Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please prepare all entries and the balance sheet. Student Name Nicholas Wilhoite each question is worth 2 points unless noted Provide complete detailed information or

Please prepare all entries and the balance sheet.

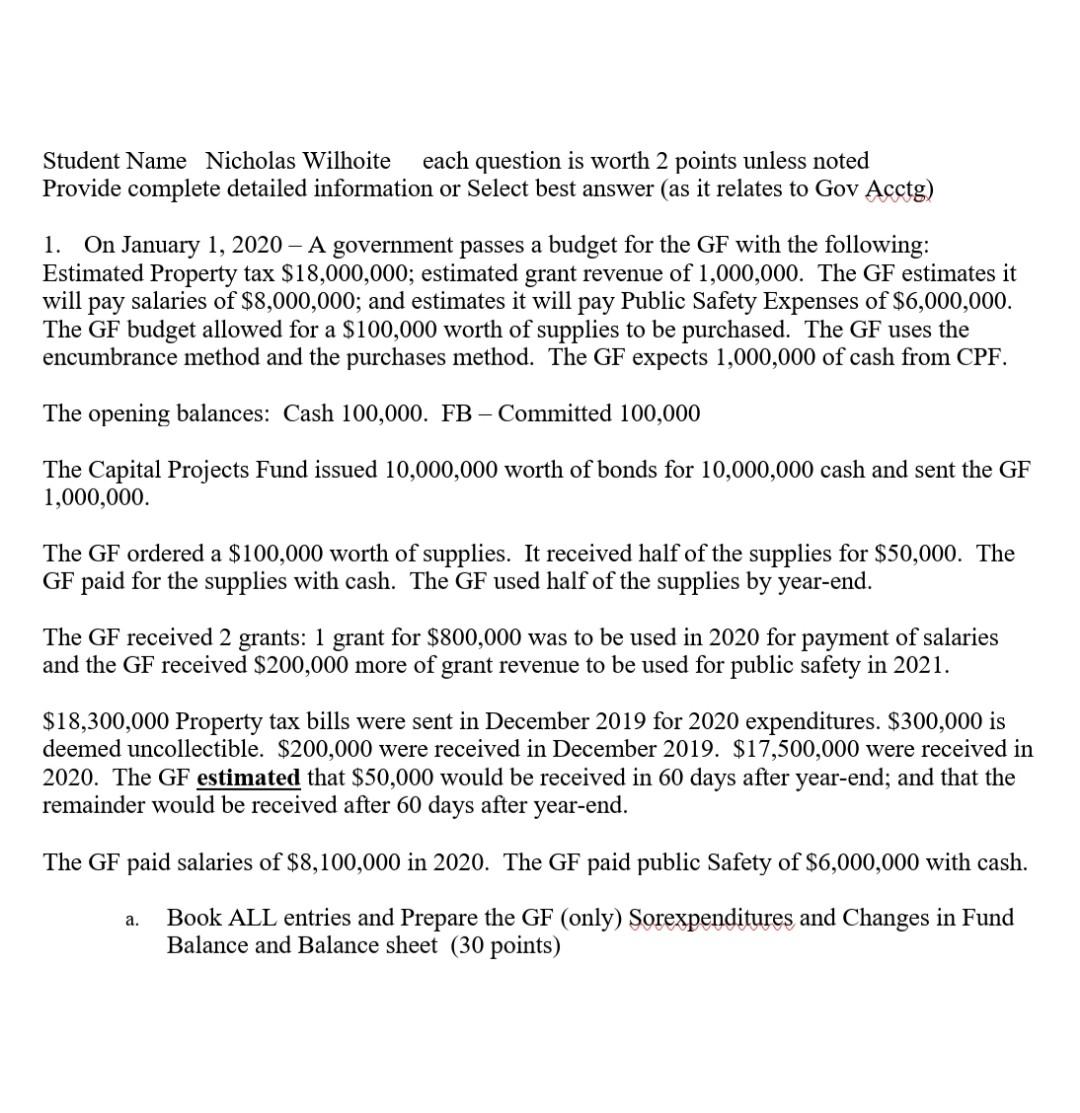

Student Name Nicholas Wilhoite each question is worth 2 points unless noted Provide complete detailed information or Select best answer (as it relates to Gov Acctg) 1. On January 1, 2020 - A government passes a budget for the GF with the following: Estimated Property tax $18,000,000; estimated grant revenue of 1,000,000. The GF estimates it will pay salaries of $8,000,000; and estimates it will pay Public Safety Expenses of $6,000,000. The GF budget allowed for a $100,000 worth of supplies to be purchased. The GF uses the encumbrance method and the purchases method. The GF expects 1,000,000 of cash from CPF. The opening balances: Cash 100,000. FB - Committed 100,000 The Capital Projects Fund issued 10,000,000 worth of bonds for 10,000,000 cash and sent the GF 1,000,000. The GF ordered a $100,000 worth of supplies. It received half of the supplies for $50,000. The GF paid for the supplies with cash. The GF used half of the supplies by year-end. The GF received 2 grants: 1 grant for $800,000 was to be used in 2020 for payment of salaries and the GF received $200,000 more of grant revenue to be used for public safety in 2021. $18,300,000 Property tax bills were sent in December 2019 for 2020 expenditures. $300,000 is deemed uncollectible. $200,000 were received in December 2019. $17,500,000 were received in 2020. The GF estimated that $50,000 would be received in 60 days after year-end; and that the remainder would be received after 60 days after year-end. The GF paid salaries of $8,100,000 in 2020. The GF paid public Safety of $6,000,000 with cash. a. Book ALL entries and Prepare the GF (only) Sorexpenditures and Changes in Fund Balance and Balance sheet (30 points) Student Name Nicholas Wilhoite each question is worth 2 points unless noted Provide complete detailed information or Select best answer (as it relates to Gov Acctg) 1. On January 1, 2020 - A government passes a budget for the GF with the following: Estimated Property tax $18,000,000; estimated grant revenue of 1,000,000. The GF estimates it will pay salaries of $8,000,000; and estimates it will pay Public Safety Expenses of $6,000,000. The GF budget allowed for a $100,000 worth of supplies to be purchased. The GF uses the encumbrance method and the purchases method. The GF expects 1,000,000 of cash from CPF. The opening balances: Cash 100,000. FB - Committed 100,000 The Capital Projects Fund issued 10,000,000 worth of bonds for 10,000,000 cash and sent the GF 1,000,000. The GF ordered a $100,000 worth of supplies. It received half of the supplies for $50,000. The GF paid for the supplies with cash. The GF used half of the supplies by year-end. The GF received 2 grants: 1 grant for $800,000 was to be used in 2020 for payment of salaries and the GF received $200,000 more of grant revenue to be used for public safety in 2021. $18,300,000 Property tax bills were sent in December 2019 for 2020 expenditures. $300,000 is deemed uncollectible. $200,000 were received in December 2019. $17,500,000 were received in 2020. The GF estimated that $50,000 would be received in 60 days after year-end; and that the remainder would be received after 60 days after year-end. The GF paid salaries of $8,100,000 in 2020. The GF paid public Safety of $6,000,000 with cash. a. Book ALL entries and Prepare the GF (only) Sorexpenditures and Changes in Fund Balance and Balance sheet (30 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started