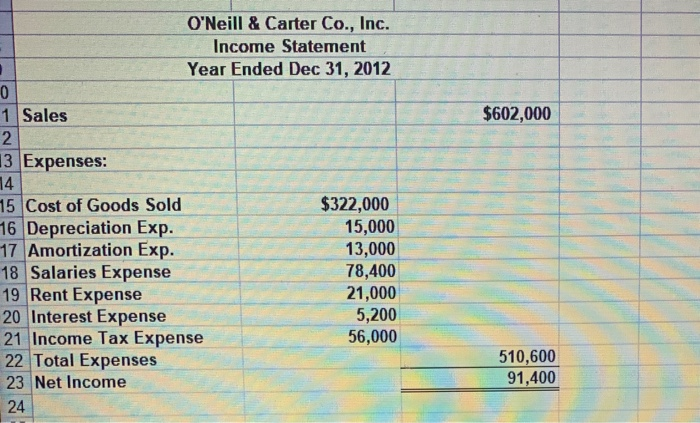

please prepare a statement of cash flows using the direct method and the indirect method

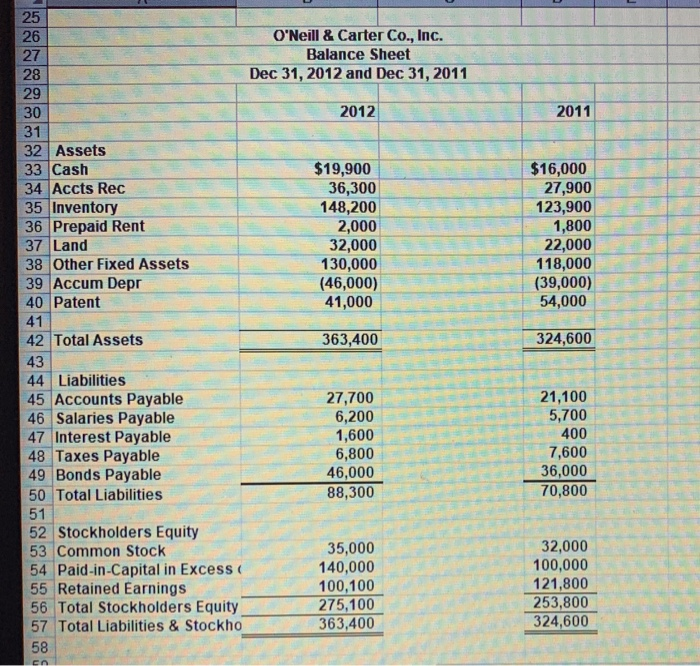

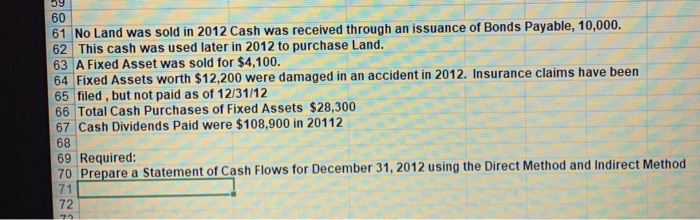

To O'Neill & Carter Co., Inc. Income Statement Year Ended Dec 31, 2012 1 Sales $602,000 2 13 Expenses: 14 15 Cost of Goods Sold 16 Depreciation Exp. 17 Amortization Exp. 18 Salaries Expense 19 Rent Expense 20 Interest Expense 21 Income Tax Expense 22 Total Expenses 23 Net Income 24 $322,000 15,000 13,000 78,400 21,000 5,200 56,000 510,600 91,400 / e / O'Neill & Carter Co., Inc.N Balance Sheet Dec 31, 2012 and Dec 31, 2011 / / / 2012 TE 2011 _ $19,900 36,300 148,200 2,000 32,000 32,0 130,000 (46,000) 41,000 $16,000 27,900 123,900 1,800 22,000 118,000 (39,000) 54,000 363,400 324,600 32 Assets 33 Cash 34 Accts Rec 35 Inventory 36 Prepaid Rent 37 Land 38 Other Fixed Assets 39 Accum Depr 40 Patent 41 42 Total Assets 43 44 Liabilities 45 Accounts Payable 46 Salaries Payable 47 Interest Payable 48 Taxes Payable 49 Bonds Payable 50 Total Liabilities 51 52 Stockholders Equity 53 Common Stock 54 Paid-in-Capital in Excess 55 Retained Earnings 56 Total Stockholders Equity 57 Total Liabilities & Stockho 58 - 21,100 5,700 400 27,700 6,200 1,600 6,800 46,000 88,300 5 7,600 36,000 70,800 35,000 140,000 100,100 275,100 363,400 32,000 100,000 121,800 253,800 324,600 en 61 No Land was sold in 2012 Cash was received through an issuance of Bonds Payable, 10,000. 62 This cash was used later in 2012 to purchase Land. 63 A Fixed Asset was sold for $4,100. 64 Fixed Assets worth $12,200 were damaged in an accident in 2012. Insurance claims have been 65 filed, but not paid as of 12/31/12 66 Total Cash Purchases of Fixed Assets $28,300 67 Cash Dividends Paid were $108,900 in 20112 68 69 Required: 70 Prepare a Statement of Cash Flows for December 31, 2012 using the Direct Method and Indirect Method To O'Neill & Carter Co., Inc. Income Statement Year Ended Dec 31, 2012 1 Sales $602,000 2 13 Expenses: 14 15 Cost of Goods Sold 16 Depreciation Exp. 17 Amortization Exp. 18 Salaries Expense 19 Rent Expense 20 Interest Expense 21 Income Tax Expense 22 Total Expenses 23 Net Income 24 $322,000 15,000 13,000 78,400 21,000 5,200 56,000 510,600 91,400 / e / O'Neill & Carter Co., Inc.N Balance Sheet Dec 31, 2012 and Dec 31, 2011 / / / 2012 TE 2011 _ $19,900 36,300 148,200 2,000 32,000 32,0 130,000 (46,000) 41,000 $16,000 27,900 123,900 1,800 22,000 118,000 (39,000) 54,000 363,400 324,600 32 Assets 33 Cash 34 Accts Rec 35 Inventory 36 Prepaid Rent 37 Land 38 Other Fixed Assets 39 Accum Depr 40 Patent 41 42 Total Assets 43 44 Liabilities 45 Accounts Payable 46 Salaries Payable 47 Interest Payable 48 Taxes Payable 49 Bonds Payable 50 Total Liabilities 51 52 Stockholders Equity 53 Common Stock 54 Paid-in-Capital in Excess 55 Retained Earnings 56 Total Stockholders Equity 57 Total Liabilities & Stockho 58 - 21,100 5,700 400 27,700 6,200 1,600 6,800 46,000 88,300 5 7,600 36,000 70,800 35,000 140,000 100,100 275,100 363,400 32,000 100,000 121,800 253,800 324,600 en 61 No Land was sold in 2012 Cash was received through an issuance of Bonds Payable, 10,000. 62 This cash was used later in 2012 to purchase Land. 63 A Fixed Asset was sold for $4,100. 64 Fixed Assets worth $12,200 were damaged in an accident in 2012. Insurance claims have been 65 filed, but not paid as of 12/31/12 66 Total Cash Purchases of Fixed Assets $28,300 67 Cash Dividends Paid were $108,900 in 20112 68 69 Required: 70 Prepare a Statement of Cash Flows for December 31, 2012 using the Direct Method and Indirect Method