Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please post answer with excel functions for work. Thank you! 3. What is each of the following investments worth today assuming an annual discount rate

Please post answer with excel functions for work. Thank you!

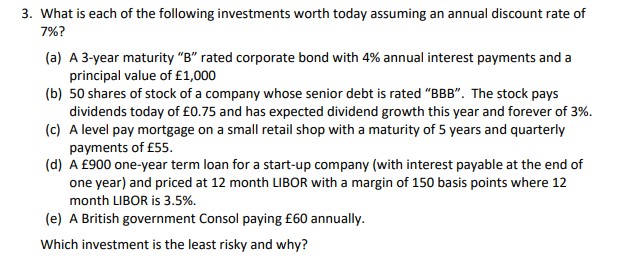

3. What is each of the following investments worth today assuming an annual discount rate of 7%? (a) A 3-year maturity "B" rated corporate bond with 4% annual interest payments and a principal value of 1,000 (b) 50 shares of stock of a company whose senior debt is rated "BBB". The stock pays dividends today of 0.75 and has expected dividend growth this year and forever of 3%. (c) A level pay mortgage on a small retail shop with a maturity of 5 years and quarterly payments of 55. (d) A 900 one-year term loan for a start-up company (with interest payable at the end of one year) and priced at 12 month LIBOR with a margin of 150 basis points where 12 month LIBOR is 3.5%. (e) A British government Consol paying 60 annually. Which investment is the least risky and whyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started