Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide a financial statement with journal entries in Microsoft Excel Arnie's Transportation Company (ATC) is a large, privately incorporated company that has been operating

Please provide a financial statement with journal entries in Microsoft Excel

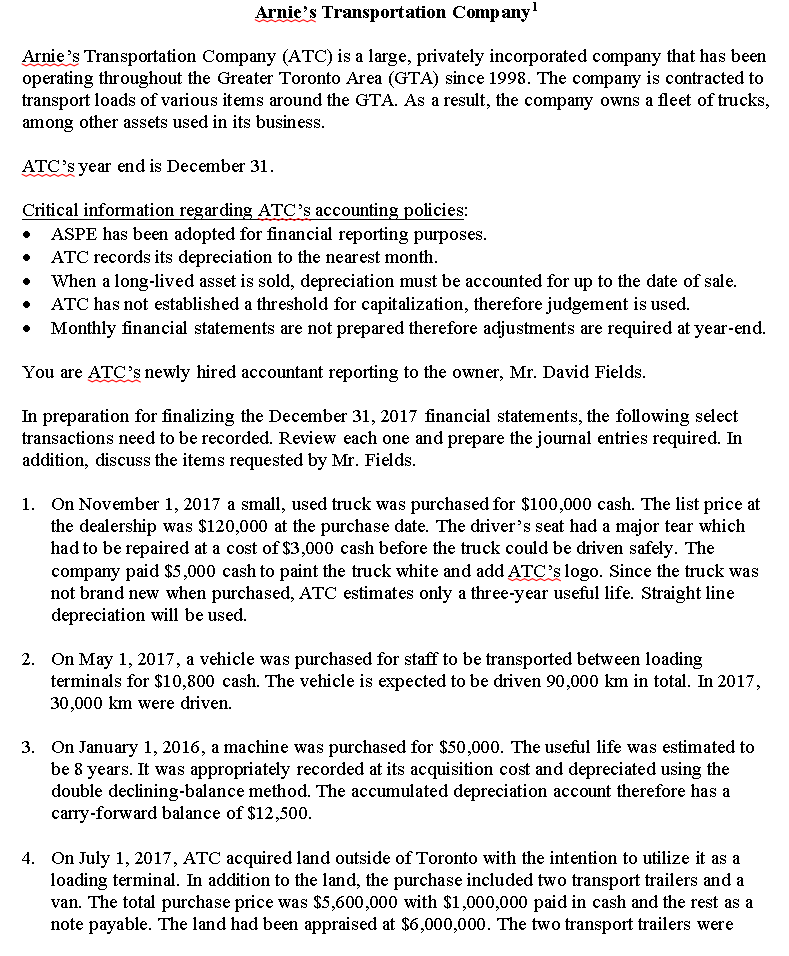

Arnie's Transportation Company (ATC) is a large, privately incorporated company that has been operating throughout the Greater Toronto Area (GTA) since 1998. The company is contracted to transport loads of various items around the GTA. As a result, the company owns a fleet of trucks, among other assets used in its business. ATC's year end is December 31 . Critical information regarding ATC's accounting policies: - ASPE has been adopted for financial reporting purposes. - ATC records its depreciation to the nearest month. - When a long-lived asset is sold, depreciation must be accounted for up to the date of sale. - ATC has not established a threshold for capitalization, therefore judgement is used. - Monthly financial statements are not prepared therefore adjustments are required at year-end. You are ATC's newly hired accountant reporting to the owner, Mr. David Fields. In preparation for finalizing the December 31,2017 financial statements, the following select transactions need to be recorded. Review each one and prepare the journal entries required. In addition, discuss the items requested by Mr. Fields. 1. On November 1,2017 a small, used truck was purchased for $100,000 cash. The list price at the dealership was $120,000 at the purchase date. The driver's seat had a major tear which had to be repaired at a cost of $3,000 cash before the truck could be driven safely. The company paid $5,000 cash to paint the truck white and add ATC's logo. Since the truck was not brand new when purchased, ATC estimates only a three-year useful life. Straight line depreciation will be used. 2. On May 1, 2017, a vehicle was purchased for staff to be transported between loading terminals for $10,800 cash. The vehicle is expected to be driven 90,000km in total. In 2017 , 30,000km were driven. 3. On January 1, 2016, a machine was purchased for $50,000. The useful life was estimated to be 8 years. It was appropriately recorded at its acquisition cost and depreciated using the double declining-balance method. The accumulated depreciation account therefore has a carry-forward balance of $12,500. 4. On July 1, 2017, ATC acquired land outside of Toronto with the intention to utilize it as a loading terminal. In addition to the land, the purchase included two transport trailers and a van. The total purchase price was $5,600,000 with $1,000,000 paid in cash and the rest as a note payable. The land had been appraised at $6,000,000. The two transport trailers were appraised at $200,000 each and van was appraised at $100,000. The expected useful life of the trailers and the van is 5 years each. Residual value for each trailer is $10,000. ATC plans to depreciate these assets straight-line. 5. On January 1, 2016, ATC purchased a machine for $55,000. The estimated useful life from the date of purchase was 5 years and residual value was estimated at $5,000. This asset is depreciated using the double declining-balance method. 6. On April 2,2017 ATC scrapped a very old and rusted piece of equipment. The equipment had a cost of $7,000 and accumulated depreciation of $7,000. 7. On August 1, 2017, ATC sold a building which it owned for $660,000. The building had originally cost ATC $250,000 and had accumulated depreciation of $118,000 at December 31,2016 . Depreciation of $15,000 that had accumulated up to August 1,2017 had not been recorded. Proceeds of the sale were received in cash. 8. On July 22,2017, ATC decided to sell furniture from inside one of its administrative buildings that it no longer needed. The original cost was $22,000 and accumulated depreciation at December 31,2016 was $5,000. Depreciation of $1,000 that had accumulated up to the point of sale had not been recorded. ATC was able to secure $10,000 cash for the sale from one of its employees. 9. A total of $30,000 was spent in 2017 for power washing of ATC's fleet of trucks. The previous accountant was unsure whether to expense or capitalize this amount. Also during 2017 , one of ATC's trucks was outfitted with a new engine costing $3,500cash, which was expected to increase the life of the truck by at least 4 years. Discuss the two transactions. 10. A customer list from Benjamin's Transport Inc. was purchased by ATC on October 1, 2017 for $75,000 cash. It is expected that the list will generate revenues for the next 6 years. 11. ATC has a copyright for some of its mapped trucking routes. The previous accountant did not believe it needed to be amortized. Mr. Fields would like you to comment whether this is accurate and explain why or why not. 12. On January 1, 2017, the previous accountant determined that trucks with a cost of $575,000 and accumulated depreciation of $57,500 would have an estimated useful life of 8 more years. The previous estimated useful life had been 10 years when the asset was acquired on January 1, 2016. Straight line depreciation has been used. Mr. Fields is concerned with whether the previous year's financial statements need to be revised now that the estimated useful life has been reduced. 13. ATC has an administrative building outside the city centre. The building cost $800,000 when it was purchased on January 1, 2013 with an estimated useful life of 20 years. Straight line depreciation has been used. On December 31,2017 , it was determined that there was a major soil issue around the building which will make it difficult to sell. It is estimated that the building's fair value and value in use is now 30% of its original cost, with an estimated $40,000 in costs to sellStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started