Answered step by step

Verified Expert Solution

Question

1 Approved Answer

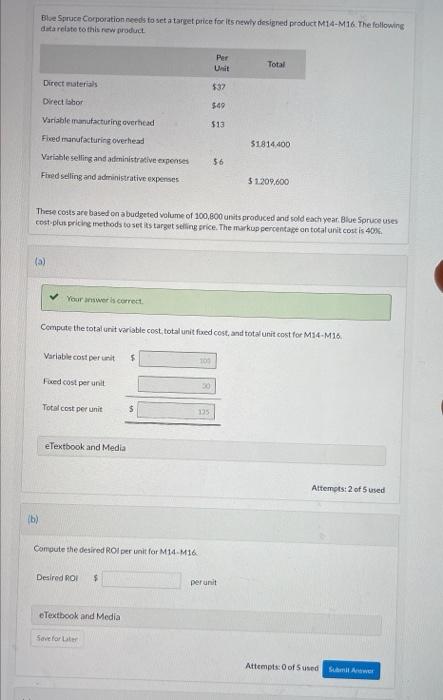

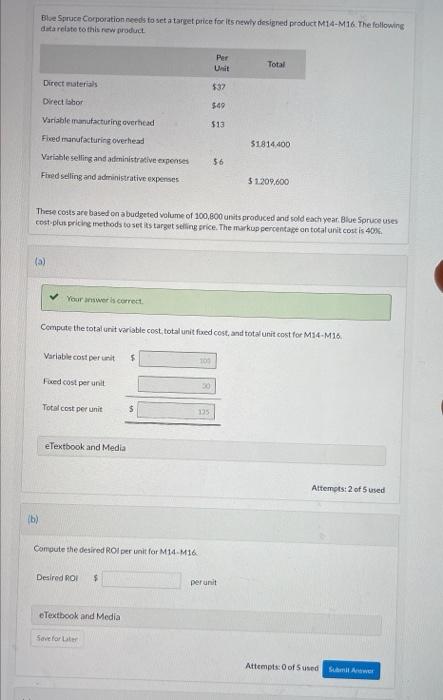

please post full answer Blue Spruce Corporation needs to set a target price for its newly designed product M14-M16. The following data reiste to this

please post full answer

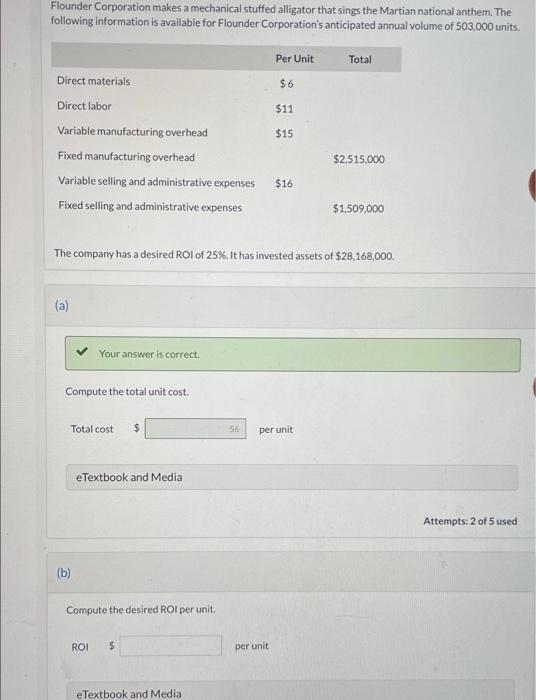

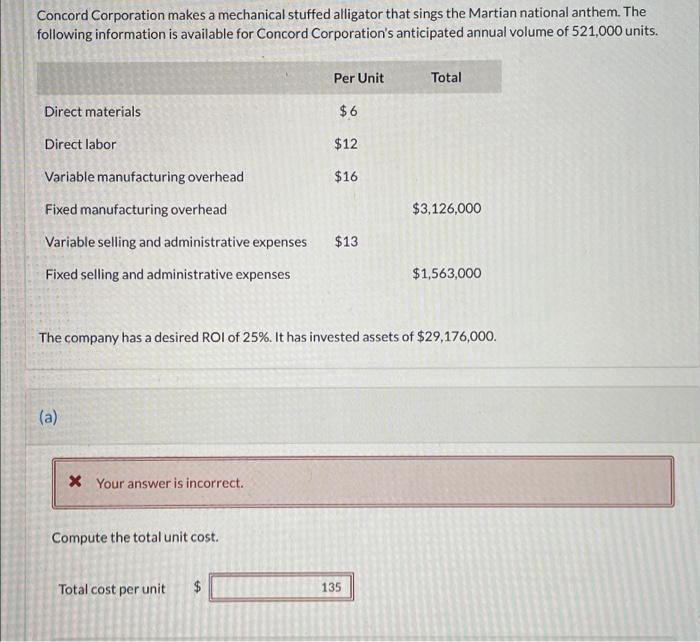

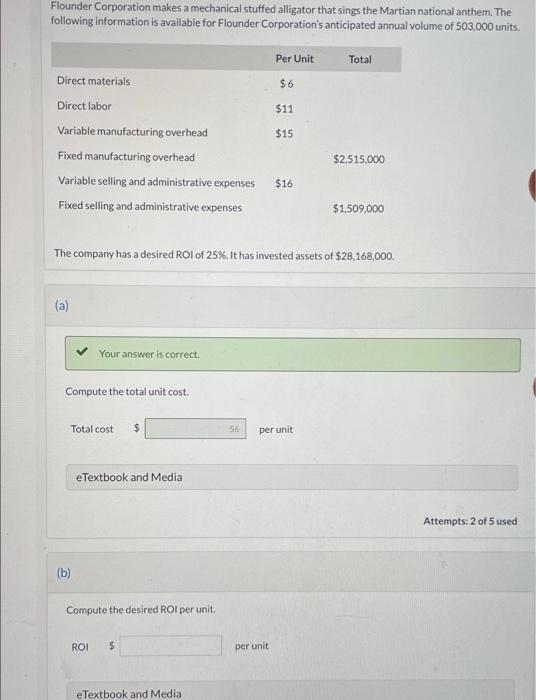

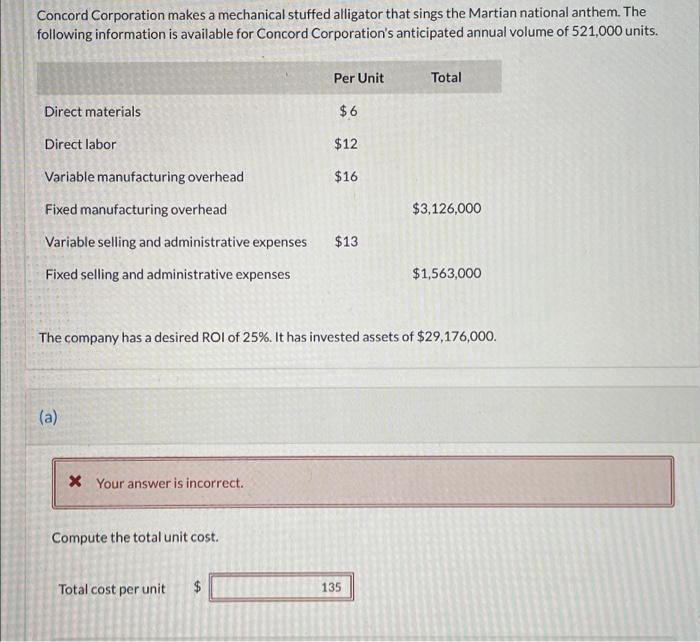

Blue Spruce Corporation needs to set a target price for its newly designed product M14-M16. The following data reiste to this new product Per Total Direct materials $32 Direct shor $49 $13 Variable manufacturing overhead Fleed manufacturing overhead Variable selling and administrative expenses Fred selling and administrative expenses S1814400 56 $ 1.209,600 These costs are based on a budgeted volume of 100,800 units produced and sold each year Blue Spruce uses cost puspriche methods to set is target selling price. The markup percentage on total unit cost is 40% (5) Your awer is correct Compute the total unit variable cost total unit foxed cost and total unit cost for M14-M16 Variable cost per unit 5 TO Foxed cost per unit Total cost per unit $ 135 eTextbook and Media Attempts: 2 of 5 used (b) Compute the desired Rolper unit for M14.M16 Desired ROI $ per unit eTextbook and Media Save for Attempts of Sused Flounder Corporation makes a mechanical stuffed alligator that sings the Martian national anthem. The following information is available for Flounder Corporation's anticipated annual volume of 503,000 units. Per Unit Total $6 $11 $15 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $2.515.000 $16 $1.509,000 The company has a desired ROI of 25%. It has invested assets of $28,168,000 (a) Your answer is correct Compute the total unit cost. Total cost $ 56 per unit eTextbook and Media Attempts: 2 of 5 used (b) Compute the desired ROI per unit. ROI $ per unit e Textbook and Media Concord Corporation makes a mechanical stuffed alligator that sings the Martian national anthem. The following information is available for Concord Corporation's anticipated annual volume of 521,000 units. Per Unit Total $6 Direct materials Direct labor Variable manufacturing overhead $12 $16 Fixed manufacturing overhead $3,126,000 Variable selling and administrative expenses $13 Fixed selling and administrative expenses $1,563,000 The company has a desired ROI of 25%. It has invested assets of $29,176,000. (a) * Your answer is incorrect. Compute the total unit cost. Total cost per unit $ 135

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started