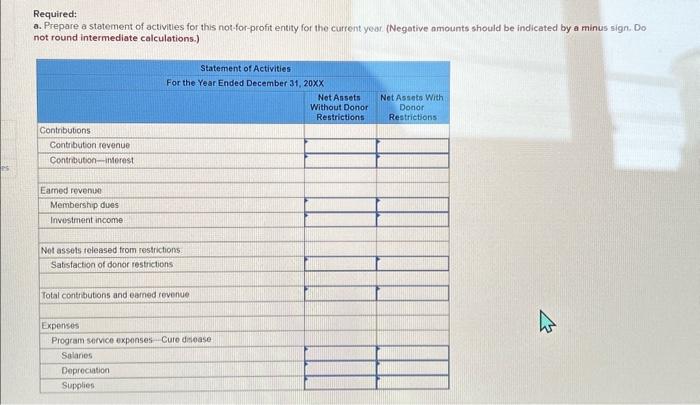

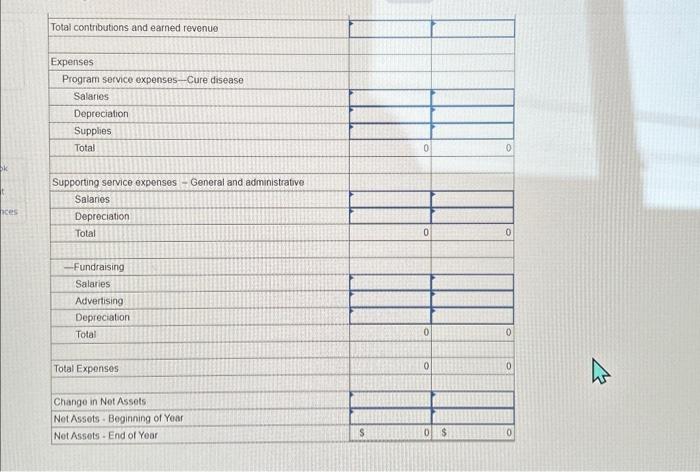

please plug in to the graph all the other ones i see posted dont follow the graph

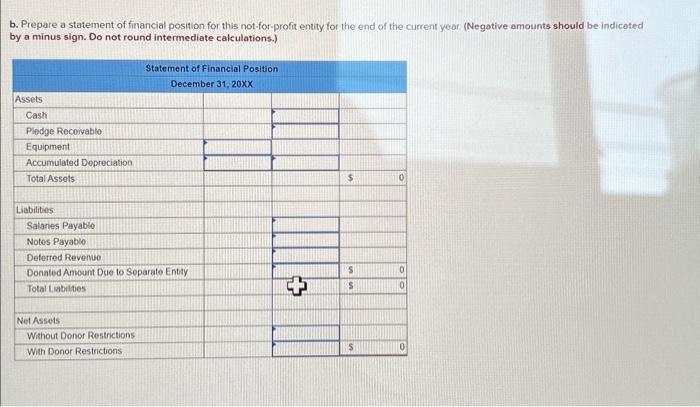

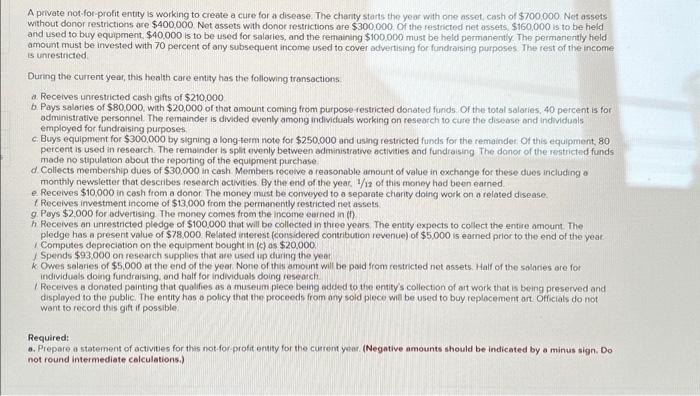

A private not-fot-profit entity is working to create a cure for a disease. The charity starts the year with one asset cash of $700,000 Net assets without donor restrictions are $400,000 Net assets with donor restrictions are $300,000 0f the restricted riet assets $160,000 is io be held and used to buy equipment. $40,000 is to be used for salaries, and the remaining $100,000 must be held permanently. The permanently held amount must be invested with 70 percent of any subsequent income used to cover advertising for fundraising purpeses. The rest of the income is unrestricted During the current year; this health care entity has the following transections a. Recelves unestricted cash gifts of $210,000 b. Pays salares of $80,000, with $20,000 of that amount coming from purpose-festricted donated funds. Of the total 5 alaries, 40 percent is for. odministrative personnel. The remainder is divided evenly among individuals working on research to cure the disease and individuals employed for fundraising purposes c. Buys equipment for $300.000 by signing a long-term note for $250.000 and using restricted funds for the remainder 0 t this equipment, 80 percent is used in research. The remainder is splt evenly between administratse activities and fundraising The donor of the restricted funds made no stipulation about the reporting of the equipment purchase. d Coliects membership dues of $30,000 in cash Membets rocese o reasonable amount of value in oxchange for these dues including o monthly newsletter that describes research octivities. By the end of the year, 1/12 of this money had been earned. e. Recelves $10,000 in cash from a donor. The money must be conveyed to a separate charity doing work on a related disease. 1. Receives investment income of $13,000 from the permanently festricted net assets g. Pays $2000 for odvertising. The money comos from the incoine earned in (f) h Receives an unrestricted pledge of $100,000 that will be collocted in three years. The entity expects to collect the entire amount The pledge has a present value of $78.000 Related interest (considered contribution revenue) of $5.000 is earned prior to the end of the yeat. 1 Computes deprecietion on the equipment bought in (c) as $20,000. Spends $93.000 on research supplies that are usind up during the veet k Owes salaries of $5,000 at the end of the yeor. None of this amount will be poid from restricted net assets 1 Half of the salaries are for individuals doing fundraising. and half for individuols doing research f Receives a donated peinting that quolifies as a museiam piece being edded to the entity's collection of art work that is being preserved and displayed to the public. The entity has o policy that the proceeds from any sold plece will be used to buy replocement art Officials do not want to recard this gift if possible. Required: a. Prepare a statement of activities for thits not-for-profit entify for the current yeus (Negotive amounts should be indicated by a minus sign. Do not round intermediate celculations.) Required: a. Prepare a statement of activities for this not-for-profit entity for the curtent year. (Negotive amounts should be indicated by a minus sign. Do not round intermediate calculations.) Prepare a statement of financial position for this not-for-profit entity for the end of the current year: (Negative amounts should be indicated oy a minus sign. Do not round intermediate calculations.)