Question

Please prepare the M-1 Book/Tax Reconciliation for the following example using the attached M-1 Schedule. ABC Corporation a calendar year C corporation has Net loss

Please prepare the M-1 Book/Tax Reconciliation for the following example using the attached M-1 Schedule.

ABC Corporation a calendar year C corporation has Net loss for books at year-end of $1,000,000 and has the following activity on the books:

1) Federal Income Tax ($300,000)

2) NYS Income Tax- $45,000

3) Supplies- $20,000

4) M & E - $75,000

5) DPAD- $65,000

6) OLI- $47,000

7) Proceeds from insurance $101,000

8) A/R Reserve decrease $40,000

9) Sec 263A increase $100,000

10) Tax Depreciation $150,000

11) Book Depreciation $75,000

12) Tax exempt interest $200,000

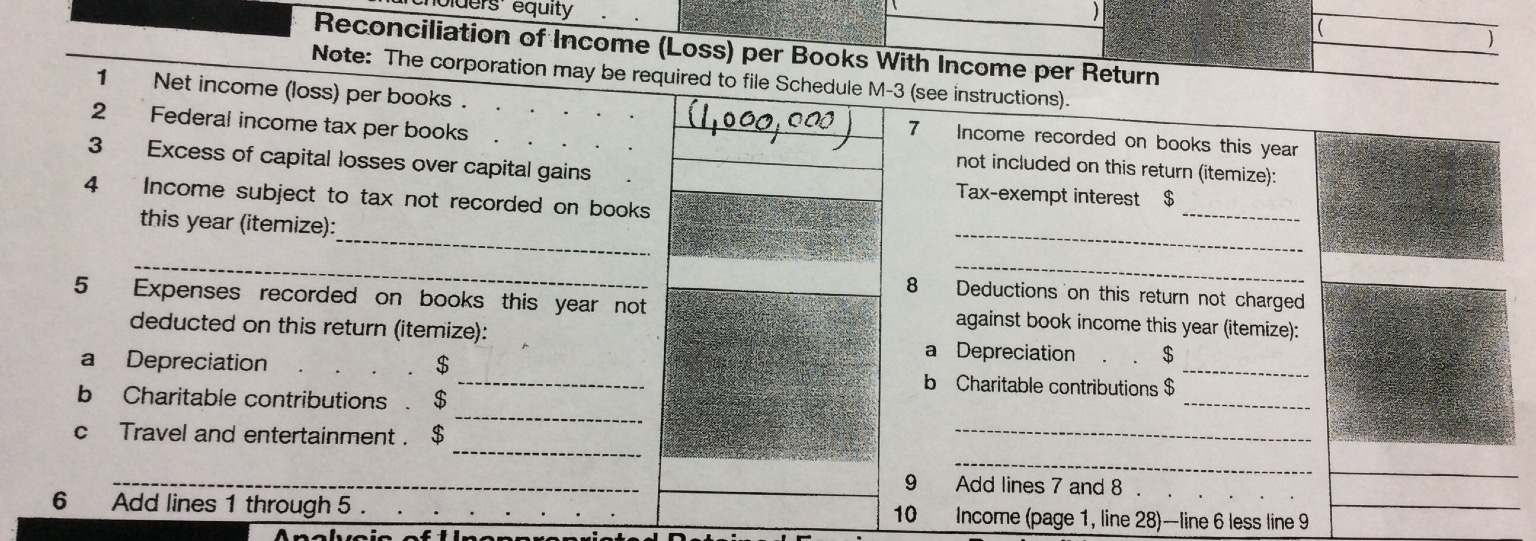

Reconciliation of Income (Loss) per Books With Income per Return

Note:The corporation may be required to file Schedule M-3 (see instructions).

1. Net income (loss) per books ..... .........(1,000,000)

2. Federal income tax per books...................................................................__________

3. Excess if capital losses over capital gains.........................................................______

4. Income subject to tax not recorded on books this year (itemize): _______________________

5. Expenses recorded on books this year not deducted on this return (itemized):

a. Dpreciation ..........$____________

b. Charitable contributions ......$_________

c. Travel and entertainment.....$_______

.................................................................................................................................._____________

6. Add lines 1 through 5.............................................................................................___________

7. Income recorede on books thie year not included on this return (itemize):

Tax-exempt interest .............$_____________

.................................................................................................................................___________

8. Deductions on this return not charged against book income this year (itemize):

a. Depreciation .........................$_____________

b. Charitable Contribution...........$____________

.................................................................................................................................._____________

9. Add lines 7 and 8...................................................................................................____________

10. Income (page 1, line 28) ---- line 6 less line 9......................................................____________

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started