Answered step by step

Verified Expert Solution

Question

1 Approved Answer

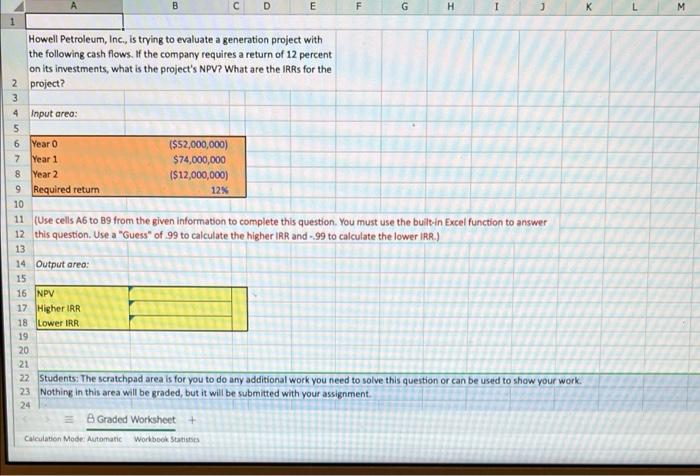

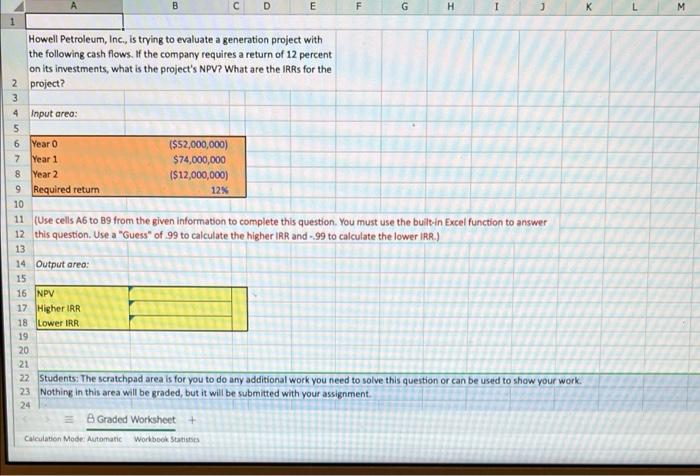

Please post excel formula B D E 71 G H 3 K M 00 Howell Petroleum, Inc., is trying to evaluate a generation project with

Please post excel formula

B D E 71 G H 3 K M 00 Howell Petroleum, Inc., is trying to evaluate a generation project with the following cash flows. If the company requires a return of 12 percent on its investments, what is the project's NPV? What are the IRRs for the 2 project? 3 4 Input area: 5 6 Year 0 ($52,000,000) 7 Year 1 $74,000,000 8 Year 2 ($12,000,000) 9 Required return 12% 10 11 (Use cells A6 to B9 from the given information to complete this question. You must use the built-in Excel function to answer 12 this question. Use a "Guess" of 99 to calculate the higher IRR and -99 to calculate the lower IRR.) 13 14 Output area: 15 16 INPY 17 Higher IRR 18 Lower IRR 19 20 21 22 Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work. 23 Nothing in this area will be graded, but it will be submitted with your assignment. Graded Worksheet + Calculation Mode: Automatic Workbook Statistics 24

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started