Question

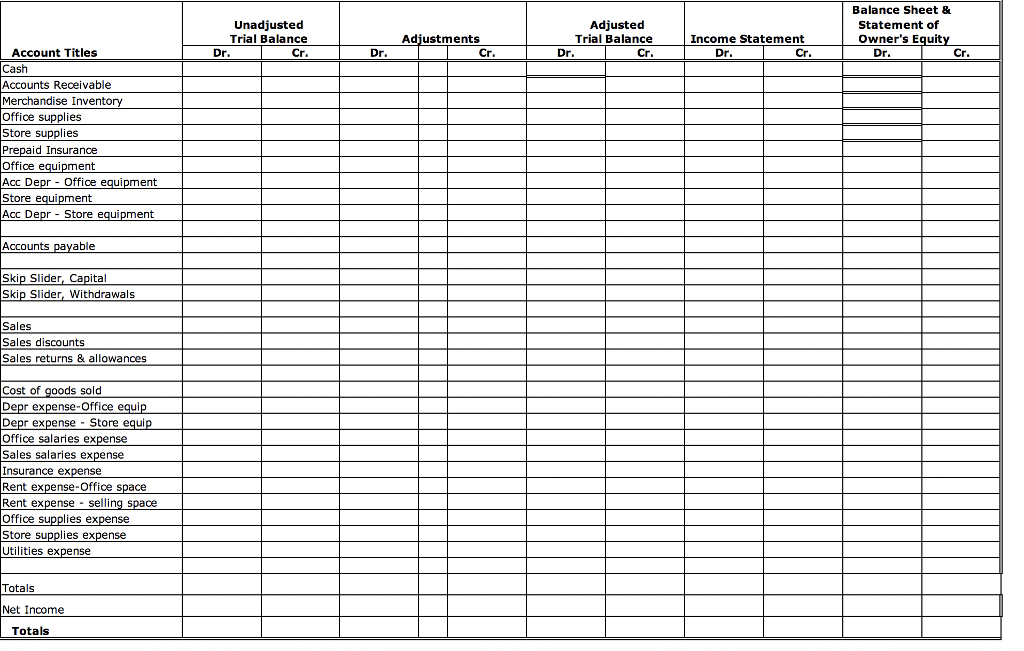

Please prepare worksheet, unadjusted, adjusted, adjusted trail balance, income statement, balance sheet. Adjusted balances are at the bottom and starting balances 2) Worksheet - complete

Please prepare worksheet, unadjusted, adjusted, adjusted trail balance, income statement, balance sheet. Adjusted balances are at the bottom and starting balances

2) Worksheet - complete and tied out

Please finish preparing the Worksheet- all included

Beginning Balances For May-

Cash = 88,900 - debit

Merchandise Inventory = 163,284 - debit

Office Supplies = 2,430 - debit

Store Supplies = 3,158 - debit

Prepaid Insurance = 6,427 - debit

Office Equipment = 58,752 - debit

Accumulated depreciation - office equipment - credit - 19,898

Store equipment - 134,960 - debit

Accumulated Depreciation - Store equipment - credit - 27,420

Capital - credit - 410,593

Withdrawls = 4,800 - debit

Sales and return and allowances = 150.00 - debit

The numbers don't add up from the past month. Have to work with what is here.

May 1 - Issued Check No. 5200 to L&J Management Co. in payment of the May rent, $6,000. (Use two lines to record the transaction. Charge 80% of the rent to Rent Expense Selling Space and the balance to Rent Expense Office Space.

May 2 Sold merchandise on credit to Yellow Rock Company, Invoice No. 9501, for $3,500 (cost is $1,500)

May 3 - Issued a $150 credit memorandum to Yellow Rock Company for defective (worthless) merchandise sold on May 2 and returned for credit.

May 4 Purchased the following on credit from Jerrys Curling Supply Co. Invoice dated May 4, terms n/10 EOM. Merchandise = 27027.00, Store Supplies = 754, Office Supplies = 38.00

May 5 Received payment from Yellow Rock Company for the May 2 sale less the May 3rd return and discount.

May 8 Issued Check No. 5201 to Jerrys Curling Supply Company for merchandise purchased on May 4th.

May 9 Sold store supplies to the merchant next door at their cost of $220 cash. (Hint what are we selling to the next door neighbor, it is not Merchandise Inventory and does not have a cost associated with it)

May 10 Purchased $2,047 of office equipment on credit from Jerrys Curling Supply Co., invoice dated May 10, terms n/10 EOM.

May 11 Purchased $6,200 of merchandise from Red Rock, Inc., invoice dated May 10, terms 2/10, n/30

May 12 Received an $97 credit memorandum from Jerrys Curling Supply for the return of defective office equipment received on May 10.

May 13 Issued Check No. 5203 to Red Rock, Inc. in payment of its May 11 invoice less the discount.

May 15 Issued Check No. 5202, payable to Payroll, in payment of sales salaries, $3,230, and office salaries, $1,510. Cashed the check and paid the employees.

May 15 Cash sales for the first half of the month are 41,380 (cost is $18,200). (Cash sales are recorded daily but are recorded in a lump sum format through two entries May 15 and May 31)

May 16 Sold merchandise on credit to House Curling Company, Invoice No. 9502, for $3,990 (cost is $1,890)

May 17 Purchased $23,650 of merchandise from Olympics Gold, invoice dated May 17, terms 2/10, n/60.

May 22 Sold merchandise to Sweep Services, Invoice No. 9503, for $8,650 (cost is $4,990), terms 2/10, n/60.

May 23 Issued Check No. 5204 to Olympics Gold in payment of its May 17 invoice less the discount.

May 24 Purchased the following on credit from Jerrys Curling Supply Company Invoice dated May 24, terms n/10 EOM. Merchandise = 8102.00, Store Supplies = 630.00, Office Supplies = 280.00

May 25 Purchased $4,120 of merchandise from Burned Stone Curling, invoice dated May 25, terms 2/10, n/30.

May 26 Sold merchandise on credit to Draw Weight, Invoice No. 9504, for $21,315 (cost is $12,230)

May 26 Issued Check No. 5205 to Pebble Power in payment of the May electric bill, $983.

May 29 The owner of Curling Rocks, Skip Slider, used Check No. 5206 to withdraw $4,800 cash from the business for personal use.

May 30 Received payment from Sweep Services for the May 22 sale less the discount.

May 30 Issued Check No. 5207, payable to Payroll, in payment of sales salaries, $3,230, and office salaries, $1,510. Cashed the check and paid the employees.

May 31 Cash sales for the last half of the month are $48,030 (cost is $20,100)

Here are the adjustments that need to be made -

Prepare Adjusting Journal entires and put them in the worksheet should = 10,585 both credit and debit.

a. Expired Insurance = 1500

b. Engin store supplies inventory = 794

c. Ending office supplies Inventory = 46

d. Depreciation of Store Equipment = 580

e. Depreciation Of office equipment = 795

f. Physical count of Merchandise Inventory = 171,396

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started