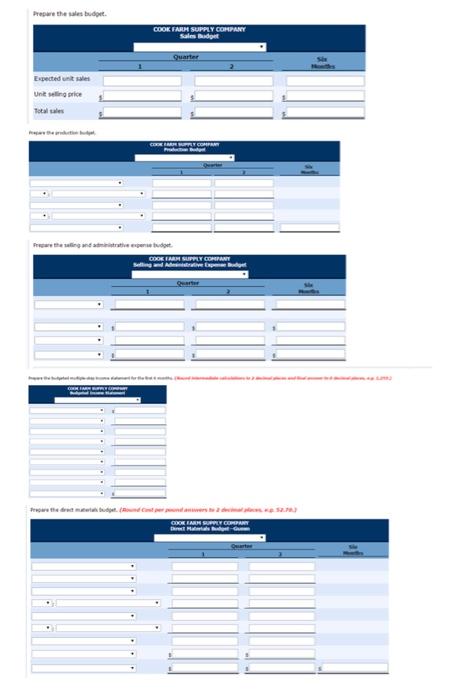

please provide a bugeted income statement and direct materials budget too please

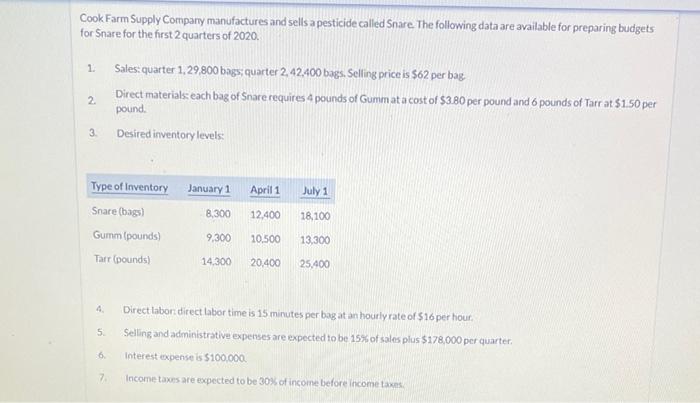

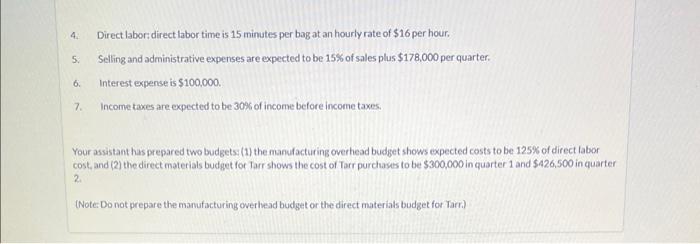

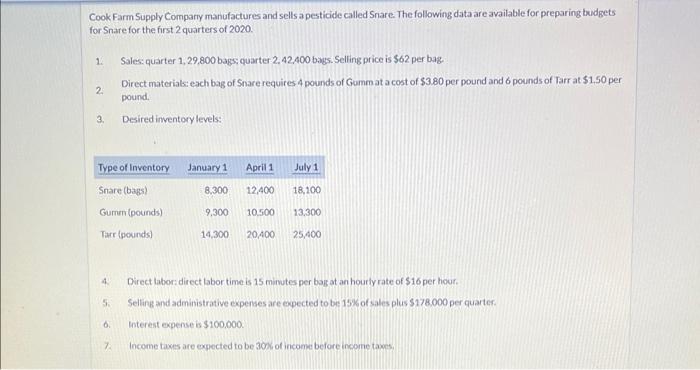

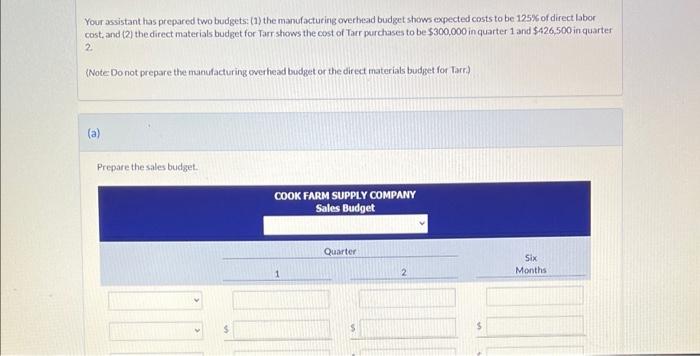

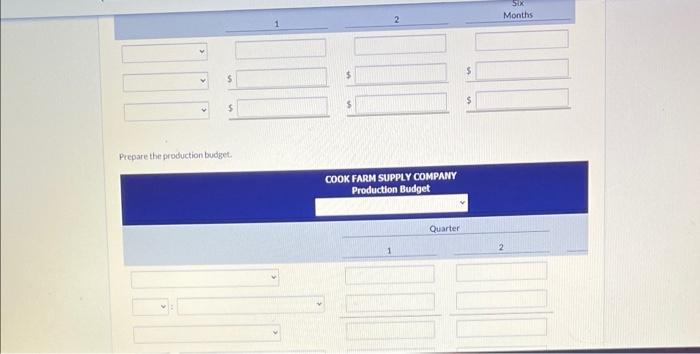

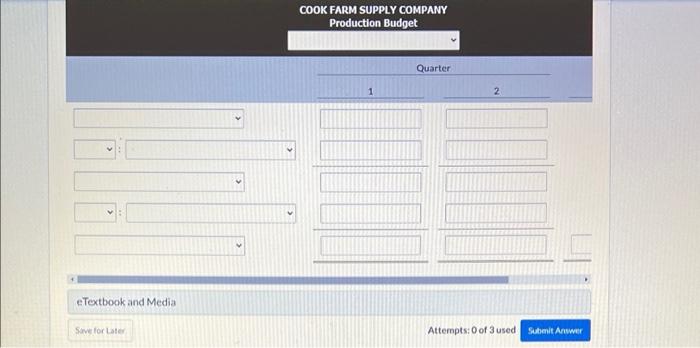

Cook Farm Supply Compary manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for $ nare for the first 2 quarters of 2020 . 1. Sales: quarter 1,29,800 bags; quarter 2,42,400 bags. Selling price is $62 per bag 2. Direct materials each bag of $ nare requires 4 pounds of Gummat a cost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: 4. Direct labor direct labor time is 15 minutes per bag at an houtly rate of $16 per houf, 5. Selling and administrative expenses are expected to be 15% of sales plus $178,000 per quarter. 6. Interest expense is $100,000 7. Income taxs are expected to be 30% of income before income taxns. 4. Direct labori direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling and administrative expenses are expected to be 15$ of sales plus $178,000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30% of inconne before income taxes. Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $300,000 in quarter 1 and $426,500 in quarter 2. (Note: Do not prepare the manufacturing overhead budget or the direct materials bodget for Tarr.) 11 Cook Farm Supply Comparyy manufactures and sells a pesticide called Snare. The following data are available for preparing bud for S nare for the first 2 quarters of 2020. 1. Sales quarter 1,29,800 bags quarter 2,42,400 bags. Selling price is $62 per bag. 2. Direct materials: each bag of $ nare requires 4 pounds of Gummat a cost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: 4. Direct labor direct tabor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling and administrative expenses are epected to be 15% of sales plus $178.000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30\%i of income before incone taws. Your assistant has prepared two budgets: (1) the manulacturing overhead budget shows epected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $300,000 in quarter 1 and $426,500 in quarter 2. (Note Do not prepare the manufacturing werhead bodget or the direct materials budget for Tarr)? (a) Prepare the sales budget. Prepare the production budget