please provide blank 1 with the answer and so on Assume that ayisiyiniwiwinak Corp. paid $30 million to purchase 10-Trees Inc. Below is a summary

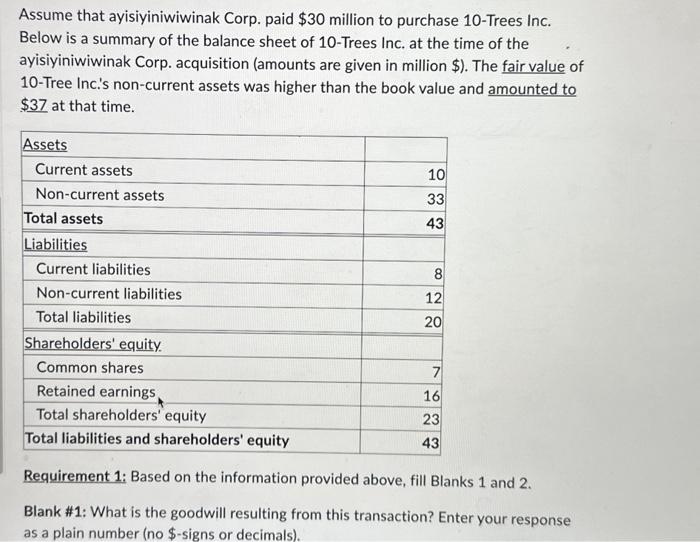

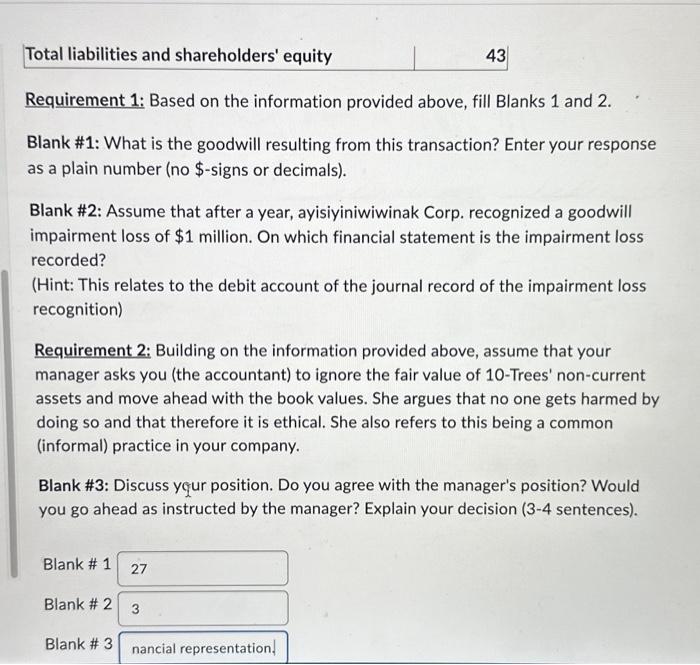

Assume that ayisiyiniwiwinak Corp. paid $30 million to purchase 10-Trees Inc. Below is a summary of the balance sheet of 10-Trees Inc. at the time of the ayisiyiniwiwinak Corp. acquisition (amounts are given in million $). The fair value of 10-Tree Inc.'s non-current assets was higher than the book value and amounted to $37 at that time. Assets Current assets Non-current assets Total assets Liabilities Current liabilities Non-current liabilities Total liabilities Shareholders' equity Common shares 10 33 43 8 12 222 20 Retained earnings, Total shareholders' equity Total liabilities and shareholders' equity 7 16 23 43 Requirement 1: Based on the information provided above, fill Blanks 1 and 2. Blank #1: What is the goodwill resulting from this transaction? Enter your response as a plain number (no $-signs or decimals)..

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Blank 1 To find the goodwill we need to calculate the difference between the purchase price ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started