Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide answer to all the questions 2. [28 points] Blaine Kitchenware, Inc. was a mid-sized producer of branded small appliances primarily used in residential

please provide answer to all the questions

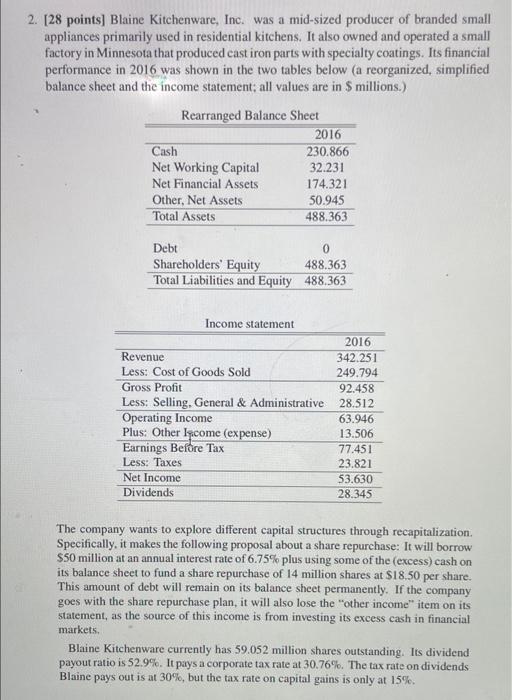

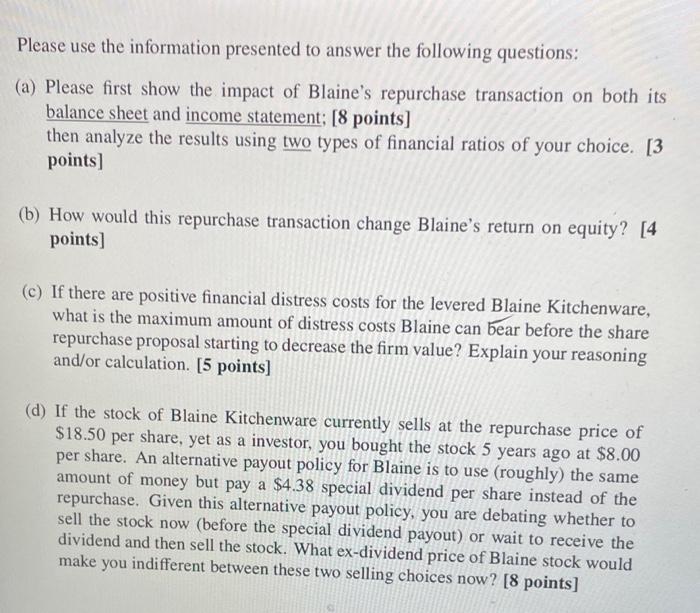

2. [28 points] Blaine Kitchenware, Inc. was a mid-sized producer of branded small appliances primarily used in residential kitchens. It also owned and operated a small factory in Minnesota that produced cast iron parts with specialty coatings. Its financial performance in 2016 was shown in the two tables below (a reorganized, simplified balance sheet and the income statement; all values are in $ millions.) Rearranged Balance Sheet 2016 Cash 230.866 Net Working Capital 32.231 Net Financial Assets 174.321 Other, Net Assets 50.945 Total Assets 488.363 Debt 0 Shareholders' Equity 488.363 Total Liabilities and Equity 488.363 Income statement 2016 Revenue 342.251 Less: Cost of Goods Sold 249.794 Gross Profit 92.458 Less: Selling, General & Administrative 28.512 Operating Income 63.946 13.506 Plus: Other Income (expense) Earnings Before Tax 77.451 Less: Taxes 23.821 Net Income 53.630 Dividends 28.345 The company wants to explore different capital structures through recapitalization. Specifically, it makes the following proposal about a share repurchase: It will borrow $50 million at an annual interest rate of 6.75% plus using some of the (excess) cash on its balance sheet to fund a share repurchase of 14 million shares at $18.50 per share. This amount of debt will remain on its balance sheet permanently. If the company goes with the share repurchase plan, it will also lose the "other income" item on its statement, as the source of this income is from investing its excess cash in financial markets. Blaine Kitchenware currently has 59.052 million shares outstanding. Its dividend payout ratio is 52.9%. It pays a corporate tax rate at 30.76%. The tax rate on dividends Blaine pays out is at 30%, but the tax rate on capital gains is only at 15%. Please use the information presented to answer the following questions: (a) Please first show the impact of Blaine's repurchase transaction on both its balance sheet and income statement; [8 points] then analyze the results using two types of financial ratios of your choice. [3 points] (b) How would this repurchase transaction change Blaine's return on equity? [4 points] (c) If there are positive financial distress costs for the levered Blaine Kitchenware, what is the maximum amount of distress costs Blaine can bear before the share repurchase proposal starting to decrease the firm value? Explain your reasoning and/or calculation. [5 points] (d) If the stock of Blaine Kitchenware currently sells at the repurchase price of $18.50 per share, yet as a investor, you bought the stock 5 years ago at $8.00 per share. An alternative payout policy for Blaine is to use (roughly) the same amount of money but pay a $4.38 special dividend per share instead of the repurchase. Given this alternative payout policy, you are debating whether to sell the stock now (before the special dividend payout) or wait to receive the dividend and then sell the stock. What ex-dividend price of Blaine stock would make you indifferent between these two selling choices now? [8 points] 2. [28 points] Blaine Kitchenware, Inc. was a mid-sized producer of branded small appliances primarily used in residential kitchens. It also owned and operated a small factory in Minnesota that produced cast iron parts with specialty coatings. Its financial performance in 2016 was shown in the two tables below (a reorganized, simplified balance sheet and the income statement; all values are in $ millions.) Rearranged Balance Sheet 2016 Cash 230.866 Net Working Capital 32.231 Net Financial Assets 174.321 Other, Net Assets 50.945 Total Assets 488.363 Debt 0 Shareholders' Equity 488.363 Total Liabilities and Equity 488.363 Income statement 2016 Revenue 342.251 Less: Cost of Goods Sold 249.794 Gross Profit 92.458 Less: Selling, General & Administrative 28.512 Operating Income 63.946 13.506 Plus: Other Income (expense) Earnings Before Tax 77.451 Less: Taxes 23.821 Net Income 53.630 Dividends 28.345 The company wants to explore different capital structures through recapitalization. Specifically, it makes the following proposal about a share repurchase: It will borrow $50 million at an annual interest rate of 6.75% plus using some of the (excess) cash on its balance sheet to fund a share repurchase of 14 million shares at $18.50 per share. This amount of debt will remain on its balance sheet permanently. If the company goes with the share repurchase plan, it will also lose the "other income" item on its statement, as the source of this income is from investing its excess cash in financial markets. Blaine Kitchenware currently has 59.052 million shares outstanding. Its dividend payout ratio is 52.9%. It pays a corporate tax rate at 30.76%. The tax rate on dividends Blaine pays out is at 30%, but the tax rate on capital gains is only at 15%. Please use the information presented to answer the following questions: (a) Please first show the impact of Blaine's repurchase transaction on both its balance sheet and income statement; [8 points] then analyze the results using two types of financial ratios of your choice. [3 points] (b) How would this repurchase transaction change Blaine's return on equity? [4 points] (c) If there are positive financial distress costs for the levered Blaine Kitchenware, what is the maximum amount of distress costs Blaine can bear before the share repurchase proposal starting to decrease the firm value? Explain your reasoning and/or calculation. [5 points] (d) If the stock of Blaine Kitchenware currently sells at the repurchase price of $18.50 per share, yet as a investor, you bought the stock 5 years ago at $8.00 per share. An alternative payout policy for Blaine is to use (roughly) the same amount of money but pay a $4.38 special dividend per share instead of the repurchase. Given this alternative payout policy, you are debating whether to sell the stock now (before the special dividend payout) or wait to receive the dividend and then sell the stock. What ex-dividend price of Blaine stock would make you indifferent between these two selling choices now? [8 points] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started