Answered step by step

Verified Expert Solution

Question

1 Approved Answer

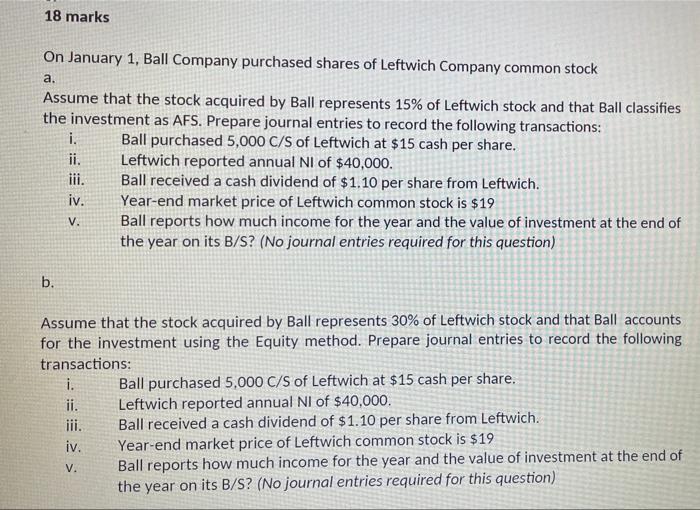

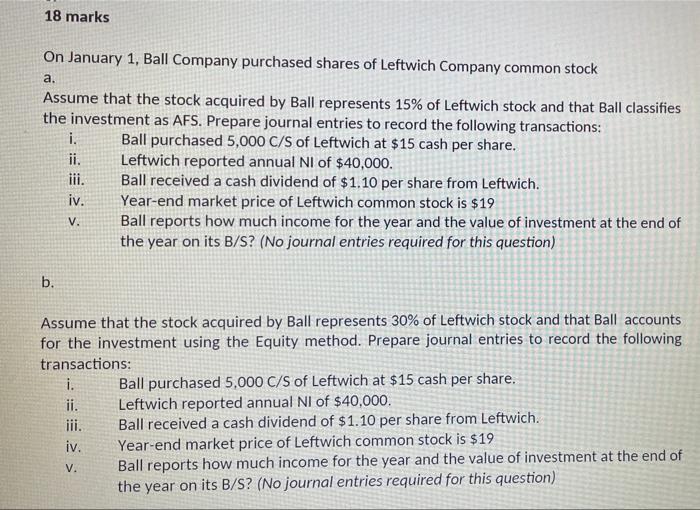

please provide clear pictures 18 marks On January 1, Ball Company purchased shares of Leftwich Company common stock a. Assume that the stock acquired by

please provide clear pictures

18 marks On January 1, Ball Company purchased shares of Leftwich Company common stock a. Assume that the stock acquired by Ball represents 15% of Leftwich stock and that Ball classifies the investment as AFS. Prepare journal entries to record the following transactions: i. Ball purchased 5,000 C/S of Leftwich at $15 cash per share. ii. Leftwich reported annual Nl of $40,000. iii. Ball received a cash dividend of $1.10 per share from Leftwich. iv. Year-end market price of Leftwich common stock is $19 Ball reports how much income for the year and the value of investment at the end of the year on its B/S? (No journal entries required for this question) V. b. Assume that the stock acquired by Ball represents 30% of Leftwich stock and that Ball accounts for the investment using the Equity method. Prepare journal entries to record the following transactions: i. Ball purchased 5,000 C/S of Leftwich at $15 cash per share. ii. Leftwich reported annual NI of $40,000. iii. Ball received a cash dividend of $1.10 per share from Leftwich. iv. Year-end market price of Leftwich common stock is $19 Ball reports how much income for the year and the value of investment at the end of the year on its B/S? (No journal entries required for this question) V

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started