Answered step by step

Verified Expert Solution

Question

1 Approved Answer

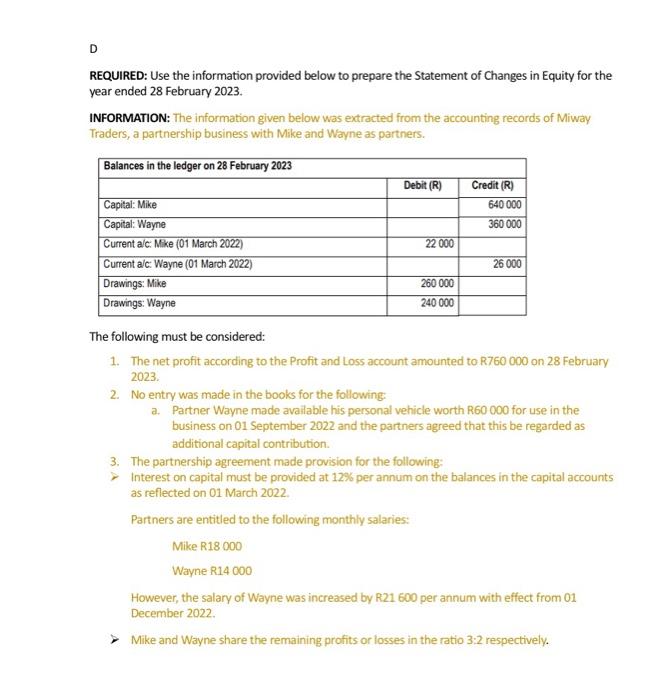

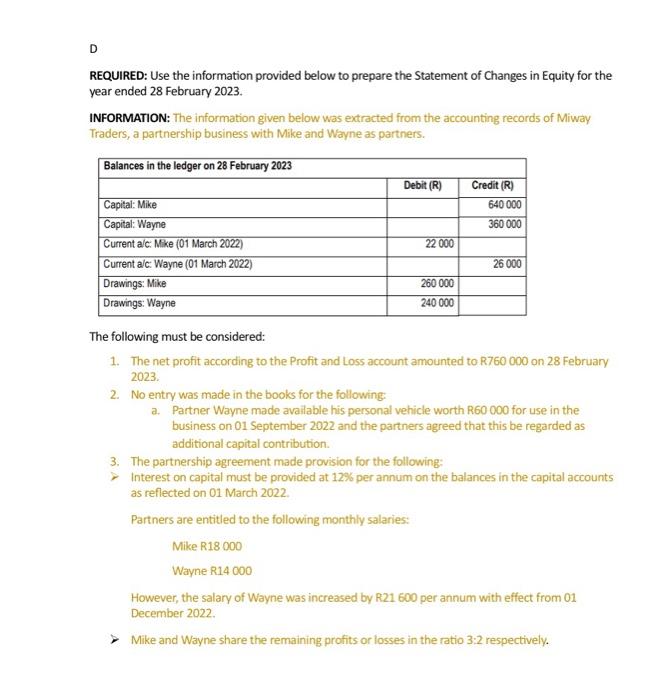

please provide answer in detailed steps D REQUIRED: Use the information provided below to prepare the Statement of Changes in Equity for the year ended

please provide answer in detailed steps

D REQUIRED: Use the information provided below to prepare the Statement of Changes in Equity for the year ended 28 February 2023. INFORMATION: The information given below was extracted from the accounting records of Miway Traders, a partnership business with Mike and Wayne as partners. The following must be considered: 1. The net profit according to the Profit and Loss account amounted to R760000 on 28 February 2023. 2. No entry was made in the books for the following: a. Partner Wayne made available his personal vehicle worth R60000 for use in the business on 01 September 2022 and the partners agreed that this be regarded as additional capital contribution. 3. The partnership agreement made provision for the following: Interest on capital must be provided at 12% per annum on the balances in the capital accounts as reflected on 01 March 2022. Partners are entitled to the following monthly salaries: Mike R18 000 Wayne R14 000 However, the salary of Wayne was increased by R21 600 per annum with effect from 01 December 2022. Mike and Wayne share the remaining profits or losses in the ratio 3:2 respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started