Answered step by step

Verified Expert Solution

Question

1 Approved Answer

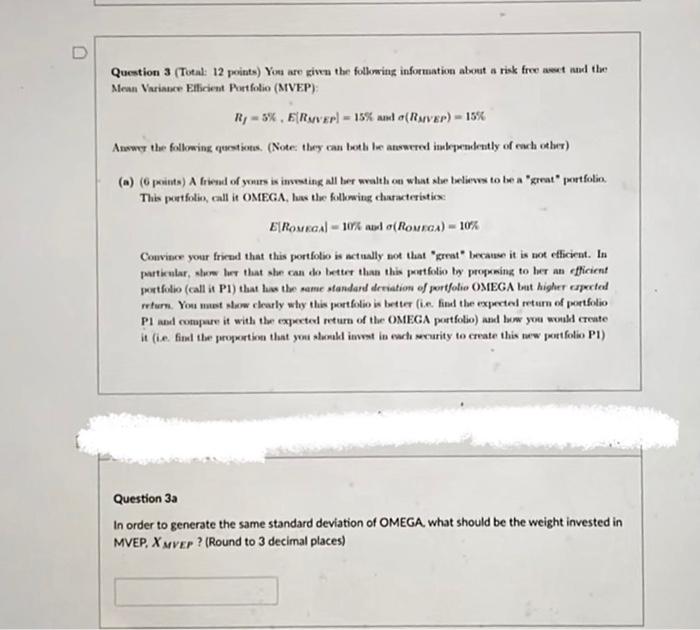

please post formulas used too! Question 3 (Total: 12 points) You are given the following information about a risk free to the Mean Variance Ellicient

please post formulas used too!

Question 3 (Total: 12 points) You are given the following information about a risk free to the Mean Variance Ellicient Portfolio (NIVEP); R; -5%, Ryver) = 15% and (Ryver) -15% Answer the following questions. (Note: they can both be atswered inbependently of each other) (a) (print) Abrwoud of yours is investing all ber walth on what she believes to be a great portfolio This portfolin, call it OMEGA, lus the following characteristics E|Ronaal - Wolo(Roma) - 10% Convince your friend that this portfolio is actually not that great became it is not efficient. In particular, show how that she can do better than this petfolio w prowning to her an officient portfolio (call i P1) that has the same standard deviation of portfolio OMEGA but higher caspected return. You met low clearly why this portfolio is better le find the expected return of portfolio Pl and compare it with the expected return of the OMEGA portfolio) and how you would create in die find the proportion that you surakinat in each curity to create this ww portfolio P1) Question 3a In order to generate the same standard deviation of OMEGA, what should be the weight invested in MVEP, XMVEP ? (Round to 3 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started