Please Provide all formulas used. My course requires the use of formulas even when they are not needed or there is a quicker way. Thanks!

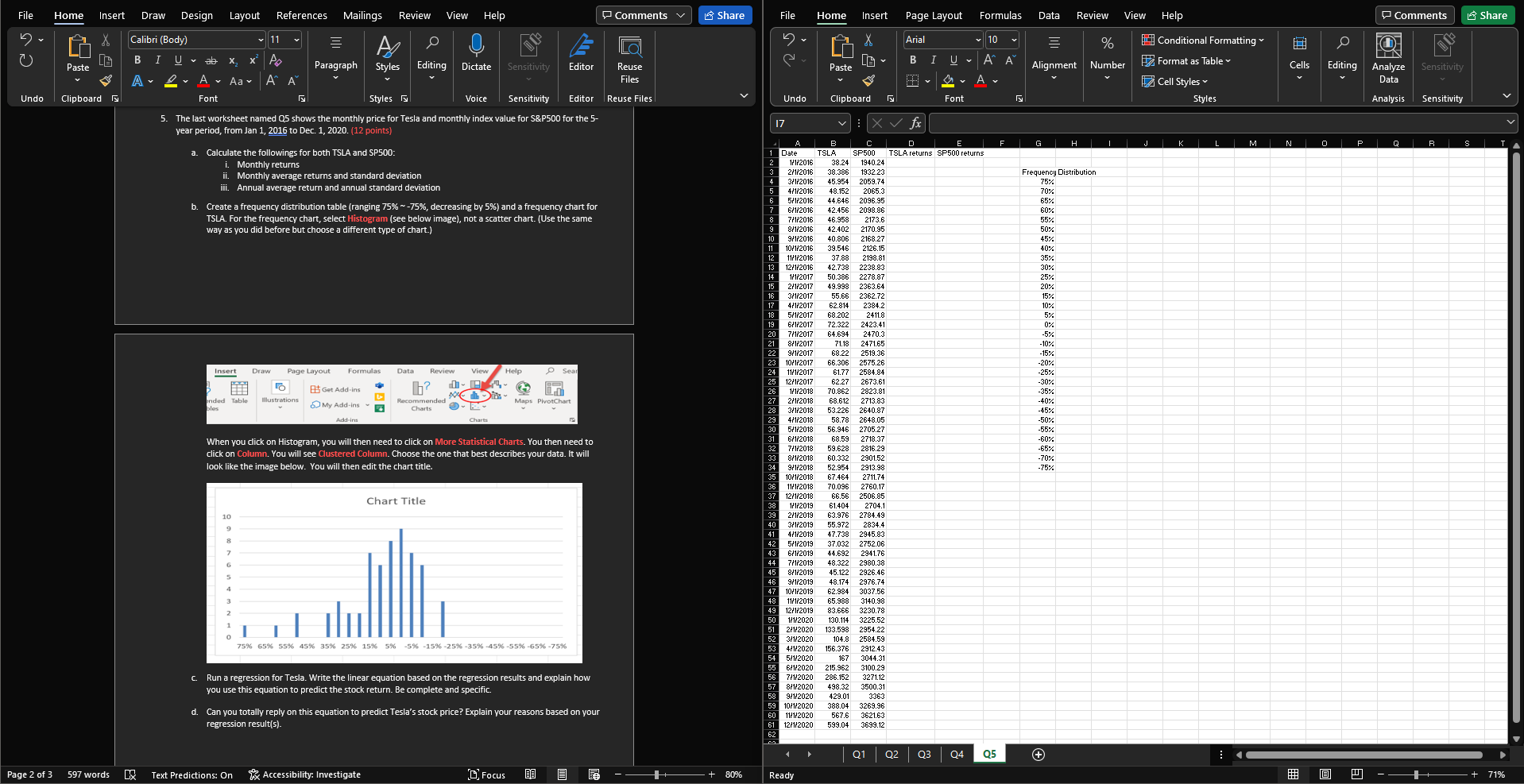

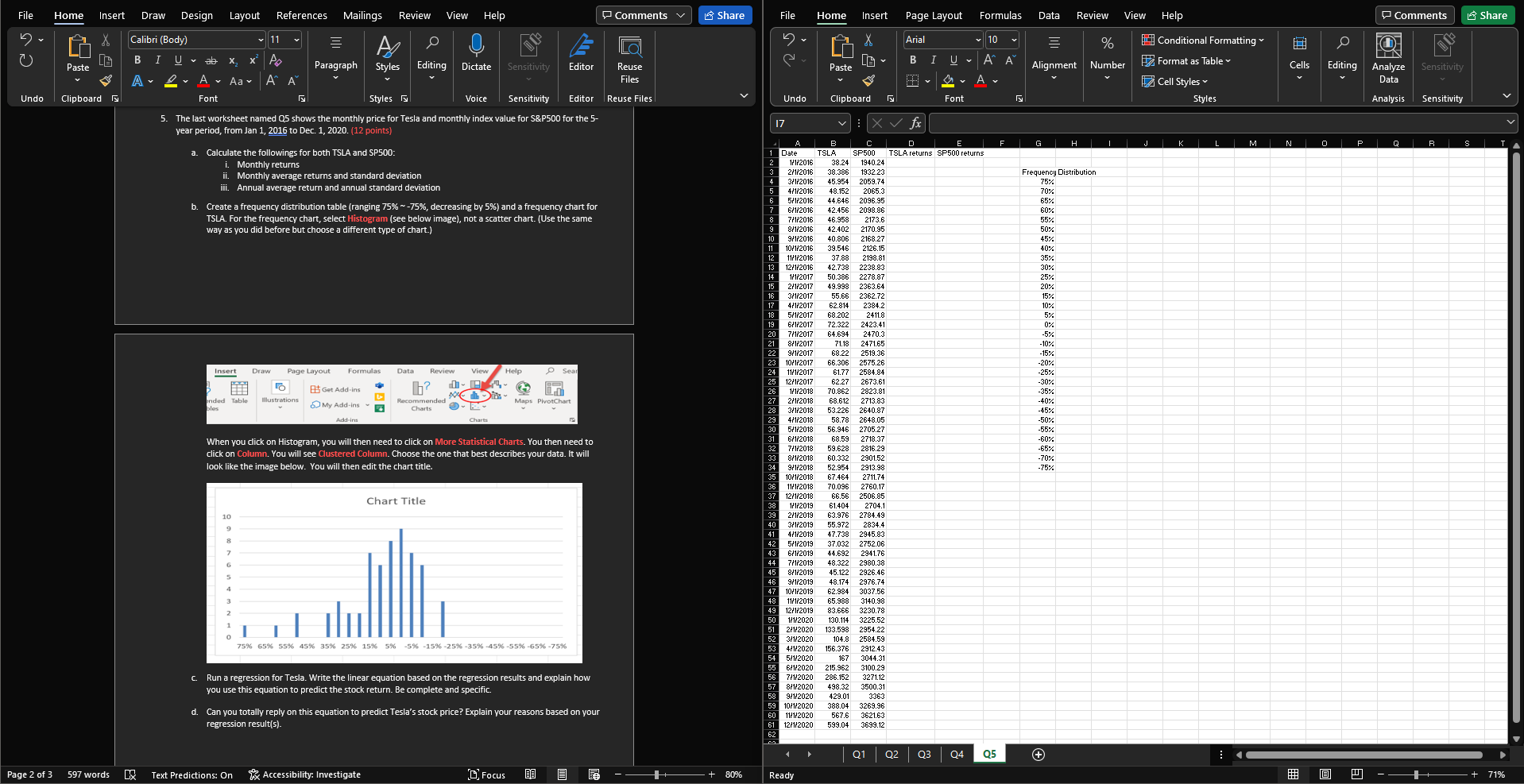

File Home Insert Draw Design Layout References Mailings Review View Help Comments V Share File Home Insert Page Layout Formulas Data Review View Help Comments Share X Calibri (Body) 11 = X Arial 10 % FO LO () B I A A Paste Paragraph Styles Editing Dictate Sensitivity Editor Paste Alignment Number Cells Conditional Formatting Format as Table Cell Styles Styles Editing Reuse Files Sensitivity B I ab X X A A A Aa A A Font , Analyze Data A Undo Clipboard Styles Voice Sensitivity Editor Reuse Files Undo Clipboard Font Analysis Sensitivity 5. The last worksheet named Q5 shows the monthly price for Tesla and monthly index value for S&P500 for the 5- year period, from Jan 1, 2016 to Dec. 1, 2020. (12 points) 17 | X fx F M N 0 P Q R S D TSLA returns SP500 returns 38.386 a. Calculate the followings for both TSLA and SP500: i. Monthly returns ii. Monthly average returns and standard deviation iii. Annual average return and annual standard deviation b. Create a frequency distribution table (ranging 75%--75%, decreasing by 5%) and a frequency chart for TSLA. For the frequency chart, select Histogram (see below image), not a scatter chart. (Use the same way as you did before but choose a different type of chart.) Frequency Distribution 75% 70% 65% 60% 55% 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% -5% -10% -15% -20% -25% -30% -35% -40% -45% -50% -55% -60% -65% -70% -75% insert Draw Page Layout Formulas Data Review View Help Get Add-ins L? 70.862 HH nded Table bles illustrations Recommended Charts Maps PivotChart My Add-ins Add-ins A | C 1 Date TSLA SP500 2 1/1/2016 38.24 1940.24 3 2/1/2016 1932.23 4 3/1/2018 45.954 2059.74 5 4/1/2016 48.152 2065.3 6 5/1/2016 44.646 2096.95 7 6/1/2018 42.45 2098.86 8 7/1/2016 46.958 2173.6 9 8/1/2016 42.402 2170.95 10 9/1/2016 40.806 2168.27 11 10/1/2018 39.546 2126.15 12 11/1/2016 37.88 2198.81 12/1/2016 42.738 2238.83 14 1/1/2017 50.386 2278.87 15 2/1/2017 49.998 2363.64 16 311/2017 55.66 2362.72 17 4/1/2017 62.814 2384.2 18 5/1/2017 68.202 2411.8 19 6/1/2017 72.322 2423.41 20 7/1/2017 64.694 2470.3 21 8/1/2017 71.18 2471.65 22 9/1/2017 68.22 2519.36 23 10/1/2017 66.306 2575.26 24 11/1/2017 61.77 2584.84 25 12/1/2017 62.27 2673.61 26 1/1/2018 2823.81 27 2/1/2018 68.612 2713.83 28 3/1/2018 53.226 2640.87 29 4/1/2018 58.78 2648.05 30 5/1/2018 56.946 2705.27 31 6/1/2018 68.59 2718.37 7/1/2018 2816.29 33 8/1/2018 60.332 2901.52 9/1/2018 52.954 2913.98 10/1/2018 67.464 2711.74 36 11/1/2018 70.096 2760.17 37 12/1/2018 66.56 2506.85 38 1/1/2019 61.404 39 2/1/2019 63.976 2784.49 40 3/1/2019 2834.4 41 4/1/2019 47.738 2945.83 42 5/1/2019 37.032 2752.06 43 6/1/2019 44.692 2941.76 44 7/1/2018 48.322 2980.38 45 8/1/2019 45.122 2926.46 46 9/1/2018 48.174 2976.74 47 10/1/2019 62.984 3037.56 4 11/1/2018 3140.98 49 12/1/2019 83.666 3230.78 50 1/1/2020 130.114 3225.52 51 2/1/2020 133.598 2954.22 52 3/1/2020 104.8 2584.59 53 4/1/2020 156.376 2912.43 54 5/1/2020 167 3044.31 55 6/1/2020 215.962 3100.29 56 7/1/2020 286.152 3271.12 57 8/1/2020 498.32 3500.31 58 9/1/2020 429.01 3363 59 10/1/2020 3269.96 11/1/2020 567.6 3621.63 12/1/2020 3699.12 Charts 59.628 When you click on Histogram, you will then need to click on More Statistical Charts. You then need to click on Column. You will see Clustered Column. Choose the one that best describes your data. It will look like the image below. You will then edit the chart title. Chart Title 27041 10 55.972 & 7 G 65.989 o 75% 65% 55% 45% 35% 25% 15% 5% -5% -15%-25%-35% -45% -55% -65% -75% c Run a regression for Tesla. Write the linear equation based on the regression results and explain how you use this equation to predict the stock return. Be complete and specific. 388.04 d. Can you totally reply on this equation to predict Tesla's stock price? Explain your reasons based on your regression result(s). 599,04 01 02 Q3 Q4 05 # Page 2 of 3 597 words Text Predictions: On Accessibility: Investigate Focus + 80% Ready + 71% File Home Insert Draw Design Layout References Mailings Review View Help Comments V Share File Home Insert Page Layout Formulas Data Review View Help Comments Share X Calibri (Body) 11 = X Arial 10 % FO LO () B I A A Paste Paragraph Styles Editing Dictate Sensitivity Editor Paste Alignment Number Cells Conditional Formatting Format as Table Cell Styles Styles Editing Reuse Files Sensitivity B I ab X X A A A Aa A A Font , Analyze Data A Undo Clipboard Styles Voice Sensitivity Editor Reuse Files Undo Clipboard Font Analysis Sensitivity 5. The last worksheet named Q5 shows the monthly price for Tesla and monthly index value for S&P500 for the 5- year period, from Jan 1, 2016 to Dec. 1, 2020. (12 points) 17 | X fx F M N 0 P Q R S D TSLA returns SP500 returns 38.386 a. Calculate the followings for both TSLA and SP500: i. Monthly returns ii. Monthly average returns and standard deviation iii. Annual average return and annual standard deviation b. Create a frequency distribution table (ranging 75%--75%, decreasing by 5%) and a frequency chart for TSLA. For the frequency chart, select Histogram (see below image), not a scatter chart. (Use the same way as you did before but choose a different type of chart.) Frequency Distribution 75% 70% 65% 60% 55% 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% -5% -10% -15% -20% -25% -30% -35% -40% -45% -50% -55% -60% -65% -70% -75% insert Draw Page Layout Formulas Data Review View Help Get Add-ins L? 70.862 HH nded Table bles illustrations Recommended Charts Maps PivotChart My Add-ins Add-ins A | C 1 Date TSLA SP500 2 1/1/2016 38.24 1940.24 3 2/1/2016 1932.23 4 3/1/2018 45.954 2059.74 5 4/1/2016 48.152 2065.3 6 5/1/2016 44.646 2096.95 7 6/1/2018 42.45 2098.86 8 7/1/2016 46.958 2173.6 9 8/1/2016 42.402 2170.95 10 9/1/2016 40.806 2168.27 11 10/1/2018 39.546 2126.15 12 11/1/2016 37.88 2198.81 12/1/2016 42.738 2238.83 14 1/1/2017 50.386 2278.87 15 2/1/2017 49.998 2363.64 16 311/2017 55.66 2362.72 17 4/1/2017 62.814 2384.2 18 5/1/2017 68.202 2411.8 19 6/1/2017 72.322 2423.41 20 7/1/2017 64.694 2470.3 21 8/1/2017 71.18 2471.65 22 9/1/2017 68.22 2519.36 23 10/1/2017 66.306 2575.26 24 11/1/2017 61.77 2584.84 25 12/1/2017 62.27 2673.61 26 1/1/2018 2823.81 27 2/1/2018 68.612 2713.83 28 3/1/2018 53.226 2640.87 29 4/1/2018 58.78 2648.05 30 5/1/2018 56.946 2705.27 31 6/1/2018 68.59 2718.37 7/1/2018 2816.29 33 8/1/2018 60.332 2901.52 9/1/2018 52.954 2913.98 10/1/2018 67.464 2711.74 36 11/1/2018 70.096 2760.17 37 12/1/2018 66.56 2506.85 38 1/1/2019 61.404 39 2/1/2019 63.976 2784.49 40 3/1/2019 2834.4 41 4/1/2019 47.738 2945.83 42 5/1/2019 37.032 2752.06 43 6/1/2019 44.692 2941.76 44 7/1/2018 48.322 2980.38 45 8/1/2019 45.122 2926.46 46 9/1/2018 48.174 2976.74 47 10/1/2019 62.984 3037.56 4 11/1/2018 3140.98 49 12/1/2019 83.666 3230.78 50 1/1/2020 130.114 3225.52 51 2/1/2020 133.598 2954.22 52 3/1/2020 104.8 2584.59 53 4/1/2020 156.376 2912.43 54 5/1/2020 167 3044.31 55 6/1/2020 215.962 3100.29 56 7/1/2020 286.152 3271.12 57 8/1/2020 498.32 3500.31 58 9/1/2020 429.01 3363 59 10/1/2020 3269.96 11/1/2020 567.6 3621.63 12/1/2020 3699.12 Charts 59.628 When you click on Histogram, you will then need to click on More Statistical Charts. You then need to click on Column. You will see Clustered Column. Choose the one that best describes your data. It will look like the image below. You will then edit the chart title. Chart Title 27041 10 55.972 & 7 G 65.989 o 75% 65% 55% 45% 35% 25% 15% 5% -5% -15%-25%-35% -45% -55% -65% -75% c Run a regression for Tesla. Write the linear equation based on the regression results and explain how you use this equation to predict the stock return. Be complete and specific. 388.04 d. Can you totally reply on this equation to predict Tesla's stock price? Explain your reasons based on your regression result(s). 599,04 01 02 Q3 Q4 05 # Page 2 of 3 597 words Text Predictions: On Accessibility: Investigate Focus + 80% Ready + 71%