Answered step by step

Verified Expert Solution

Question

1 Approved Answer

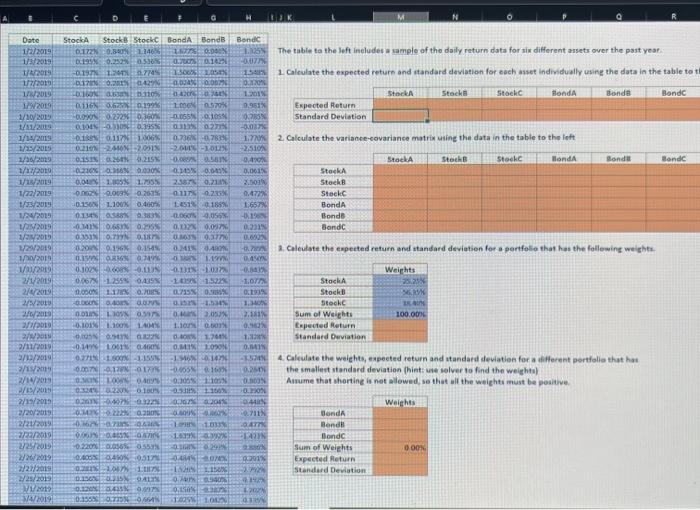

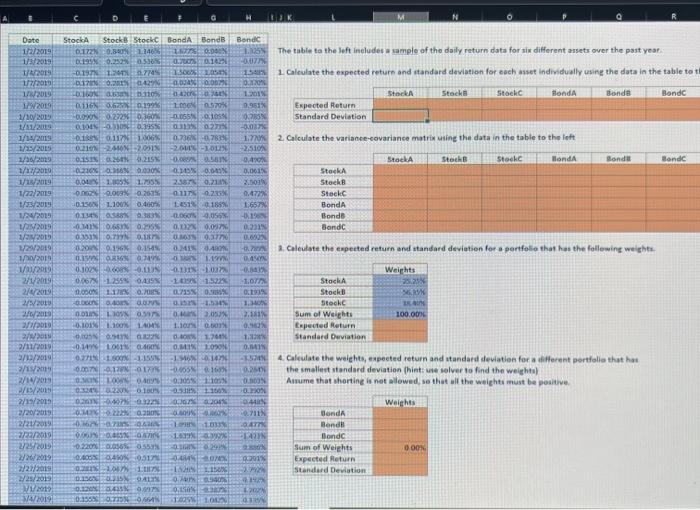

Please post the EXCEL FORMULAS D H DUK Bandc 1SN NEO SO The table to the loft include a sample of the daily return data

Please post the EXCEL FORMULAS

D H DUK Bandc 1SN NEO SO The table to the loft include a sample of the daily return data for six different assets over the past year 13 1 Caleulate the expected return and standard deviation for each esset individually using the data in the table to t Stock Stock Honda Bonds Bond Expected Return Standard Deviation SOLEIRO NOSO SOLA Date 1/2/2019 1/3/2019 1/ 2019 2019 IN 2009 1/10/2010 1/11/2013 1/1/2015 1/27/2009 1/10/2009 1/2010 1/19 1:2015 9.951 Stock Stock Stock Band Bond 0.1720.8.2014 LIS. D.1990.500.550 0.01 -0-1971.17745 1.300 1.05 1200030429 1.000 21-00 0.16 0.1996 LOON 07 DOON 02372360 -0.055.105 0.1013030.2955 0.737 0210-260-2.5 -2.0-1012 -0.00 0216160.000 0.00 100% 100% 230.21 NICO SECOND -0.0 900 NITO SITO SI XSTS NOSSO Bandc NO SAVIO SD 100 000 ZOWED VEZDU 0.150 L100% 0.4605 SERE SEED SO 90 ECO- TO NEZONOCO LE10185 -0.09.09 0.0.0 COORD 0.2010. 1960.154 COMO SD O.M. 1. 011-10 WESENT O SEZO 0.1020.0 -0.13 0.06741255% 0.435% 1.000 1.100 OBOR 0.00 0.0 0.01 10 0 1.100 140 MUR INT NET 0.5-1.5 2.05 1.100.00 . 1.71 2. Calculate the variance-covariance matrix using the data in the table to the left -2510 0.40 Stock Stock Steed londa Bond 0.001 Stock 2.00 StockB Stock 1.657 Bonda 19 Bonde 0.231 Bond 0.00 1. Calestate the expected return and standard deviation for a portfolio that has the following weights 0.4 0.143 Weights -1.07 Stack 23 0.19% Stock Stock 2.1 Sum of Weights 100.00 0.90 Repeated Return Standard Deviation 0. 4. Calculate the welchts, expected return and standard deviation for a different portfolio that has 0.250 the smallest standard deviation hinturesolver to find the weights) Anume that shorting is not allowed so that all the weight must be positive OHON 94 Welches 10.711 Bonda Am Bendl Bond Sum of Weights OOON 01% Expected Return Standard Deviation 21 STOTO 1/3/2015 /2019 2019 1/2/2019 1/28/2019 1./2019 1/1/2019 2/1/2019 2/4/2013 2010 3/6/2010 2019 2100 9/11/2019 5/12/2019 /10 2/11/2013 2/E 2/15/2015 2/20/2019 2/28/2019 2/22/2019 2/25/2019 1/26/2019 2/21/2019 2/28/2019 NED MED WE 2014 LOOK GOOX NICE NOGOL XD SISSELOSTNO TE 10.147 -0.00169 0.007 0.12 NOVO ONO SOLO NO 020 100 -0.51 116 0.000 NEED KANO NOORIZOCO EVO SEZON IVO DOO M SHE NET NECES 16 -2 041 -0.22060056 055 0.51 IS WICONOSOVO SHIT TO 1.150 OG GERAR 0.15 INN 0.00 0.15095 0.7956 L2N W/2019 0. 1.1.01 MED D H DUK Bandc 1SN NEO SO The table to the loft include a sample of the daily return data for six different assets over the past year 13 1 Caleulate the expected return and standard deviation for each esset individually using the data in the table to t Stock Stock Honda Bonds Bond Expected Return Standard Deviation SOLEIRO NOSO SOLA Date 1/2/2019 1/3/2019 1/ 2019 2019 IN 2009 1/10/2010 1/11/2013 1/1/2015 1/27/2009 1/10/2009 1/2010 1/19 1:2015 9.951 Stock Stock Stock Band Bond 0.1720.8.2014 LIS. D.1990.500.550 0.01 -0-1971.17745 1.300 1.05 1200030429 1.000 21-00 0.16 0.1996 LOON 07 DOON 02372360 -0.055.105 0.1013030.2955 0.737 0210-260-2.5 -2.0-1012 -0.00 0216160.000 0.00 100% 100% 230.21 NICO SECOND -0.0 900 NITO SITO SI XSTS NOSSO Bandc NO SAVIO SD 100 000 ZOWED VEZDU 0.150 L100% 0.4605 SERE SEED SO 90 ECO- TO NEZONOCO LE10185 -0.09.09 0.0.0 COORD 0.2010. 1960.154 COMO SD O.M. 1. 011-10 WESENT O SEZO 0.1020.0 -0.13 0.06741255% 0.435% 1.000 1.100 OBOR 0.00 0.0 0.01 10 0 1.100 140 MUR INT NET 0.5-1.5 2.05 1.100.00 . 1.71 2. Calculate the variance-covariance matrix using the data in the table to the left -2510 0.40 Stock Stock Steed londa Bond 0.001 Stock 2.00 StockB Stock 1.657 Bonda 19 Bonde 0.231 Bond 0.00 1. Calestate the expected return and standard deviation for a portfolio that has the following weights 0.4 0.143 Weights -1.07 Stack 23 0.19% Stock Stock 2.1 Sum of Weights 100.00 0.90 Repeated Return Standard Deviation 0. 4. Calculate the welchts, expected return and standard deviation for a different portfolio that has 0.250 the smallest standard deviation hinturesolver to find the weights) Anume that shorting is not allowed so that all the weight must be positive OHON 94 Welches 10.711 Bonda Am Bendl Bond Sum of Weights OOON 01% Expected Return Standard Deviation 21 STOTO 1/3/2015 /2019 2019 1/2/2019 1/28/2019 1./2019 1/1/2019 2/1/2019 2/4/2013 2010 3/6/2010 2019 2100 9/11/2019 5/12/2019 /10 2/11/2013 2/E 2/15/2015 2/20/2019 2/28/2019 2/22/2019 2/25/2019 1/26/2019 2/21/2019 2/28/2019 NED MED WE 2014 LOOK GOOX NICE NOGOL XD SISSELOSTNO TE 10.147 -0.00169 0.007 0.12 NOVO ONO SOLO NO 020 100 -0.51 116 0.000 NEED KANO NOORIZOCO EVO SEZON IVO DOO M SHE NET NECES 16 -2 041 -0.22060056 055 0.51 IS WICONOSOVO SHIT TO 1.150 OG GERAR 0.15 INN 0.00 0.15095 0.7956 L2N W/2019 0. 1.1.01 MED

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started