Answered step by step

Verified Expert Solution

Question

1 Approved Answer

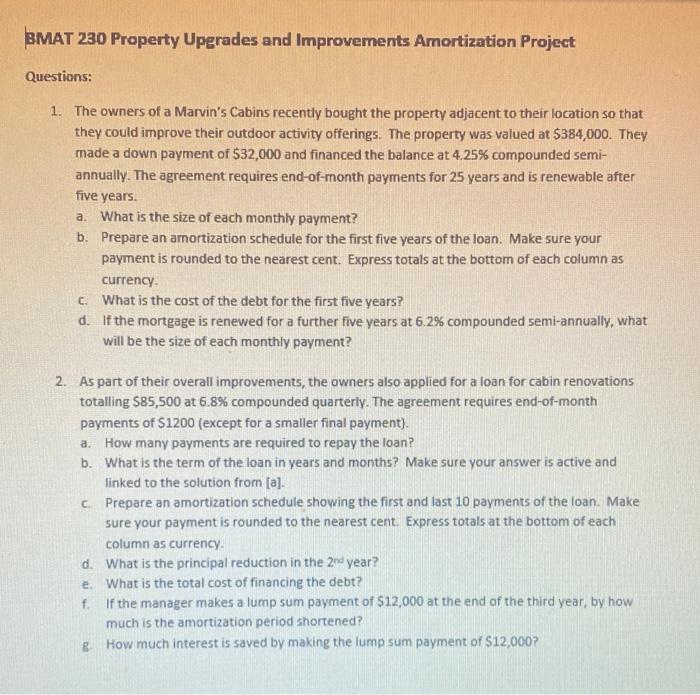

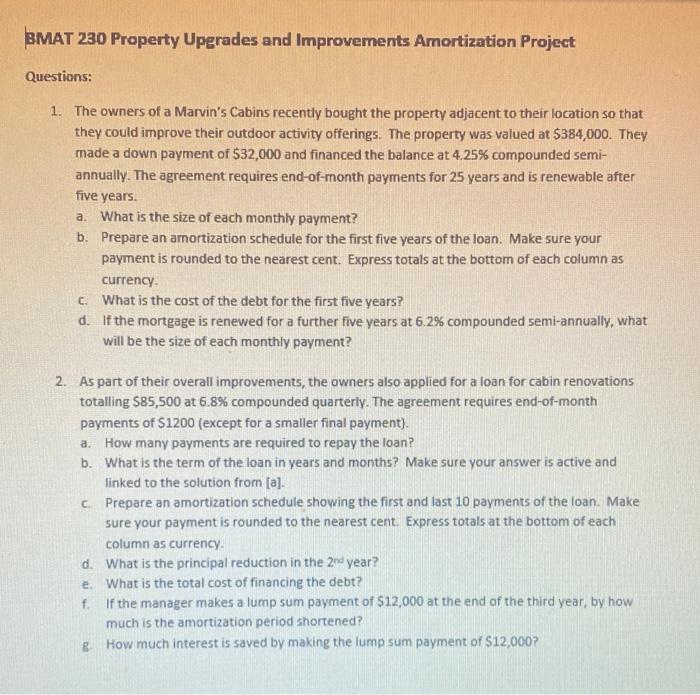

please provide correct answers and don't use chat gpt cause the answers it provides are incorrect. BMAT 230 Property Upgrades and Improvements Amortization Project Questions:

please provide correct answers and don't use chat gpt cause the answers it provides are incorrect.

BMAT 230 Property Upgrades and Improvements Amortization Project Questions: 1. The owners of a Marvin's Cabins recently bought the property adjacent to their location so that they could improve their outdoor activity offerings. The property was valued at $384,000. They made a down payment of $32,000 and financed the balance at 4.25% compounded semiannually. The agreement requires end-of-month payments for 25 years and is renewable after five years. a. What is the size of each monthly payment? b. Prepare an arnortization schedule for the first five years of the loan. Make sure your payment is rounded to the nearest cent. Express totals at the bottom of each column as currency. c. What is the cost of the debt for the first five years? d. If the mortgage is renewed for a further five years at 6.2% compounded semi-annually, what will be the size of each monthly payment? 2. As part of their overall improvements, the owners also applied for a loan for cabin renovations totalling $85,500 at 6.8% compounded quarterly. The agreement requires end-of-month payments of $1200 (except for a smaller final payment). a. How many payments are required to repay the loan? b. What is the term of the loan in years and months? Make sure your answer is active and linked to the solution from [a]. c. Prepare an amortization schedule showing the first and last 10 payments of the loan. Make sure your payment is rounded to the nearest cent. Express totals at the bottom of each column as currency. d. What is the principal reduction in the 2rd year? e. What is the total cost of financing the debt? f. If the manager makes a lump sum payment of $12,000 at the end of the third year, by how much is the amortization period shortened? g. How much interest is saved by making the lump sum payment of $12,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started