Answered step by step

Verified Expert Solution

Question

1 Approved Answer

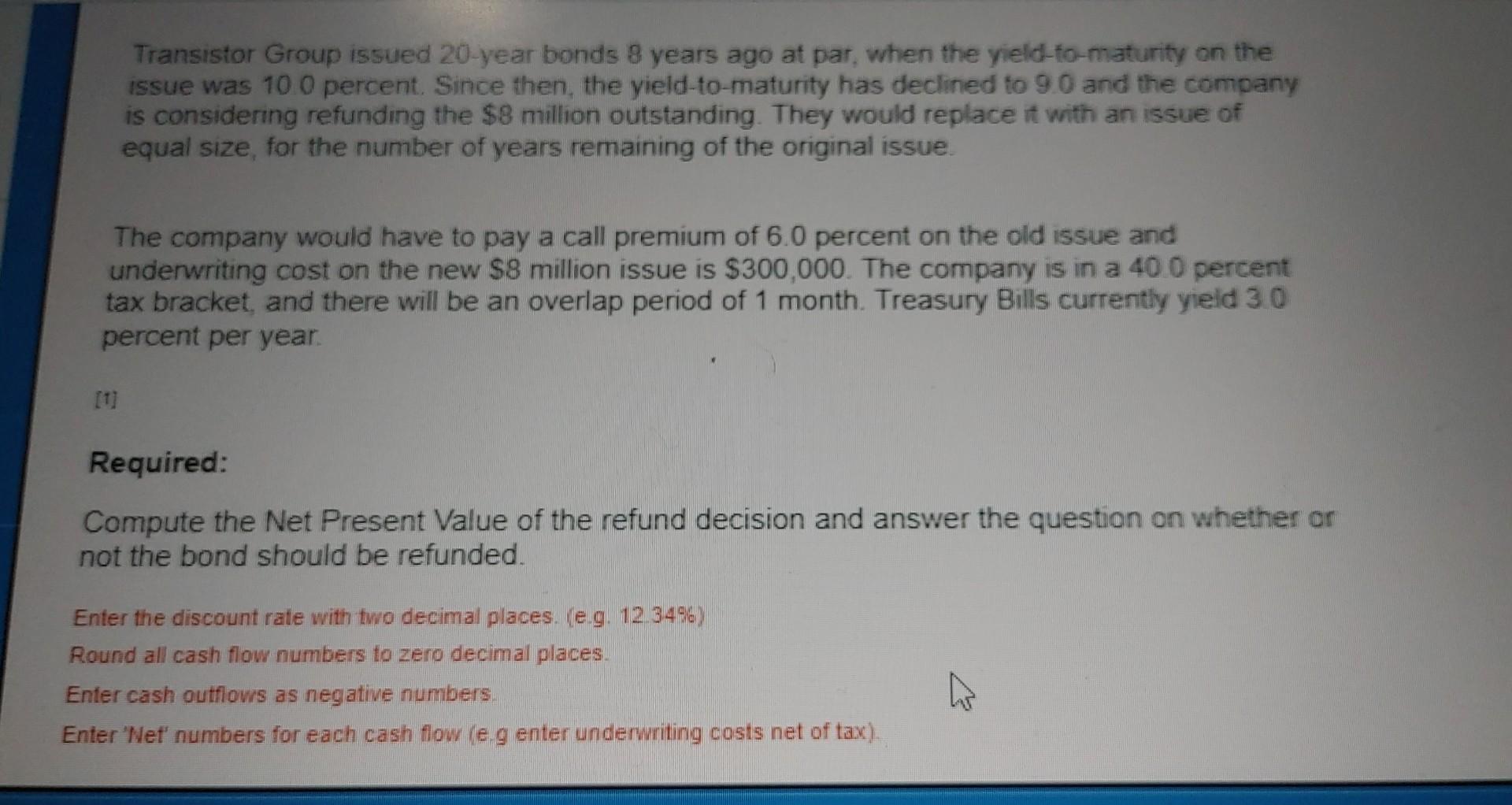

Please provide cell references. Transistor Group issued 20-year bonds 8 years ago at par, when the yield-fo-maturity on the issue was 100 percent. Since then,

Please provide cell references.

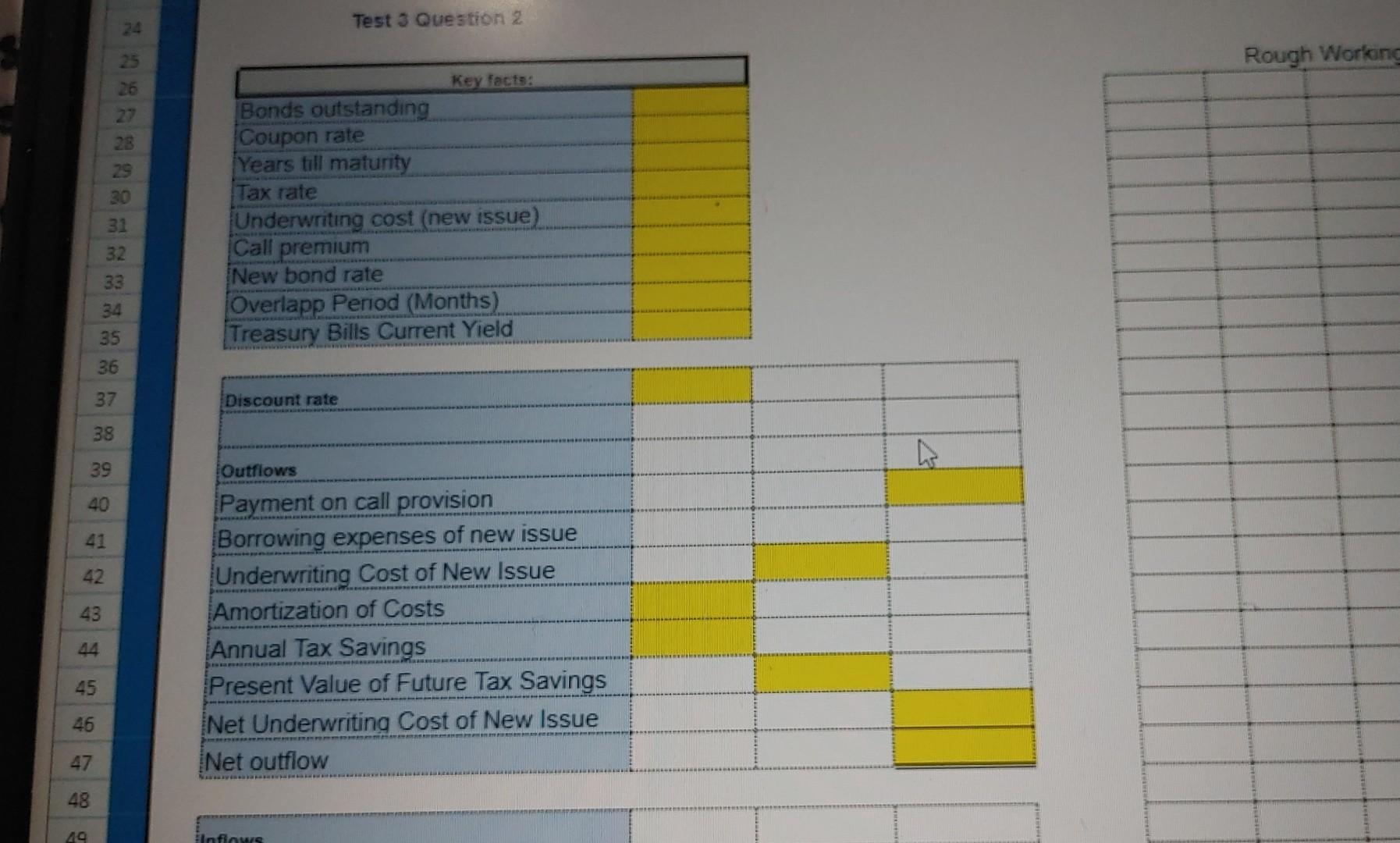

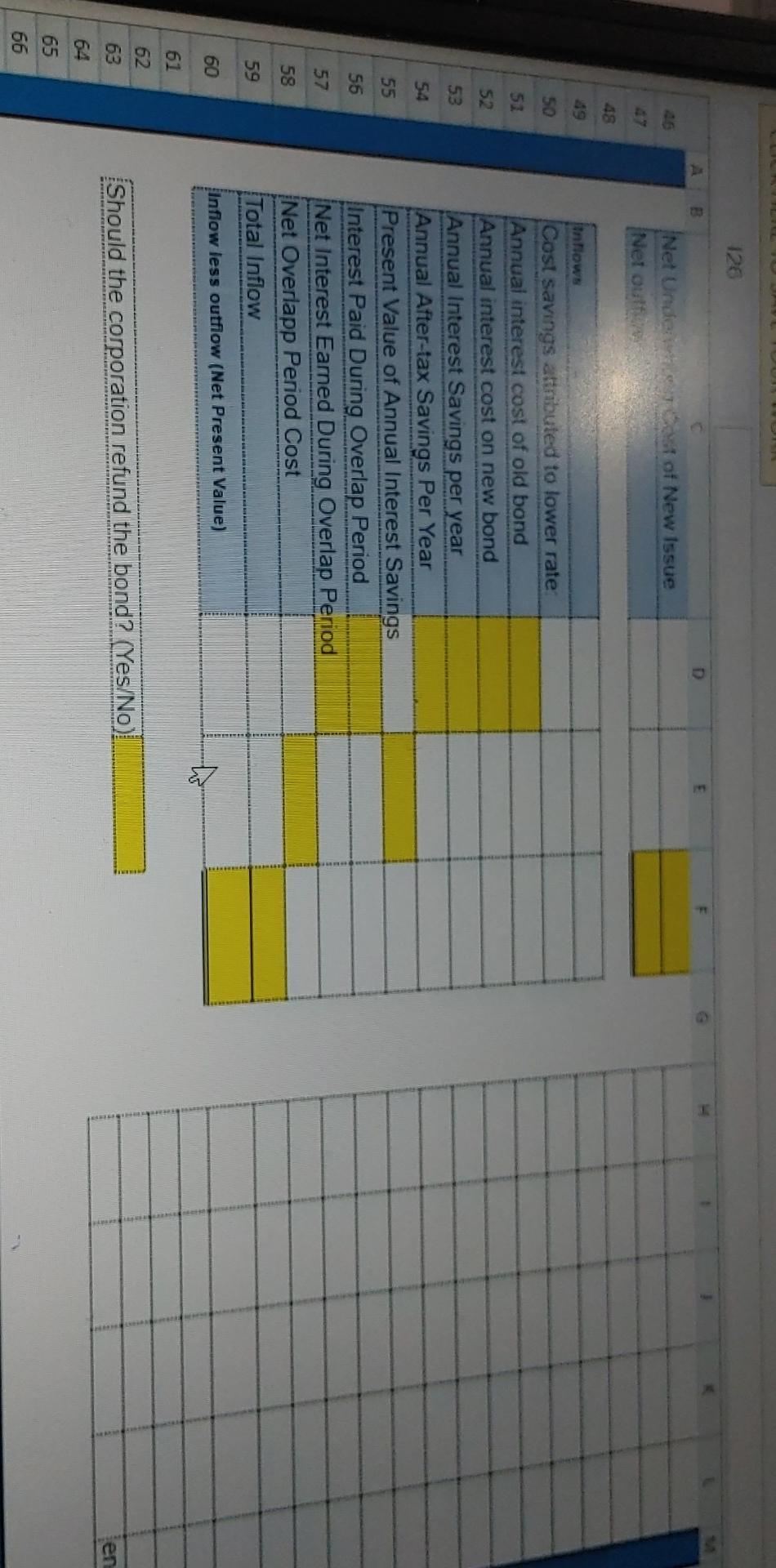

Transistor Group issued 20-year bonds 8 years ago at par, when the yield-fo-maturity on the issue was 100 percent. Since then, the yield-to-maturity has declined to 9.0 and the company is considering refunding the $8 million outstanding. They would replace it with an issue of equal size, for the number of years remaining of the original issue. The company would have to pay a call premium of 6.0 percent on the old issue and underwriting cost on the new $8 million issue is $300,000. The company is in a 400 percent tax bracket, and there will be an overlap period of 1 month. Treasury Bills currently yield 30 percent per year. [1] Required: Compute the Net Present Value of the refund decision and answer the question on whether or not the bond should be refunded. Enter the discount rate with two decimal places. (e.g. 12.34\%) Round all cash flow numbers to zero decimal places. Enter cash outflows as negative numbers. Enter 'Net' numbers for each cash flow (e.g enter underwriting costs net of tax). Test 3 Question 2 Should the corporation refund the bond? (Yes/No) Transistor Group issued 20-year bonds 8 years ago at par, when the yield-fo-maturity on the issue was 100 percent. Since then, the yield-to-maturity has declined to 9.0 and the company is considering refunding the $8 million outstanding. They would replace it with an issue of equal size, for the number of years remaining of the original issue. The company would have to pay a call premium of 6.0 percent on the old issue and underwriting cost on the new $8 million issue is $300,000. The company is in a 400 percent tax bracket, and there will be an overlap period of 1 month. Treasury Bills currently yield 30 percent per year. [1] Required: Compute the Net Present Value of the refund decision and answer the question on whether or not the bond should be refunded. Enter the discount rate with two decimal places. (e.g. 12.34\%) Round all cash flow numbers to zero decimal places. Enter cash outflows as negative numbers. Enter 'Net' numbers for each cash flow (e.g enter underwriting costs net of tax). Test 3 Question 2 Should the corporation refund the bond? (Yes/No)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started