Question

Please prepare the balance sheet: Different categories available for type of transaction as follows PLEASE USE THESE: accts payable accts receivable (net) accrued liabilities accumulated

Please prepare the balance sheet:

Different categories available for type of transaction as follows PLEASE USE THESE:

accts payable

accts receivable (net)

accrued liabilities

accumulated depreciation buildings

accumulated depreciation equipment

additional paid in capital

allowance for uncollectible accouints

bonds payable

buildings

cash and cash equivalents

common stock

deferred revenue

depreciation expense

equipment

finished goods

furniture and fixtures

income taxes payable

interest expense

interest payable

interest receivable

inventory

land

land held for sale

long-term investments

mortgage payable

notes payable *current maturities of long term debt

notes payable current

notes payable long term

notes receivable

operating expenses

patent

prepaid expenses

prepaid insurance

prepaid rent

restricted cash

retained earnings

salaries payable

short term investments

work in process

THANK YOU :)

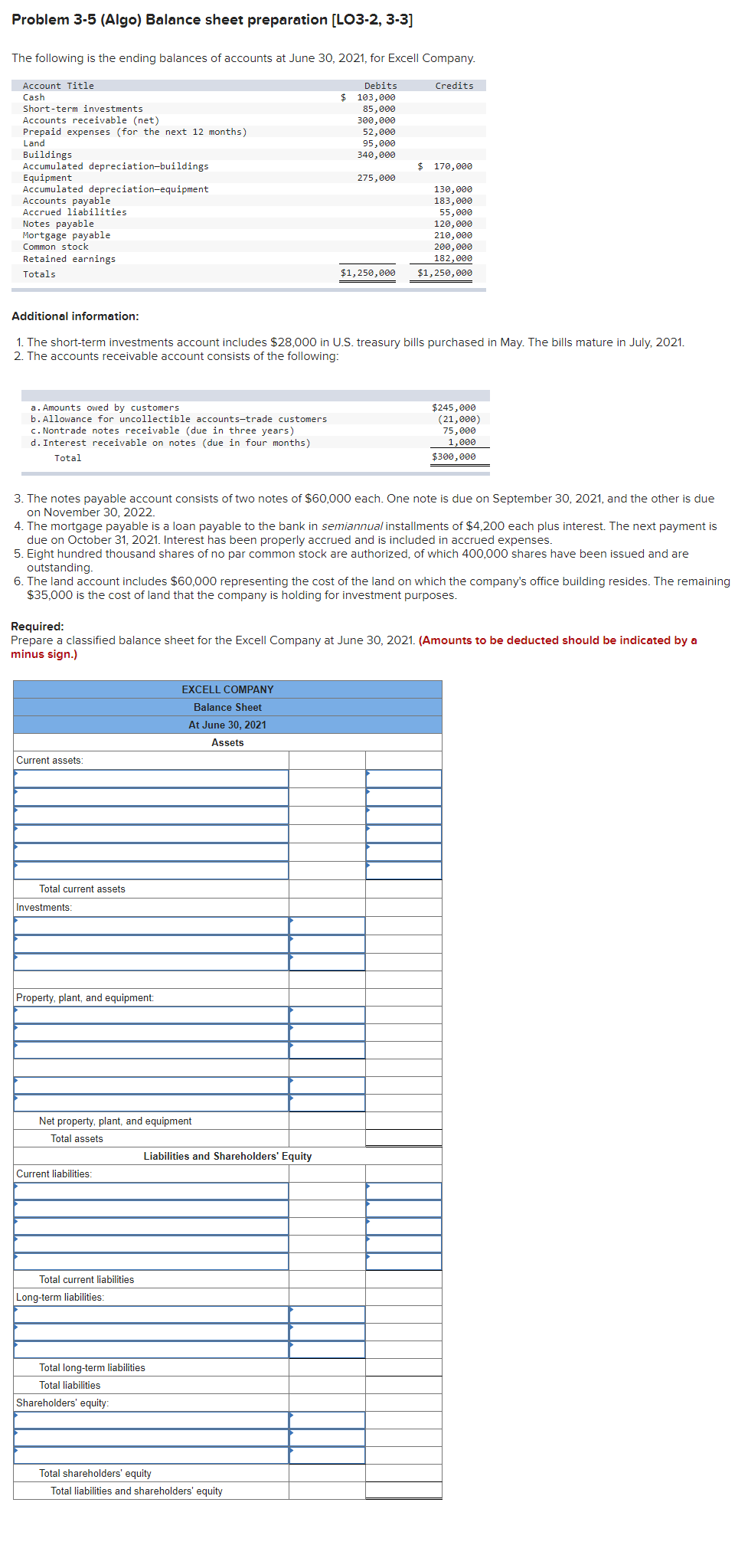

Problem 3-5 (Algo) Balance sheet preparation (LO3-2, 3-3] The following is the ending balances of accounts at June 30, 2021, for Excell Company. Account Title Credits Cash Debits $ 103,000 85,000 300,000 52,000 95,000 340,000 $ 170,000 275,000 Short-term investments Accounts receivable (net) Prepaid expenses (for the next 12 months) Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation equipment Accounts payable Accrued liabilities Notes payable Mortgage payable Common stock Retained earnings Totals 130,000 183,000 55,000 120,000 210,000 200,000 182,000 $1,250,000 $1,250,000 Additional information: 1. The short-term investments account includes $28,000 in U.S. treasury bills purchased in May. The bills mature in July, 2021. 2. The accounts receivable account consists of the following: a. Amounts owed by customers b. Allowance for uncollectible accounts-trade customers c. Nontrade notes receivable (due in three years) d. Interest receivable on notes (due in four months) Total $245,000 (21,000) 75,000 1,000 $300,000 3. The notes payable account consists of two notes of $60,000 each. One note is due on September 30, 2021, and the other is due on November 30, 2022. 4. The mortgage payable is a loan payable to the bank in semiannual installments of $4,200 each plus interest. The next payment is due on October 31, 2021. Interest has been properly accrued and is included in accrued expenses. 5. Eight hundred thousand shares of no par common stock are authorized, of which 400,000 shares have been issued and are outstanding. 6. The land account includes $60,000 representing the cost of the land on which the company's office building resides. The remaining $35,000 is the cost of land that the company is holding for investment purposes. Required: Prepare a classified balance sheet for the Excell Company at June 30, 2021. (Amounts to be deducted should be indicated by a minus sign.) EXCELL COMPANY Balance Sheet At June 30, 2021 Assets Current assets: Total current assets Investments: Property, plant, and equipment: Net property, plant, and equipment Total assets Liabilities and Shareholders' Equity Current liabilities: Total current liabilities Long-term liabilities Total long-term liabilities Total liabilities Shareholders' equity Total shareholders' equity Total liabilities and shareholders' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started