Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide a complete computation PRACTICE PROBLEMS FOR STOCHASTIC INVENTORY MODELS 1. The daily demand for an item is 20 units. The procurement lead time

please provide a complete computation

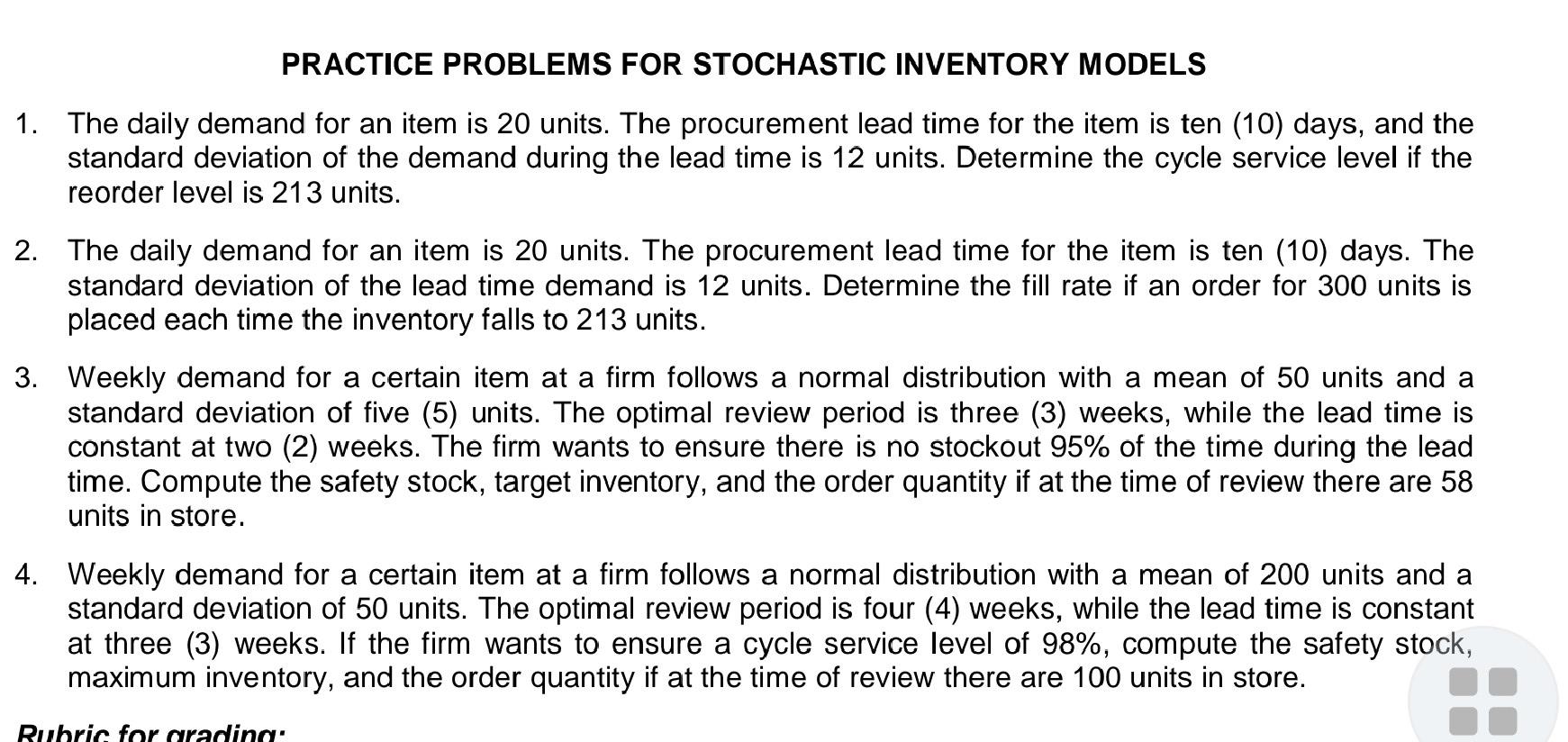

PRACTICE PROBLEMS FOR STOCHASTIC INVENTORY MODELS 1. The daily demand for an item is 20 units. The procurement lead time for the item is ten (10) days, and the standard deviation of the demand during the lead time is 12 units. Determine the cycle service level if the reorder level is 213 units. 2. The daily demand for an item is 20 units. The procurement lead time for the item is ten (10) days. The standard deviation of the lead time demand is 12 units. Determine the fill rate if an order for 300 units is placed each time the inventory falls to 213 units. 3. Weekly demand for a certain item at a firm follows a normal distribution with a mean of 50 units and a standard deviation of five (5) units. The optimal review period is three (3) weeks, while the lead time is constant at two (2) weeks. The firm wants to ensure there is no stockout 95% of the time during the lead time. Compute the safety stock, target inventory, and the order quantity if at the time of review there are 58 units in store. 4. Weekly demand for a certain item at a firm follows a normal distribution with a mean of 200 units and a standard deviation of 50 units. The optimal review period is four (4) weeks, while the lead time is constant at three (3) weeks. If the firm wants to ensure a cycle service level of 98%, compute the safety stock, maximum inventory, and the order quantity if at the time of review there are 100 units in store. Rubric for aradina

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started