Please prepare an Income Statement using the information provided

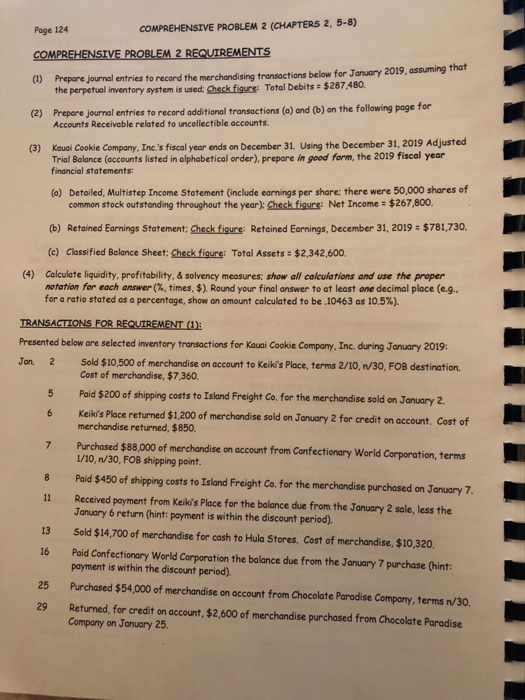

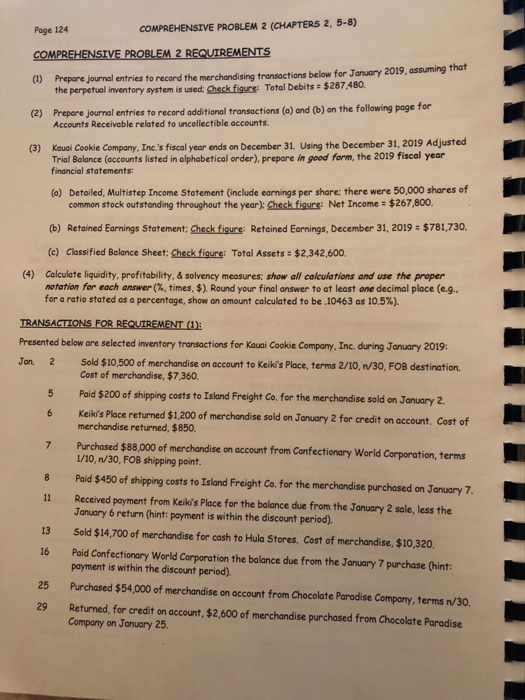

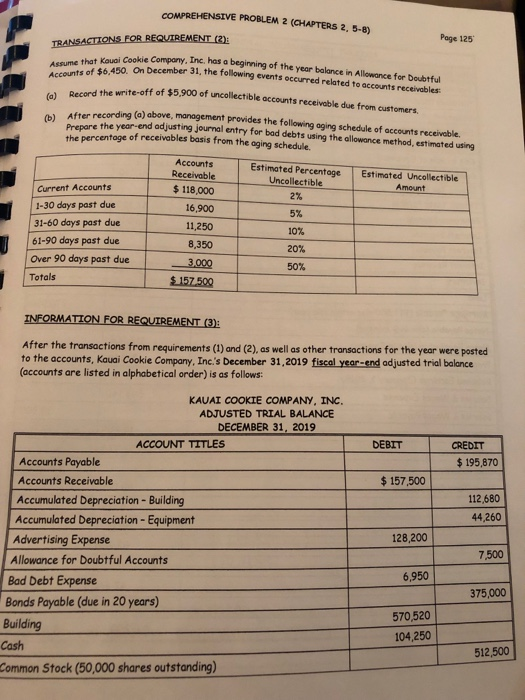

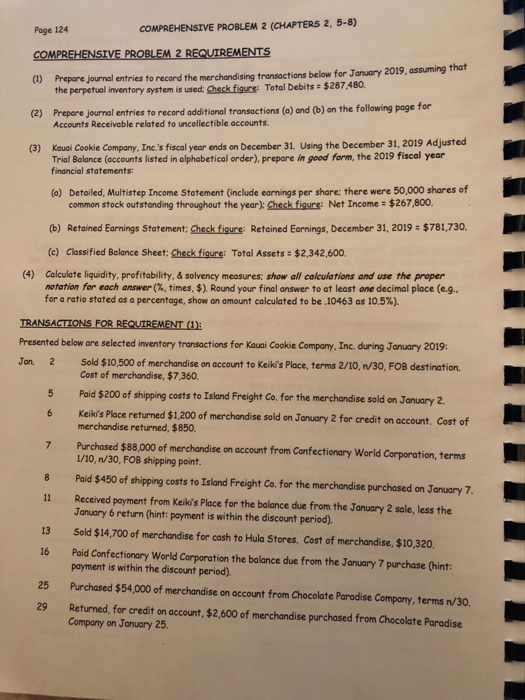

Page 124 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5-8) COMPREHENSIVE PROBLEM 2 REQUIREMENTS () Prepare journal entries to record the merchandising transactions below for January 2019, assuming that the perpetual inventory system is used: Check figure Total Debits $287.480. Prepare journal entries to record additional transactions (o) and (b) on the following page for Accounts Receivable related to uncollectible accounts. (2) (3) Kaual Cookie Company, Inc's fiscal year ends on December 31, Using the december 31, 2019 Adjusted Trial Bolance (accounts listed in alphabetical order). prepare in good form, the 2019 fiscal year financial statements: (a) Detailed, Multistep Income Statement (include earnings per share; there were 50,000 shares of common stock outstanding throughout the year): Chesk figure: Net Income $267,800. (b) Retained Earnings Statement: Check figure: Retained Earnings, December 31, 2019 $781,730 (c) Classified Balance Sheet: Check figure: Total Assets $2,342,600. (4) Calculate liquidity, profitability, & solvency measures: show all calculations and use the proper nottin for each answer (% ti es, $). Round your firal answer to at least an, deci al place (eg, for a ratio stated as a percentage, show an amount calculated to be .10463 as 10.5%). TRANSACTIONS FOR REQUTREMENT C Presented below are selected inventory transactions for Kauai Cookie Company, Inc. during January 2019: Jon. 2 Sold $10,500 of merchandise on account to Keik's Place, terms 2/10, n/30, FOB destination. Cost of merchandise, $7 360 5 Paid $200 of shipping costs to Island Freight Co, for the merchandise sold on January 2 6 Keiki's Place returned $1,200 of merchandise sold on January 2 for credit on account. Cost of 7 Purchased $88,000 of merchandise on account from Confectionary World Corporation, terms 8 Paid $450 of shipping costs to Island Freight Co. for the merchandise purchased on January 7 11 Received payment from Keiki's Place for the balance due from the January 2 sale, less the 13 Sold $14,700 of merchandise for cash to Hula Stores. Cost of merchandise, $10,320 16 Paid Confectionary World Corporation the balance due from the January 7 purchase (hint: merchandise returned, $850. 1/10, n/30, FOB shipping point. January 6 return (hint: payment is within the discount period). payment is within the discount period). Purchased $54,000 of merchandise on account from Chocolate Paradise Company, terms n/30. Returned, for credit on account, $2,600 of merchandise purchased from Chocolate Paradise Company on January 25 25 29 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5-8) Page 125 Assume that Kauai Cookie Company, Inc, has a beginning of the year balance in Allowance for Doubtful a On December 31, the following events occurred related to accounts receivables: of $5,900 of uncollectible accounts receivable due from customers After recording (a) above, management prevides the following aging schedule of accounts receivable. te year-end adjusting journal entry for bad debts using the allowance method, estimated using the percentoge of receivables basis from t he aging schedule. Accounts Receivable $ 118,000 16,900 11,250 8,350 Estimated Percentage Estimated Uncollectible Current Accounts 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due Uncollectible 2% 5% 10% 20% 50% Amount Totals INFORMATION FOR REQUIREMENT (3 After the transactions from requirements (1) and (2), as well as other transactions for the year were posted to the accounts, Kauai Cookie Company, Inc's December 31,2019 fiscal year-end adjusted trial balance (accounts are listed in alphabetical order) is as follows: KAUAI COOKIE COMPANY, INC. ADJUSTED TRIAL BALANCE DECEMBER 31, 2019 ACCOUNT TITLES DEBIT CREDIT Accounts Payable $195,870 Accounts Receivable $157,500 Accumulated Depreciation - Building 112,680 Accumulated Depreciation - Equipment 44,260 128,200 Advertising Expense Allowance for Doubtful Accounts Bad Debt Expense Bonds Payable (due in 20 years) Building Cash Common Stock (50,000 shares outstanding) 7,500 6,950 375,000 570520 104,250 512,500 COMPREHENSIVE PROBLEM 2 (CHAPTERS 2, 5-8) CREDIT 2.470,600 30,900 62,500 281,320 10,860 186,000 ACCOUNT TITLES Sold ared) t-Out Expense Fund Held to Pay Long-Term Debt Gain on Sale of Equipment Goodwill 18,500 270,500 81 52,820 67,300 68,940 Interest Expense Interest Payable Interest Revenue Inventory 26,250 27.300 330,780 324,000 Mortgage Payable ($13,500 due within one year) 270,000 Notes Payable (due in 9 months) 90,000 Notes Receivable (due in 2 years) 112,000 21,140 Retained Earnings (January 1, 2019) 576.430 Salaries & Wages Expense Salaries & Wages Payable Sales Discounts Sales Returns Sales Revenue 33,900 19,130 57.370 Short-Term Investments 3,852,980 80,030 6,300 99,070 62,700 Supplies Supplies Expense Unearned Revenue Utilities Expense 4,530 Totals