Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide details and steps so I can understand better. Delph Company uses a job order costing system and has two manufacturing departments-Molding and Fabrication.

please provide details and steps so I can understand better.

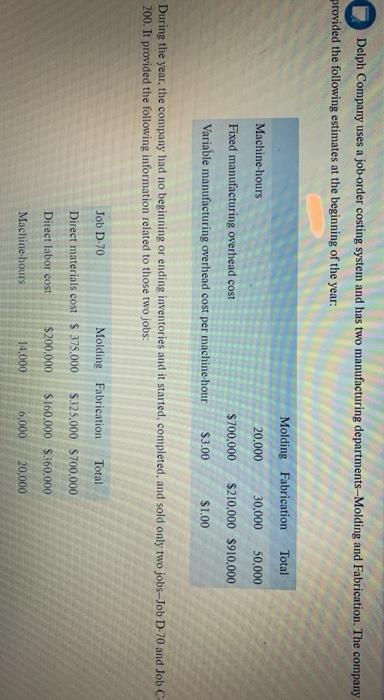

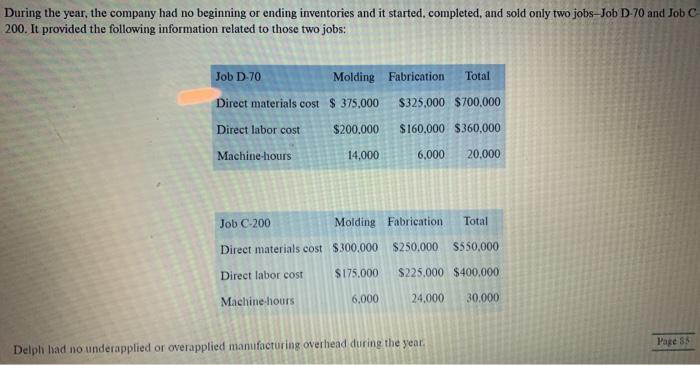

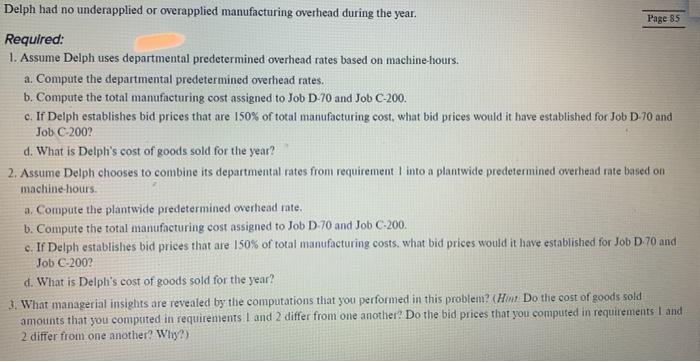

Delph Company uses a job order costing system and has two manufacturing departments-Molding and Fabrication. The company provided the following estimates at the beginning of the year: Machine-hours Molding Fabrication Total 20.000 30,000 50.000 $700,000 $210,000 $910,000 Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour $3.00 $1.00 During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs-Job D-70 and Job C 200. It provided the following information related to those two jobs: Job D-70 Molding Fabrication Total Direct materials cost $375,000 $325.000 $700.000 Direct labor cost $200,000 $160.000 $360.000 Machine Hours 14.000 6.000 20.000 During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs-Job D-70 and Job C 200. It provided the following information related to those two jobs: Job D 70 Molding Fabrication Total Direct materials cost $ 375.000 $325,000 $700.000 Direct labor cost $200,000 $160,000 $360,000 Machine-hours 14,000 6,000 20.000 Job C-200 Molding Fabrication Total Direct materials cost $300,000 $250,000 $550,000 Direct labor cost $175.000 $225,000 $400,000 Machine hours 6,000 24,000 30.000 Page 5 Delph had no underapplied or overapplied manufacturing overhead during the year. Delph had no underapplied or overapplied manufacturing overhead during the year. Page 85 Required: 1. Assume Delph uses departmental predetermined overhead rates based on machine hours. a. Compute the departmental predetermined overhead rates. b. Compute the total manufacturing cost assigned to Job D-70 and Job C-200. c. If Delph establishes bid prices that are 150% of total manufacturing cost, what bid prices would it have established for Job D 70 and Job C-2002 d. What is Delph's cost of goods sold for the year? 2. Assume Delph chooses to combine its departmental rates from requirement into a plantwide predetermined overhead rate based on machine hours. a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost assigned to Job D-70 and Job C-200. c. If Delph establishes bid prices that are 150% of total manufacturing costs, what bid prices would it have established for Job D70 and Job C-2007 d. What is Delph's cost of goods sold for the year? 3. What managerial insights are revealed by the computations that you performed in this problem? How Do the cost of goods sold amounts that you computed in requirements 1 and 2 differ from one another? Do the bid prices that you computed in requirements I and 2 differ from one another? Why?) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started