Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please prepare the statement of cash flows using the indirect method. You are an experienced staff accountant working on the audit of Charlie Corporation (the

Please prepare the statement of cash flows using the indirect method.

Please prepare the statement of cash flows using the indirect method.

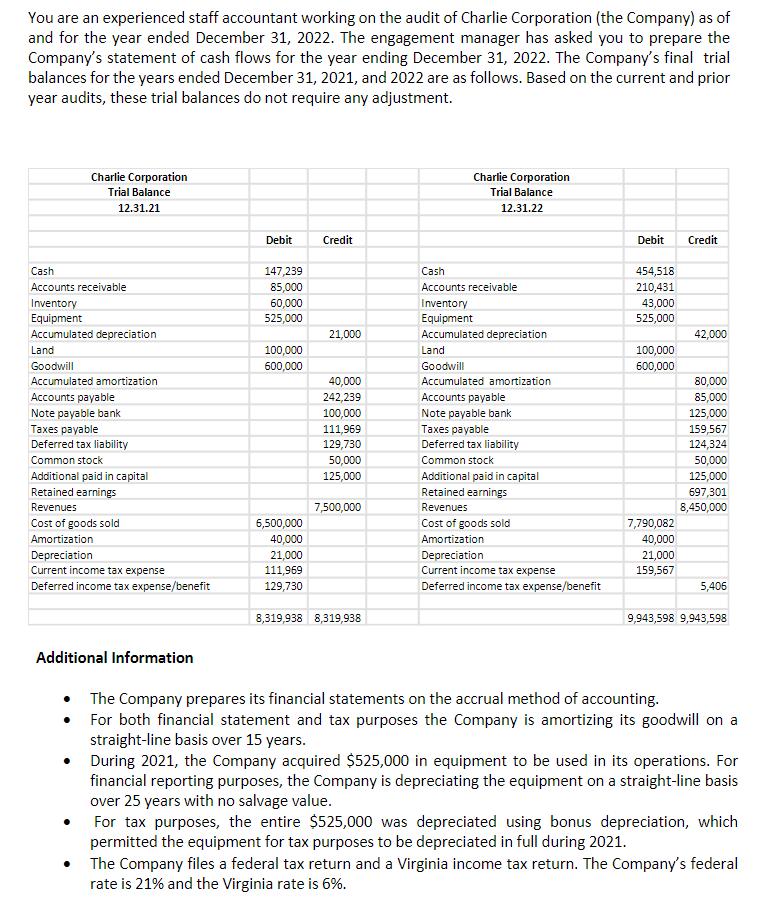

You are an experienced staff accountant working on the audit of Charlie Corporation (the Company) as of and for the year ended December 31, 2022. The engagement manager has asked you to prepare the Company's statement of cash flows for the year ending December 31, 2022. The Company's final trial balances for the years ended December 31, 2021, and 2022 are as follows. Based on the current and prior year audits, these trial balances do not require any adjustment. Charlie Corporation Trial Balance 12.31.21 Cash Accounts receivable Inventory Equipment Accumulated depreciation Land Goodwill Accumulated amortization Accounts payable Note payable bank Taxes payable Deferred tax liability Common stock Additional paid in capital Retained earnings Revenues Cost of goods sold Amortization Depreciation Current income tax expense Deferred income tax expense/benefit Debit 147,239 85,000 60,000 525,000 100,000 600,000 6,500,000 40,000 21,000 111,969 129,730 Credit 21,000 40,000 242,239 100,000 111,969 129,730 50,000 125,000 7,500,000 8,319,938 8,319,938 Charlie Corporation Trial Balance 12.31.22 Cash Accounts receivable Inventory Equipment Accumulated depreciation Land Goodwill Accumulated amortization Accounts payable Note payable bank Taxes payable Deferred tax liability Common stock Additional paid in capital Retained earnings Revenues Cost of goods sold Amortization Depreciation Current income tax expense Deferred income tax expense/benefit Debit 454,518 210,431 43,000 525,000 100,000 600,000 7,790,082 40,000 21,000 159,567 Credit 42,000 80,000 85,000 125,000 159,567 124,324 50,000 125,000 697,301 8,450,000 5,406 9,943,598 9,943,598 Additional Information The Company prepares its financial statements on the accrual method of accounting. For both financial statement and tax purposes the Company is amortizing its goodwill on a straight-line basis over 15 years. During 2021, the Company acquired $525,000 in equipment to be used in its operations. For financial reporting purposes, the Company is depreciating the equipment on a straight-line basis over 25 years with no salvage value. For tax purposes, the entire $525,000 was depreciated using bonus depreciation, which permitted the equipment for tax purposes to be depreciated in full during 2021. The Company files a federal tax return and a Virginia income tax return. The Company's federal rate is 21% and the Virginia rate is 6%.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started