Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please post the correct answers for this problem. I have attached the transaction list for each part of the problem. Thanks! PART A PART B

Please post the correct answers for this problem. I have attached the transaction list for each part of the problem. Thanks!

PART A

PART B

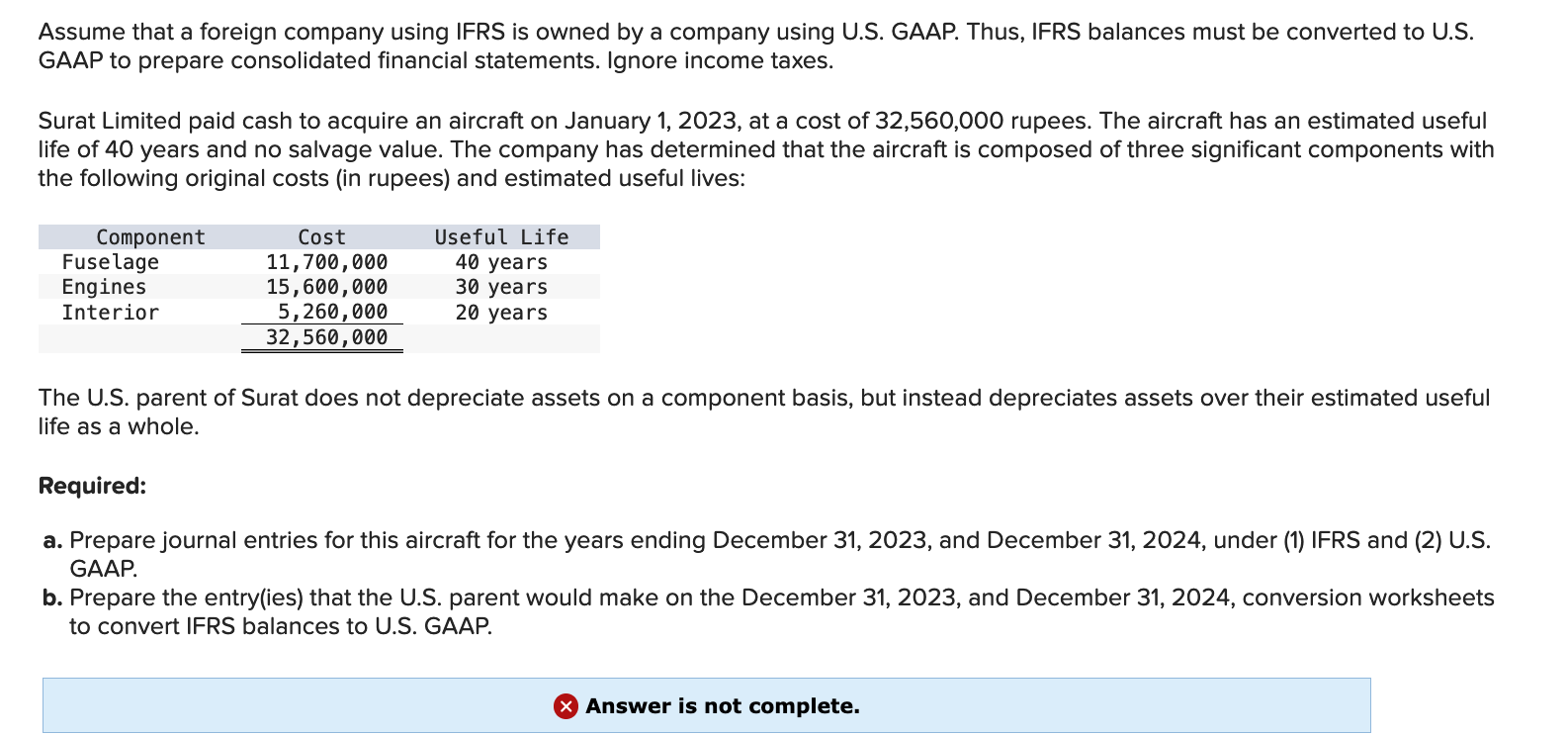

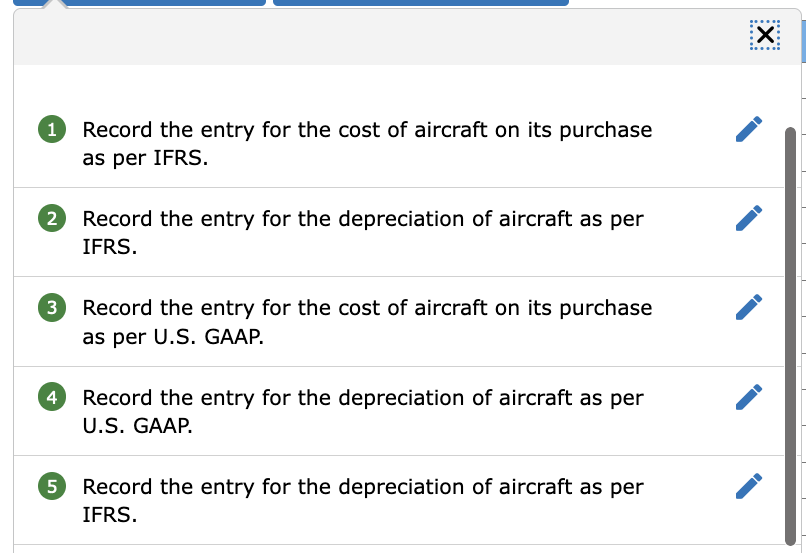

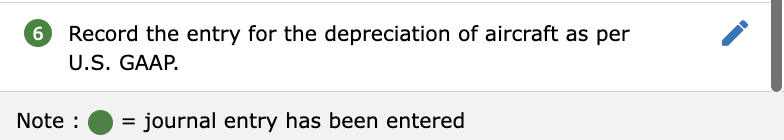

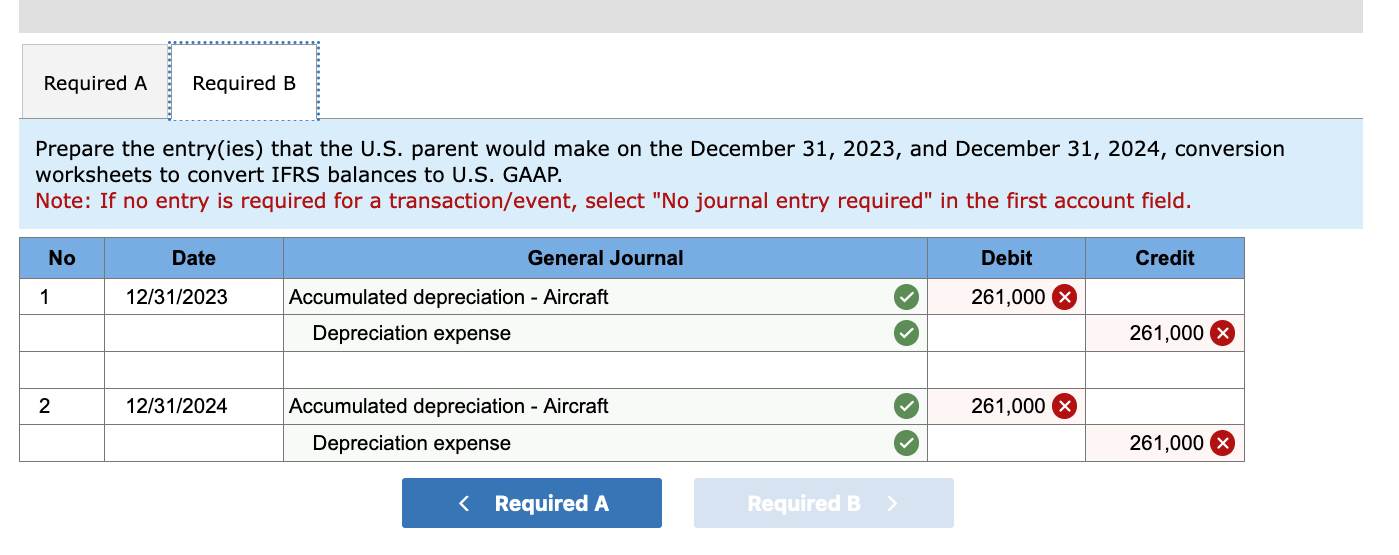

Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Surat Limited paid cash to acquire an aircraft on January 1, 2023, at a cost of 32,560,000 rupees. The aircraft has an estimated useful life of 40 years and no salvage value. The company has determined that the aircraft is composed of three significant components with the following original costs (in rupees) and estimated useful lives: The U.S. parent of Surat does not depreciate assets on a component basis, but instead depreciates assets over their estimated useful life as a whole. Required: a. Prepare journal entries for this aircraft for the years ending December 31, 2023, and December 31, 2024, under (1) IFRS and (2) U.S. GAAP. b. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2023, and December 31, 2024, conversion worksheets to convert IFRS balances to U.S. GAAP. Record the entry for the cost of aircraft on its purchase as per IFRS. Record the entry for the depreciation of aircraft as per IFRS. Record the entry for the cost of aircraft on its purchase as per U.S. GAAP. Record the entry for the depreciation of aircraft as per U.S. GAAP. Record the entry for the depreciation of aircraft as per IFRS. 6 Record the entry for the depreciation of aircraft as per U.S. GAAP. Prepare journal entries for this aircraft for the years ending December 31, 2023, and December 31, 2024, under (1) IFRS and (2) U.S. GAAP. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Record the conversion entry needed for 12/31/23. Record the conversion entry needed for 12/31/24. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2023, and December 31, 2024, conversion worksheets to convert IFRS balances to U.S. GAAP. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field

Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Surat Limited paid cash to acquire an aircraft on January 1, 2023, at a cost of 32,560,000 rupees. The aircraft has an estimated useful life of 40 years and no salvage value. The company has determined that the aircraft is composed of three significant components with the following original costs (in rupees) and estimated useful lives: The U.S. parent of Surat does not depreciate assets on a component basis, but instead depreciates assets over their estimated useful life as a whole. Required: a. Prepare journal entries for this aircraft for the years ending December 31, 2023, and December 31, 2024, under (1) IFRS and (2) U.S. GAAP. b. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2023, and December 31, 2024, conversion worksheets to convert IFRS balances to U.S. GAAP. Record the entry for the cost of aircraft on its purchase as per IFRS. Record the entry for the depreciation of aircraft as per IFRS. Record the entry for the cost of aircraft on its purchase as per U.S. GAAP. Record the entry for the depreciation of aircraft as per U.S. GAAP. Record the entry for the depreciation of aircraft as per IFRS. 6 Record the entry for the depreciation of aircraft as per U.S. GAAP. Prepare journal entries for this aircraft for the years ending December 31, 2023, and December 31, 2024, under (1) IFRS and (2) U.S. GAAP. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Record the conversion entry needed for 12/31/23. Record the conversion entry needed for 12/31/24. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2023, and December 31, 2024, conversion worksheets to convert IFRS balances to U.S. GAAP. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started