Answered step by step

Verified Expert Solution

Question

1 Approved Answer

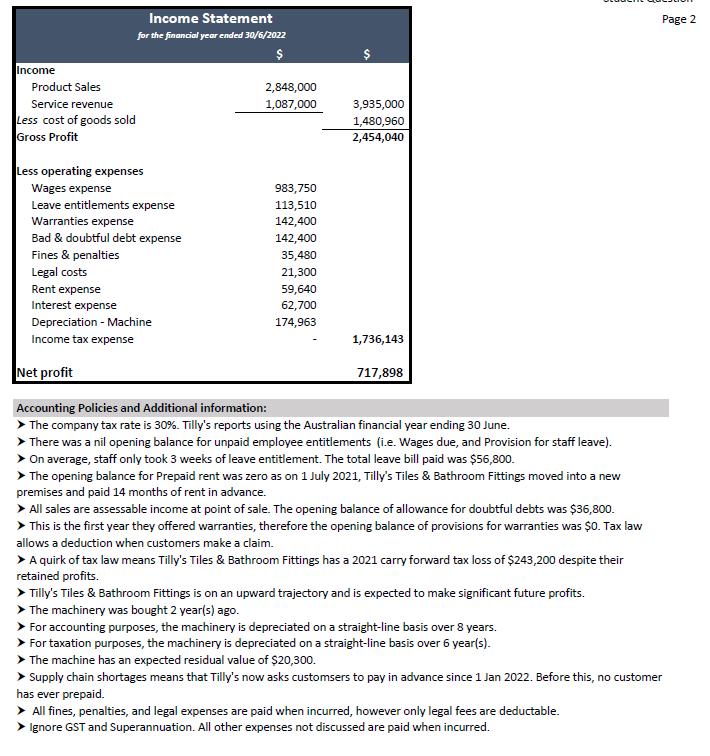

Please provide a reconciliation of accounting profit to taxable income, deferred tax worksheet and end of year journal entries for 30/6/2022 Tilly's Tiles and Bathroom

Please provide a reconciliation of accounting profit to taxable income, deferred tax worksheet and end of year journal entries for 30/6/2022

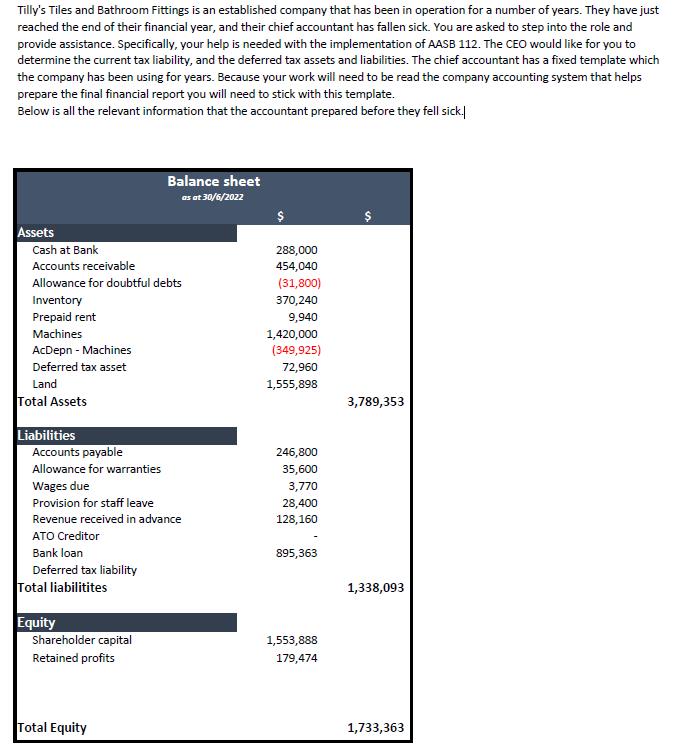

Tilly's Tiles and Bathroom Fittings is an established company that has been in operation for a number of years. They have just reached the end of their financial year, and their chief accountant has fallen sick. You are asked to step into the role and provide assistance. Specifically, your help is needed with the implementation of AASB 112. The CEO would like for you to determine the current tax liability, and the deferred tax assets and liabilities. The chief accountant has a fixed template which the company has been using for years. Because your work will need to be read the company accounting system that helps prepare the final financial report you will need to stick with this template. Below is all the relevant information that the accountant prepared before they fell sick. Assets Cash at Bank Accounts receivable Allowance for doubtful debts Inventory Prepaid rent Machines AcDepn - Machines Deferred tax asset Land Total Assets Liabilities Accounts payable Allowance for warranties Wages due Provision for staff leave Revenue received in advance ATO Creditor Bank loan Deferred tax liability Total liabilitites Equity Balance sheet as at 30/6/2022 Shareholder capital Retained profits Total Equity $ 288,000 454,040 (31,800) 370,240 9,940 1,420,000 (349,925) 72,960 1,555,898 246,800 35,600 3,770 28,400 128,160 895,363 1,553,888 179,474 $ 3,789,353 1,338,093 1,733,363

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Reconciliation of accounting profit to taxable income Item Accounting profit Taxable income Difference Revenue 2848000 2848000 0 Cost of goods sold 14...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started