Please provide full solution. Urgently need the solution. Thanks in advance.

Please provide full solution. Urgently need the solution. Thanks in advance.

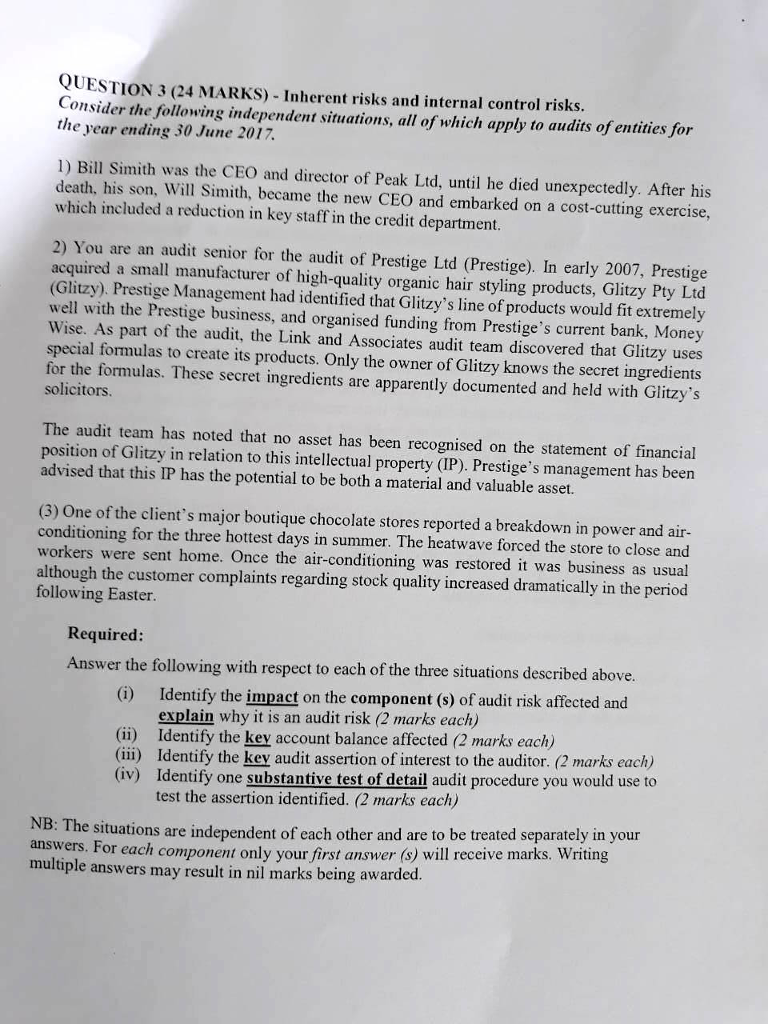

QUESTION 3 (24 MARKS) - Inherent risks and internal control risks. Consider the following independent situations, all of which apply to audits of entities for the year ending 30 June 2017 1) Bill Simith was the CEO and director of Peak Ltd, until he died unexpectedly. After his death, his son, Will Simith, became the new CEO and embarked on a cost-cutting exercise, which included a reduction in key staff in the credit department. 2) You are an audit senior for the audit of Prestige Ltd (Prestige). In early 2007, Prestige acquired a small manufacturer of high-quality organic hair styling products, Glitzy Pty Ltd (Glitzy). Prestige Management had identified that Glitzy's line of products would fit extremely well with the Prestige business, and organised funding from Prestige's current bank, Money Wise. As part of the audit, the Link and Associates audit team discovered that Glitzy uses special formulas to create its products. Only the owner of Glitzy knows the secret ingredients for the formulas. These secret ingredients are apparently documented and held with Glitzy's solicitors The audit team has noted that no asset has been recognised on the statement of financial position of Glitzy in relation to this intellectual property (IP). Prestige's management has been advised that this IP has the potential to be both a material and valuable asset. (3) One of the client's major boutique chocolate stores reported a breakdown in power and air- conditioning for the three hottest days in summer. The heatwave forced the store to close and workers were sent home. Once the air-conditioning was restored it was business as usual although the customer complaints regarding stock quality increased dramatically in the period following Easter. Required: Answer the following with respect to each of the three situations described above. Identify the impact on the component (s) of audit risk affected and explain why it is an audit risk (2 marks each) (G) (ii) Identify the key account balance affected (2 marks each) (ii) Identify the key audit assertion of interest to the auditor. (2 marks each) (iv) Identify one substantive test of detail audit procedure you would use to test the assertion identified. (2 marks each) ituations are independent of each other and are to be treated separately in your answers. For each component only multiple answers may result in nil your first answer (s) will receive marks. Writing marks being awarded

Please provide full solution. Urgently need the solution. Thanks in advance.

Please provide full solution. Urgently need the solution. Thanks in advance.