Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide compelte solution, show full calculations, explanations and proofs to the following question: 1. Stochastic matrices: The following 1-ycar transition matrix of corporate bon

Please provide compelte solution, show full calculations, explanations and proofs to the following question:

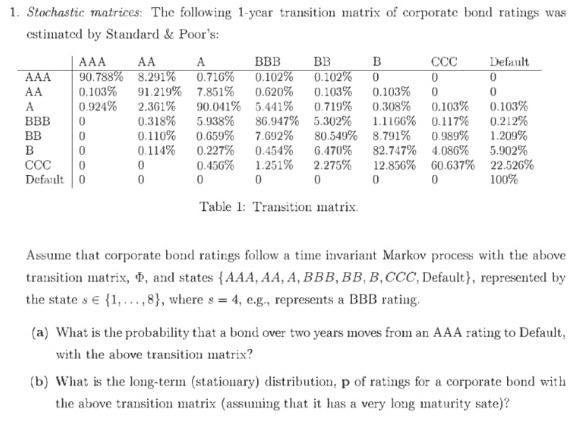

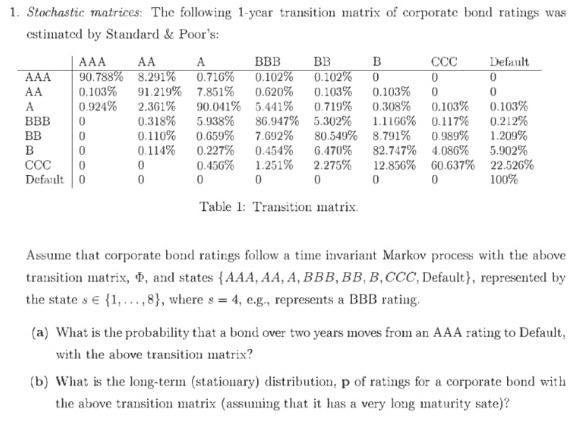

1. Stochastic matrices: The following 1-ycar transition matrix of corporate bon ratings was estimated by Standard & Poor's: AAA AA A BBB BB B Default AAA 90.788% 8.291% 0.716% 0.102% 0.102% 0 0 0 AA 0.103% 91.219% 7.851% 0.620% 0.103% 0.103% 0 0 A 0.924% 2.361% 90.041% 5.441% 0.719% 0.308% 0.103% 0.103% BBB 0 0.318% 5.938% 86.947% 5,302% 1.1166% 0.117% 0.212% BB 0 0.110% 0.659% 7.692% 80.549% 8.791% 0.989% 1.209% B 0 0.114% 0.227% 0.454% 6.470% 82.747% 4.086% 5.902% 0 0.456% 1.251% 2.275% 12.856% 60.637% 22.526% Default 0 0 0 0 0 0 100% Table 1: Transition matrix Assume that corporate bond ratings follow a time invariant Markov process with the above transition matrix, , and states (AAA, AA, A, BBB, BB,B,CCC, Default}, represented by the state s {1,...,8}, where s = 4, e.g, represents a BBB rating (a) What is the probability that a bond over two years moves from an AAA rating to Default, with the above transition matrix? (b) What is the long-term (stationary) distribution, p of ratings for a corporate bond with the above transition matrix (assuming that it has a very long maturity sate)? 1. Stochastic matrices: The following 1-ycar transition matrix of corporate bon ratings was estimated by Standard & Poor's: AAA AA A BBB BB B Default AAA 90.788% 8.291% 0.716% 0.102% 0.102% 0 0 0 AA 0.103% 91.219% 7.851% 0.620% 0.103% 0.103% 0 0 A 0.924% 2.361% 90.041% 5.441% 0.719% 0.308% 0.103% 0.103% BBB 0 0.318% 5.938% 86.947% 5,302% 1.1166% 0.117% 0.212% BB 0 0.110% 0.659% 7.692% 80.549% 8.791% 0.989% 1.209% B 0 0.114% 0.227% 0.454% 6.470% 82.747% 4.086% 5.902% 0 0.456% 1.251% 2.275% 12.856% 60.637% 22.526% Default 0 0 0 0 0 0 100% Table 1: Transition matrix Assume that corporate bond ratings follow a time invariant Markov process with the above transition matrix, , and states (AAA, AA, A, BBB, BB,B,CCC, Default}, represented by the state s {1,...,8}, where s = 4, e.g, represents a BBB rating (a) What is the probability that a bond over two years moves from an AAA rating to Default, with the above transition matrix? (b) What is the long-term (stationary) distribution, p of ratings for a corporate bond with the above transition matrix (assuming that it has a very long maturity sate)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started