Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide answer in excel. production and sales volume is 15,000 units. Monthly capacity is 20,000 units. The variable distribution costs are for transportation to

please provide answer in excel.

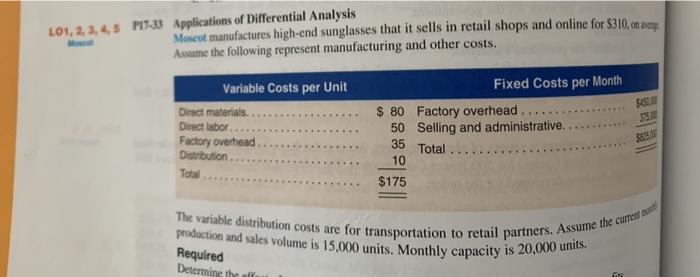

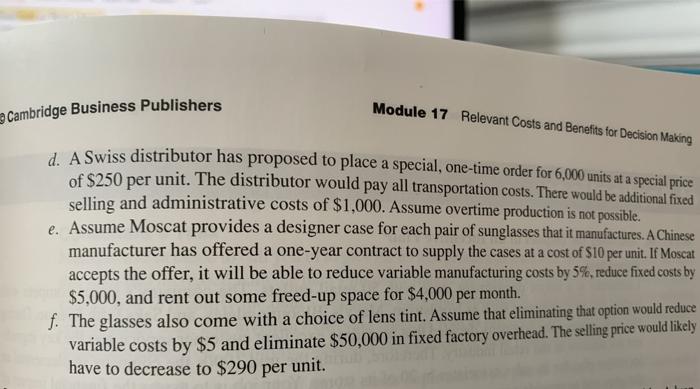

production and sales volume is 15,000 units. Monthly capacity is 20,000 units. The variable distribution costs are for transportation to retail partners. Assume the current L01, 2, 3, 4, 5 17.3 Applications of Differential Analysis Moscot manufactures high-end sunglasses that it sells in retail shops and online for $310, on avenge Assume the following represent manufacturing and other costs. SSON SAN Variable Costs per Unit Direct materials.... Direct labor Factory overhead Distribution Total Fixed Costs per Month $ 80 Factory overhead...... 50 Selling and administrative. 35 Total 10 $175 SEX Required Determine the ofr 39 Cambridge Business Publishers Module 17 Relevant Costs and Benefits for Decision Making d. A Swiss distributor has proposed to place a special, one-time order for 6,000 units at a special price of $250 per unit. The distributor would pay all transportation costs. There would be additional fixed selling and administrative costs of $1,000. Assume overtime production is not possible. e. Assume Moscat provides a designer case for each pair of sunglasses that it manufactures. A Chinese manufacturer has offered a one-year contract to supply the cases at a cost of $10 per unit. If Moscat accepts the offer, it will be able to reduce variable manufacturing costs by 5%, reduce fixed costs by $5,000, and rent out some freed-up space for $4,000 per month. f. The glasses also come with a choice of lens tint. Assume that eliminating that option would reduce variable costs by $5 and eliminate $50,000 in fixed factory overhead. The selling price would likely have to decrease to $290 per unit. production and sales volume is 15,000 units. Monthly capacity is 20,000 units. The variable distribution costs are for transportation to retail partners. Assume the current L01, 2, 3, 4, 5 17.3 Applications of Differential Analysis Moscot manufactures high-end sunglasses that it sells in retail shops and online for $310, on avenge Assume the following represent manufacturing and other costs. SSON SAN Variable Costs per Unit Direct materials.... Direct labor Factory overhead Distribution Total Fixed Costs per Month $ 80 Factory overhead...... 50 Selling and administrative. 35 Total 10 $175 SEX Required Determine the ofr 39 Cambridge Business Publishers Module 17 Relevant Costs and Benefits for Decision Making d. A Swiss distributor has proposed to place a special, one-time order for 6,000 units at a special price of $250 per unit. The distributor would pay all transportation costs. There would be additional fixed selling and administrative costs of $1,000. Assume overtime production is not possible. e. Assume Moscat provides a designer case for each pair of sunglasses that it manufactures. A Chinese manufacturer has offered a one-year contract to supply the cases at a cost of $10 per unit. If Moscat accepts the offer, it will be able to reduce variable manufacturing costs by 5%, reduce fixed costs by $5,000, and rent out some freed-up space for $4,000 per month. f. The glasses also come with a choice of lens tint. Assume that eliminating that option would reduce variable costs by $5 and eliminate $50,000 in fixed factory overhead. The selling price would likely have to decrease to $290 per unit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started